China looks to shore up belt-and-road deals with Middle East cash and partnerships as Western investment wanes

- United Arab Emirates is trying to expand its deals with China in critically important sectors such as AI, clean energy and infrastructure

- ‘Strategic’ nature of China’s massive consumer market bodes well for bilateral relations in Gulf states, but some analysts wonder if Middle East capital can replace Western investments

“We are committed to further strengthening partnerships with China’s business community, particularly in sectors such as artificial intelligence, clean energy and infrastructure,” Mohammad Ali Rashed Lootah, president and CEO of Dubai Chambers, told the Post by email.

“The scope of the [United Arab Emirates’] partnership with China will continue to expand, with new areas of cooperation including climate-change mitigation, food security, energy security, financial services and education.”

‘No doubt’ over China’s Middle East economic inroads, but politics ‘more complex’

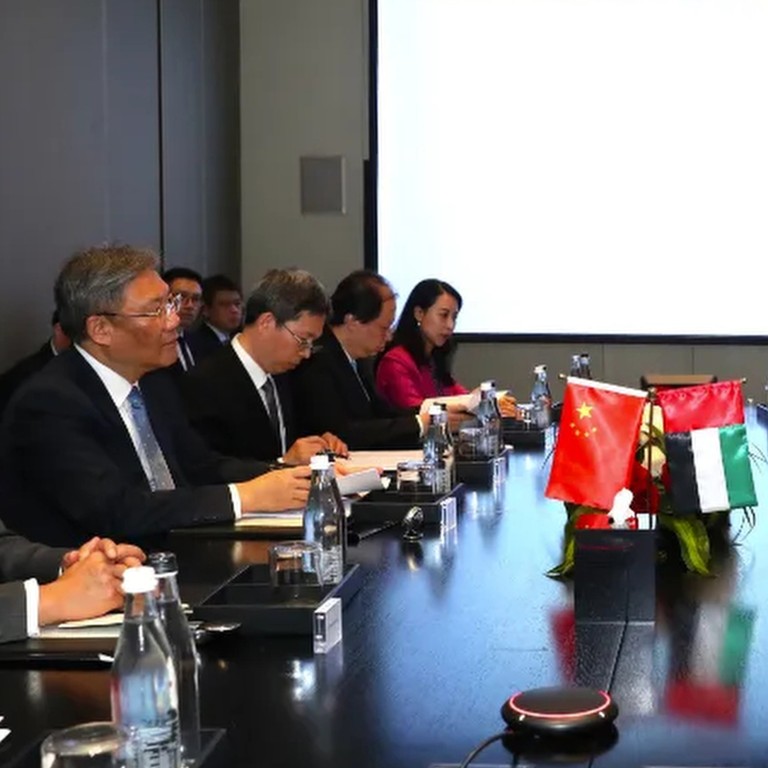

His comments immediately preceded a roundtable discussion convened by Minister of Commerce Wang Wentao in Dubai last week, when he spoke with United Arab Emirates (UAE) companies.

“China is advancing its own style of modernisation,” Wang said. “We welcome investments from companies of the United Arab Emirates to share the benefits of our development.”

According to figures from the UAE Ministry of Economy, China is a top global trade partner for the federation of seven emirates – Abu Dhabi, Ajman, Dubai, Fujairah, Ras el Khaimah, Sharjah and Umm Al Quwain.

The value of non-oil trade between both sides exceeded US$72 billion in 2022, an increase of 18 per cent from a year earlier.

The world’s second-largest economy is also seeking business cooperation – in energy and other areas – with Saudi Arabia and other Gulf countries.

In terms of developing the bilateral relationship, “much of the work … support the objectives of the Belt and Road Initiative, and [the] cooperation is moving up the value chain to more advanced areas including science and technologies,” Lootah said.

He highlighted the “strategic” nature of the Chinese market, which has become the world’s largest consumer market.

“Trade finance remains one of the most important tools used to enable international trade and commerce, as it helps simplify transactions for importers and exporters,” he said.

Beyond crude oil, is China the ‘ideal partner’ for Middle East development?

Also, “China has played an important role in accelerating the development of digital payments in the [Gulf] … creating new impetus for economic development and advancing digital transformation across the region.”

Official figures from China’s Ministry of Commerce showed that foreign direct investment (FDI) dropped 9.8 per cent, year on year, to US$111.8 billion in the first seven months of 2023.

Beijing is expected to host the third Belt and Road Forum for International Cooperation in October, and the gathering aims to further rally the growth momentum in the China-led trade initiative to offset a decline in Western investments and boost China’s business presence overseas.

However, some analysts remain sceptical about whether Middle Eastern capital can replace the declining FDI from the West.

“On a macro level, I’m going to say probably not,” said John Oliver, a non-resident scholar at the Washington-based Middle East Institute. “Their markets are just not big enough.”

The Belt and Road Initiative is a reasonable mechanism to absorb Middle Eastern capital

Oliver cited a United Nations Conference on Trade and Development report indicating that total investment flows from developed countries in 2022 were around US$1 trillion, whereas the United Arab Emirates and Saudi Arabia’s outward investments were around US$43 billion.

But on a micro level, Oliver also said: “Sure, a Middle Eastern company can make investments that a Western company might not be willing to make. Certainly, we have seen Arab investments in Chinese refineries and petrochemical plants, for example.”

Wang Yiwei, director of the Institute of International Affairs at Renmin University, said that the inflow of Middle Eastern capital to China also helps hedge potential risks of American sanctions stemming from the Ukraine war.

“The Belt and Road Initiative is a reasonable mechanism to absorb Middle Eastern capital, especially with the sovereign wealth funds of Gulf countries hoping to get into China,” he added.