Advertisement

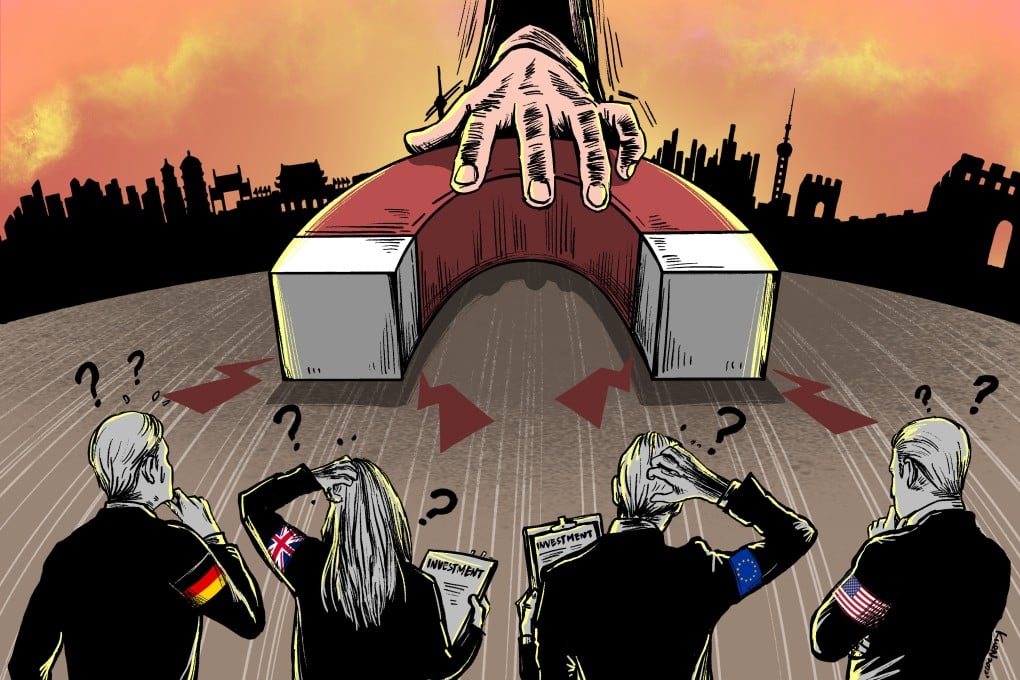

As China’s foreign direct investment falls, is its charm campaign paying dividends or falling on deaf ears?

- FDI figures for the year’s first four months show momentum is slowing despite Beijing’s all-out push to lure overseas companies and investors

- Less-than-ideal official data comes as China’s industrial output and retail sales growth in April undershot forecasts, and a weakening yuan does not help

Reading Time:2 minutes

Why you can trust SCMP

23

Despite Beijing actively wooing overseas investors as part of its post-pandemic economic recovery, China’s foreign direct investment (FDI) shrank in the first four months of the year.

The country’s actual utilisation of FDI reached US$73.5 billion in the January-April period, dropping by 3.3 per cent from a year earlier, according to data from the Ministry of Commerce on Wednesday.

The figures suggest that Beijing has still lots of work to lure foreign investors, who play vital roles in terms of China’s access to technology, funds and management expertise, especially as tensions with the United States persist and as Beijing’s raids on finance and due-diligence firms in the name of national security have raised concerns in the investor community.

Advertisement

China received US$39.71 billion worth of investments in the first two months of 2023, showing a 1 per cent year-on-year increase. The ministry, though, did not provide FDI figures in US dollar terms for the first quarter.

In yuan terms, China’s actual FDI grew by 4.9 per cent to 408.45 billion yuan (US$58 billion) in the first quarter of 2023, while foreign investments from January to February was 264.88 billion yuan, representing a 6.1 per cent increase, year on year.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x