Russia’s invasion of Ukraine clouds picture for China’s central and eastern European trade expo

- Ministry of Commerce says it expects more exhibitors and delegates this year

- But European nations are believed to have stepped back from official participation

China’s attempt to boost ties with central and eastern European countries through a trade expo this week will meet with mixed reactions due to mounting trade and political challenges following Russia’s invasion of Ukraine, analysts said.

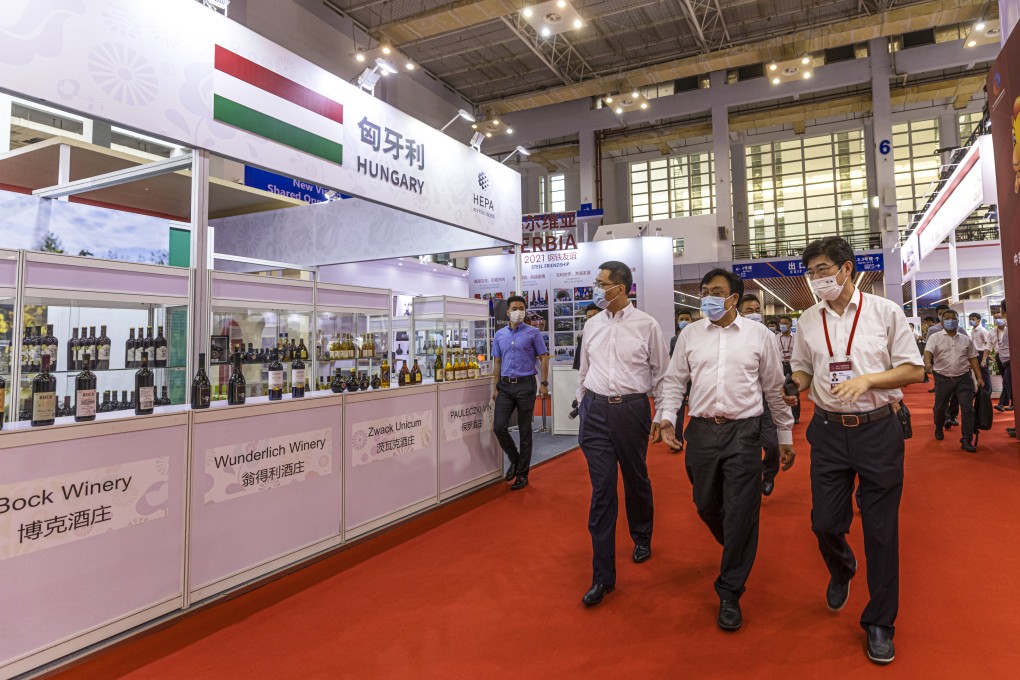

The China-CEEC Expo & International Consumer Goods Fair, starting on Tuesday in the eastern port city of Ningbo, comes as Beijing has pledged to shore up trade to support China’s economic recovery.

“It has not been easy to meet our Chinese counterparts, of course due to Covid as well, but there has not been much substantial progress on how the grand plans can actually be realised,” a central European diplomat said, requesting anonymity.

“I don’t think China is exactly clear about how they want to deal with us yet.”

There are many issues that still need to be worked on in trade with CEE countries

Zhang Min, a central and eastern Europe specialist at the Chinese Academy of Social Sciences, said the expo represented a good start for improving trade after the coronavirus pandemic, but it would “not grow overnight”.