Chinese shiver as ‘artificial shortage’ of natural gas forces them to find other ways to heat homes

- Households are struggling, especially in rural areas where authorities did not ensure enough gas supply, and Beijing may have to step in ‘if things get worse’

- Analysts say solutions to China’s gas-supply woes ‘will be multifaceted, and most of them focus on the supply side’, including possibly securing more imports

People living in remote parts of China are finding it more difficult to escape frigid winter conditions due to an “artificial shortage” of natural gas, according to analysts, although the impact is expected to be temporary.

The blistering cold spell – with strong winds coupled with sub-zero temperatures – began on Thursday and is expected to last until Saturday, according to the National Meteorological Centre.

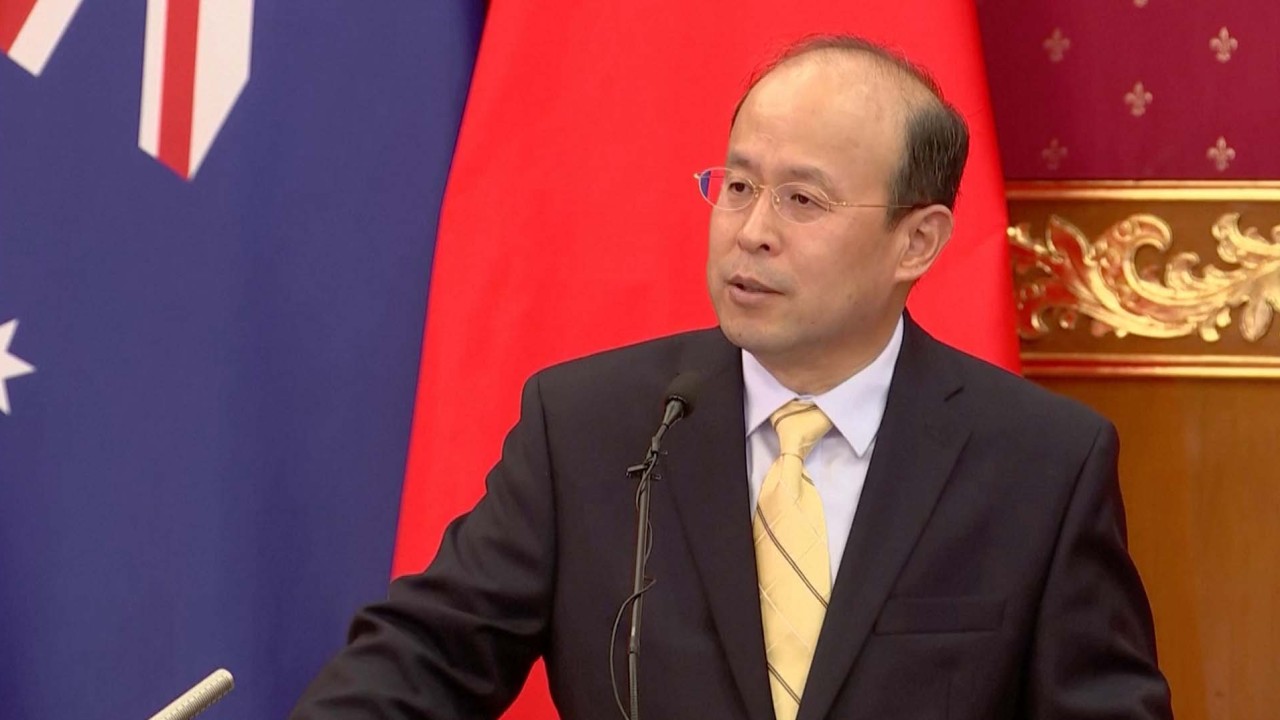

“The shortages are so far concentrated in lower-tier cities and rural areas across northern China,” said Alfredo Montufar-Helu, head of the China Centre for Economics and Business at The Conference Board. “But what’s currently happening is not really a supply shortage in the strict sense of the word. Rather, it is an artificial shortage.”

‘Surge’ in Australian coal inquiries amid reports China set to end import ban

Montufar-Helu explained that the difference between wholesale and retail gas prices, as well as the “inability” of some local governments to subsidise the price differential, are the two key factors that have left some regions desperate for gas.

Gas supplier Shandong Order Gas was quoted by Chinese media outlet Caixin earlier this month as saying that continuous financial losses and a shortage of cash had limited the company’s ability to purchase gas at premium prices, and the firm blamed increased demand and restricted supplies.

The company started halting the supply of gas on January 17 while suggesting that consumers use other means to heat their homes.

According to figures from Spanish financial services company BBVA, the total supply of natural gas in China reached 301.8 billion cubic metres, through production and imports, between January and October last year, while demand was 299.9 billion cubic metres.

“However, what we have to pay attention to is that China’s natural gas demand was restricted by the authorities’ various administrative tools, including the restriction of natural gas purchases and usage,” said Dong Jinyue, senior China economist at BBVA Research.

“If it weren’t for the imposition of purchasing restrictions on households and firms, China’s actual demand would be much higher than the current demand figure, which means that the supply cannot satisfy the actual demand.”

S&P data also shows that China’s natural gas demand likely reached around 364 billion cubic metres in 2022, and that it will see year-on-year growth of around 6 per cent to around 386 billion cubic metres in 2023.

China’s economic recovery expected to drive rising demand for power

Credit rating agency Fitch expects that gas consumption in China will continue to increase over the medium term, noting how natural gas is a transitional fuel source in China’s efforts to shift away from coal and become carbon neutral by 2060.

And Dong noted that this campaign of “changing coal to natural gas” means that the demand-supply gap will persist with natural gas.

Based on BBVA’s 2021 data, Australia was China’s largest supplier of liquid natural gas, accounting for nearly 40 per cent, followed by the United States, Qatar, Malaysia, Indonesia and Russia.

Dong explained that solutions to China’s gas-supply woes “will be multifaceted, and most of them focus on the supply side”.

“China could increase its imports of natural gas, develop various kinds of traditional clean energy to reduce the dependency on natural gas, [and] increase the efficiency of energy usage by adopting more cutting-edge technology,” she said.

[I]f things get worse, central authorities might decide to provide funds to local governments

Montufar-Helu added that the current gas-shortage situation will abate in the coming months as temperatures warm.

But he said that the price-differential issue will persist, due to volatile international energy prices and the fact that authorities will continue maintaining a strict price cap on gas sold to households, which will prevent local gas distributors from passing on the cost.

“Of course, the current situation is not easy for many Chinese households,” he said.

“There is always the possibility that, if things get worse, central authorities might decide to provide funds to local governments so they can subsidise the price differentials until winter is over.”