China digital currency: e-CNY included in official cash figures for first time

- Outstanding levels of Digital Currency Electronic Payment stood at 13.61 billion yuan (US$2 billion) at the end of December, according to the People’s Bank of China

- Digital yuan represented 0.13 per cent of outstanding M0, largely cash and bank reserves held by the central bank

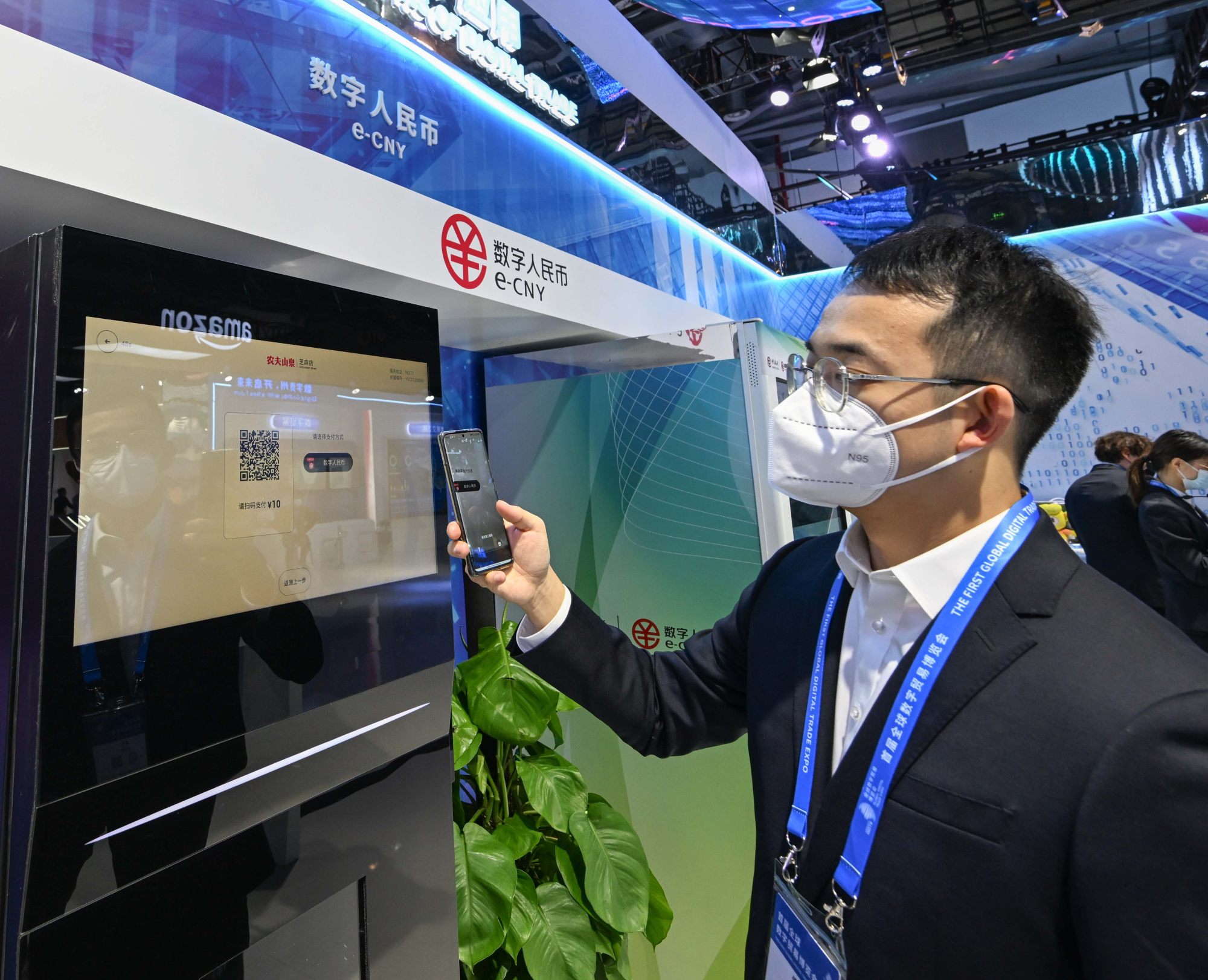

China’s central bank has started to include the digital yuan into its calculations of the amount of cash circulating in the economy, marking a new era for its use in the world’s second-largest economy.

The outstanding size of the Digital Currency Electronic Payment, also known as e-CNY, was 13.61 billion yuan (US$2 billion) at the end of December, according to data released by the People’s Bank of China (PBOC) on Tuesday.

The growth of M0, largely cash and bank reserves held by the central bank, accelerated to a 11-month high of 15.3 per cent last month, the central bank added.

The digital yuan represented 0.13 per cent of outstanding M0, or 0.005 per cent of M2, the widely-watched broad measure of money supply.

‘We need stability’: China urged to restore normal working life to lift spending

Since the e-CNY offers no interest payments, it has long been discussed how it will affect cash and current account deposits and monetary policy.

Concerns have also been raised over if it could reshape the online payment landscape, which is dominated by Alipay and WeChat Pay.

The PBOC said 1.39 trillion yuan (US$205 billion) had been injected into the domestic market last year, with the addition of the e-CNY having no obvious impact.

The central bank has yet to confirm an official timetable for the official launch of the digital yuan, only confirming at its economic conference last month that “the pilot will be run steadily”.

The ongoing pilot scheme has been expanded to 26 large cities and 5.6 million merchants, with an accumulated transaction value of 100 billion yuan (US$12.2 billion) at the end of August from consumer spending, bank lending and cross-border payments.

Local authorities have also continued to offer digital yuan vouchers, with the coastal city of Wenzhou in Zhejiang province set to offer 30 million yuan worth of consumer vouchers in the next month.

It is an opportunity to extend the central bank digital currency. What a good chance

On Tuesday, the central bank encouraged commercial banks to provide more credit for the real economy, after it extended a record-high of 21.3 trillion yuan of loans last year, amid moves to employ a more powerful and targeted monetary policy this year.

“It is an opportunity to extend the central bank digital currency. What a good chance. I think it will be a remarkable tool that can kill several birds with one stone,” Yao Yang told an economic conference at the end of December.

“If you want to receive the government’s consumer subsidy, you need to download the digital yuan app.”