South Korea caught in the middle of US-China chip war, but American export control requests unlikely

- The South Korean semiconductor industry relies on the United States for equipment needed to make chips, while China is the sector’s largest export destination

- Seoul is reportedly gearing up to join the US-led Chip 4 alliance, but Washington is unlikely ask the government to impose export restrictions, industry insiders say

South Korea is facing a complex balancing act as it finds itself positioned in the middle of an intensifying tech war between the United States and its biggest semiconductor chip trading partner China.

Such a decision is in line with a domestic consensus that joining the alliance is inevitable for South Korea, although it is likely to strain relations with China.

Analysts say in the long run South Korea must expand its competitiveness in the fast-changing semiconductor industry landscape, while bonding itself closer to the US and its allies, from which it relies on for equipment, is hard to avoid in the short term.

South Korea plays down concerns over move to join US-led chip alliance

On Tuesday, the two countries’ trade representatives held the first export control working group meeting in Seoul, where the South Korean government expressed concerns about what will happen in a year’s time.

US representative Thea Kendler, who is the assistant secretary of commerce for export administration, said there would be no sudden announcements or surprises within the next year for the South Korean companies.

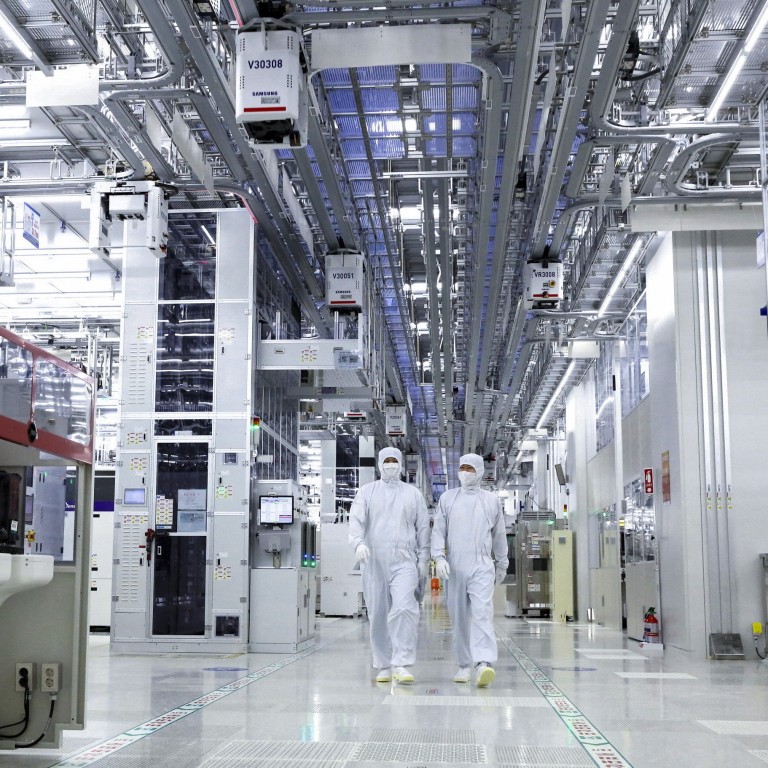

The South Korean semiconductor industry “fundamentally relies” on the US and its allies for equipment needed to manufacture chips, the Korean International Trade Association (KITA) said in a report published earlier this month.

“There’s a systematic imbalance within the country’s semiconductor industry, contrary to the strong competitiveness in producing semiconductor memories, as it is quite reliant on importing semiconductor equipment,” the report said.

The report found that South Korea’s semiconductor equipment localisation rate is around 20 per cent. In 2021, 77 per cent of South Korea’s semiconductor equipment import value came from the US, Japan and the Netherlands.

The global semiconductor industry is deeply intertwined with different countries specialising in different stages of assembly – such as designing, packaging and manufacturing semiconductor chips – and only a few have capabilities to make highly advanced equipment needed for advanced semiconductors.

The US excels in designing and building software for semiconductor chips, whereas South Korea is the world’s second largest foundry market, which means its companies manufacture chips that others design.

“Chips made in Korea almost always require US tools and software,” said Chris Miller, an associate professor of international history at Tufts University, who wrote Chip War: The Fight for the World’s Most Critical Technology.

Hi-tech innovation ‘at the heart’ of China’s modernisation drive, Xi vows

On the other hand, China is South Korea’s biggest semiconductor trading partner. According to a KIEP report earlier this year, 43.2 per cent of all semiconductor exports from South Korea were sent to mainland China in 2020 and another 18.3 per cent to Hong Kong, accounting to 61.5 per cent of South Korea’s total shipments.

South Korea’s semiconductor exports to China grew nearly 13-fold between 2000 and 2021, according to the Korea Chamber of Commerce and Industry.

Between October 1-25, South Korean exports of chips to China fell by 23.3 per cent year on year.

China’s in-house technology and mass production systems are still not mature enough to produce advanced chips, so it still relies on South Korean products, said Kim Yang-paeng, a senior researcher at the Korea Institute for Industrial Economics and Trade in a recent interview with Korean media Hankook Ilbo.

But once China has its production system ready, however, it will further reduce the proportion of Korean-made semiconductors it imports, so export diversification is needed, Kim said.

“We need to further increase our investment in semiconductor memories, in which Korea has the world’s most competitive edge right now,” Kim told Hankook Ilbo.

Increased research and development on semiconductor equipment will also be necessary.

“In the short term, it is necessary to maintain friendly relations with the three major exporting countries of semiconductor equipment through Chip 4, and at the same time to increase the localisation rate of core equipment by investing in [research and development] from a mid- to long-term perspective,” the KITA report said.

“Considering the fact that China’s semiconductor industry is stagnant at the 14 nanometre level is also a result of not being able to secure core semiconductor equipment, establishing a stable semiconductor equipment supply chain through Chip4 can be seen as a key factor in determining the life and death of the semiconductor industry.”

In the meantime, it is unlikely the US will request the South Korean government to adopt semiconductor export restrictions against China, Korean industry analysts said.

The Japanese government is reportedly discussing measures to limit exports of advanced semiconductors and related technology to China after Washington requested its ally impose measures similar to the ones it introduced early in October, according to Japanese newspaper The Nikkei.

“Japan mainly exports semiconductor materials, parts, and equipment, so it can share the same context with the US in regulatory policies, but since Korea’s strength in the semiconductor industry lies in manufacturing, Korea taking part in US’ semiconductor technology export restriction against China will have little effect,” said Kwon Suk-joon, a professor of chemical engineering at Sungkyunkwan University in Korea.

Kim, from the Korea Institute for Industrial Economics and Trade, said the South Korean semiconductor industry’s major export product was memories, not advanced semiconductors.

“The US has made export restriction requests to Japan and the Netherlands. This is because these two countries have companies that can make semiconductor equipment without American technology,” Kim told the South China Morning Post, adding that Korea does not have such technology and relies on imports of such equipment.

The Korean government has a complex balancing act to manage with regard to both China and the United States

Tufts professor Miller noted there is a chance that pressure from Washington may grow in the future if Korean companies are found to play a significant role in helping China evade US controls.

“We should expect the next US Congress to continue pushing for allies to join the export controls,” he said.

“The Korean government has a complex balancing act to manage with regard to both China and the United States.”