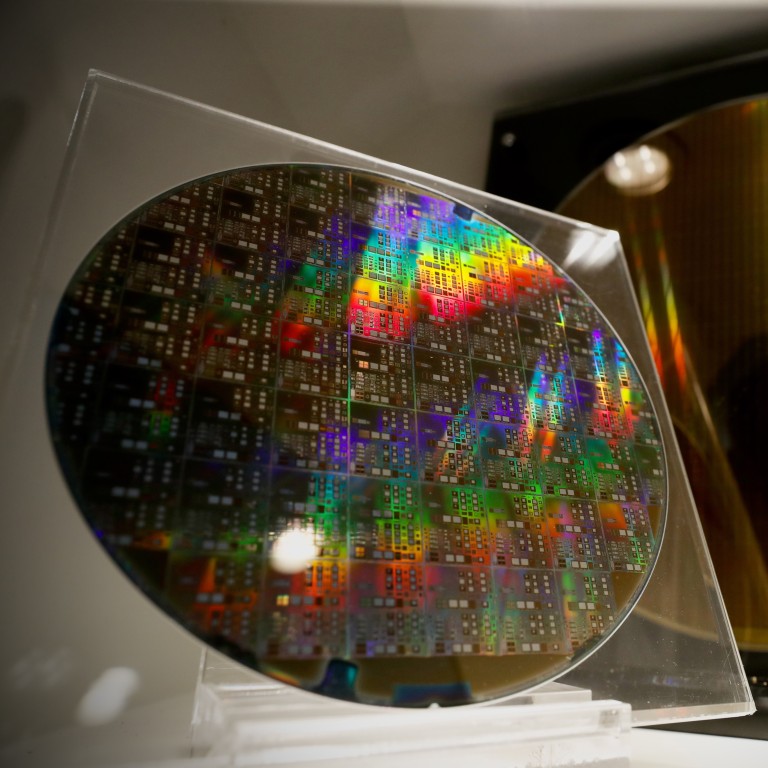

Taiwan’s semiconductor output forecast to fall 5.6 per cent in 2023, chilling economy

- The production value of Taiwan-made semiconductor chips is forecast to fall by 5.6 per cent year on year in 2023, according to a new estimate

- A slow year for chip makers will stifle Taiwan’s job market, temper new investments in tech hardware and ultimately weigh on economic output, analysts say

The production value of integrated circuits would decline by 5.6 per cent year on year to US$150.5 billion in 2023, according to Taiwan’s Industrial Technology Research Institute in a report commissioned by the Taiwan Semiconductor Industry Association.

The decline is worse than the report’s forecast of a 4.1 per cent fall in the global value of semiconductor output, and more dire than forecasts made last year.

A slow year for chip makers – many of which are trying to shed inventory as global demand eases following a surge in spending on consumer electronics early in the pandemic – would stifle Taiwan’s job market and temper new investments in tech hardware, analysts said.

After the big electronics boom in recent years, the sector is going through an inevitable adjustment

“After the big electronics boom in recent years, the sector is going through an inevitable adjustment,” said Frederic Neumann, chief Asia economist with HSBC in Hong Kong.

Tech firms could slow job creation, though not necessarily lay people off, said Tony Phoo, an economist with Standard Chartered Bank in Taipei.

Chip makers are likely to delay 2023 capital expenditure, Phoo said. Those expenses normally go toward new or expanded factories.

A shedding of inventory will cut into Taiwan’s overall exports and gross domestic product (GDP) growth, said Darson Chiu, a research fellow with the Taiwan Institute of Economic Research think tank in Taipei. He too anticipated an impact on jobs in tech manufacturing.

‘Growing pressure’ for new markets has Taiwan looking beyond mainland China

GDP growth will come to about 2 per cent this year, Chiu forecast, down from 2.43 per cent last year. The government forecasts 2.75 per cent growth.

Technology products make up about 30 per cent of Taiwan’s economy and the island supplies 60 per cent of the world’s chips.

The Industrial Technology Research Institute had anticipated 6.1 per cent growth in the Taiwanese chip sector in November. The Canalys market research firm had said in late 2022 that Taiwan’s semiconductor revenue should grow this year by a single digit percentage.

“Taiwan’s economy this year is not dependent on exports, but on domestic consumption,” Chiu said. “At present, there is still a shortage of workers in Taiwan’s domestic service industry.”

Capital expenditure may bounce back later in the year, Neumann said.

Chip makers are still getting brisk business from global manufacturers of high-end cars, an official with the industry group SEMI Taiwan said in January. Sales of electric vehicles and cars with automated functions are gaining market share around the world.

“Ongoing investment, especially in further high-end semiconductor capacity, will help cushion the economic impact on Taiwan’s broader economy this year,” Neumann said.