China cements party control over finance, clamping down on risk but making investors sweat

- At a top-level financial conference, China’s leadership reasserted the need for greater control by the Communist Party to mitigate systemic risk and keep institutions in line

- Move signals commitment to security, but undermines rhetoric of opening-up and welcoming foreign investment

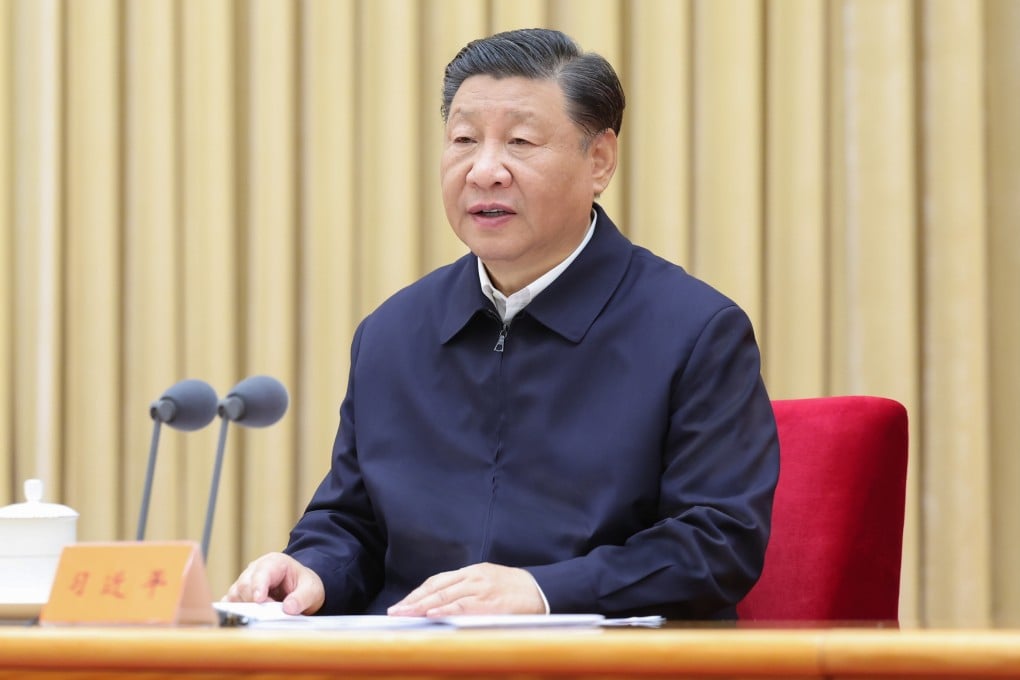

Beijing’s tightened control over its financial system – affirmed at a twice-a-decade policymaking conference on Tuesday – is a reflection of rising concerns from top leaders on the country’s economic distress and a symbol of widening divergence from more developed financial markets, analysts said.

While the consequent centralisation of resources and immediacy of decision-making could help solve the country’s present headaches, which include a slump in the property market and high levels of local debt, it may also prompt worries over whether the world’s second-largest economy is a place worth heavy investment.

Reflecting this shift in priorities, the meeting itself underwent a name change. Known as the National financial work conference since it was first convened in 1997, this year’s iteration was held as the central financial work conference.

The previous title indicated greater oversight from government organs like the State Council, China’s cabinet, while the new name signifies direct supervision by the party.

“The transition … is an apparent elevation in its status, because ‘central’ denotes the Party, and the Party leads all,” said Wang Zichen and Jia Yuxuan, researchers with the Center for China and Globalisation, a Beijing-based think tank.

Thus, operations of China’s financial institutions are driven by a different imperative compared to their Western counterparts, the analysts said in a note on Wednesday. Where Western firms maximise shareholder value as a first principle, those in China put party prerogatives in pole position – even if doing so runs counter to their own interests.