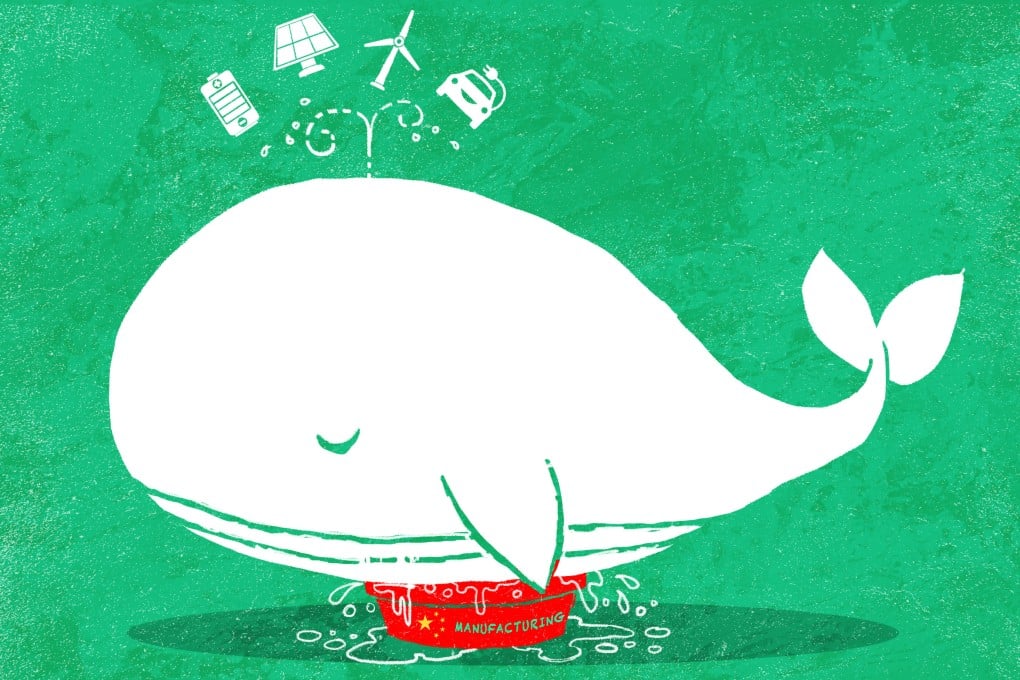

Behind China’s new-energy overcapacity as it changes the face of manufacturing and raises the stakes of competitiveness

- Amid price slashing and Western threats, on-the-ground accounts reflect how China’s new productive push is creating forces to be reckoned with

- Chinese manufacturers appear gung-ho on churning out goods and planning overseas expansions as they bide their time and wait for domestic demand to catch up

Undeterred by the overcapacity that is looming large in domestic manufacturing, and unfettered by the mounting risks of trade restrictions imposed by the West, Wang Rongshuo has still decided to go big this year – with an “all in” expansion of his business in the new-energy sector.

His company’s headquarters doubled in size last year, but he says it’s not done growing. Surging demand for solar panels and wind-energy infrastructure has led to rapid hiring – elevating the Chinese firm from a small player with a few dozen employees to one with a staff of hundreds, in just a few short years.

And that doesn’t even include the thousands of workers he has contracted at construction sites across the country, from its eastern coastal regions to the western Gobi Desert.

Wang’s supercharged confidence is rooted in China’s leadership prioritising growth of the new-energy sector, which includes electric vehicles (EVs), lithium-ion batteries and solar panels – known as the “new three” sectors, as they represent a shift away from China’s “old three” pillars of exports that comprised clothing, home appliances and furniture.

Companies will continue to invest and explore more markets. Otherwise it will be hard to survive

However, concerns have been piling up that rapid growth in the “new three” sectors appears unsustainable, as overcapacity has reared its head across the related manufacturing sectors while domestic demand is still weak.