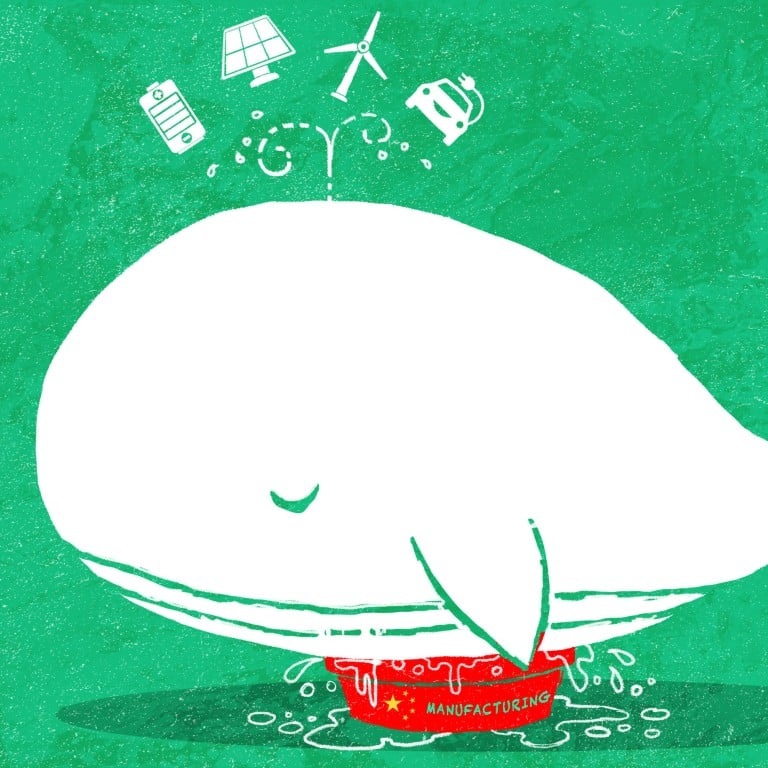

Behind China’s new-energy overcapacity as it changes the face of manufacturing and raises the stakes of competitiveness

- Amid price slashing and Western threats, on-the-ground accounts reflect how China’s new productive push is creating forces to be reckoned with

- Chinese manufacturers appear gung-ho on churning out goods and planning overseas expansions as they bide their time and wait for domestic demand to catch up

Undeterred by the overcapacity that is looming large in domestic manufacturing, and unfettered by the mounting risks of trade restrictions imposed by the West, Wang Rongshuo has still decided to go big this year – with an “all in” expansion of his business in the new-energy sector.

His company’s headquarters doubled in size last year, but he says it’s not done growing. Surging demand for solar panels and wind-energy infrastructure has led to rapid hiring – elevating the Chinese firm from a small player with a few dozen employees to one with a staff of hundreds, in just a few short years.

And that doesn’t even include the thousands of workers he has contracted at construction sites across the country, from its eastern coastal regions to the western Gobi Desert.

Wang’s supercharged confidence is rooted in China’s leadership prioritising growth of the new-energy sector, which includes electric vehicles (EVs), lithium-ion batteries and solar panels – known as the “new three” sectors, as they represent a shift away from China’s “old three” pillars of exports that comprised clothing, home appliances and furniture.

Companies will continue to invest and explore more markets. Otherwise it will be hard to survive

However, concerns have been piling up that rapid growth in the “new three” sectors appears unsustainable, as overcapacity has reared its head across the related manufacturing sectors while domestic demand is still weak.

“In early 2023, aggregate capacity utilisation dropped below 75 per cent for the first time since the worst point of China’s last overcapacity cycle in 2016, with a slight rebound since,” Rhodium Group analysts said in a report on March 26.

Numbers like these have served to incentivise firms like Wang’s to look abroad while still expanding at home.

“Before the country can achieve breakthroughs in clean energy and cut its dependence on fossil fuels, many companies will continue to invest and explore more markets. Otherwise, it will be hard to survive if they rely on only the domestic market,” Wang explained, adding that he plans to explore the Mexican market this year.

With ‘made-by-China’ under US pressure, Mexico’s trade probes spark concerns

Yangshuo Green Technology offers a raft of services, including large-scale constructions of new-energy plants, as well as installation teams that specialise in photovoltaics, energy storage, wind-energy infrastructure integration and other new-energy fields.

In 2020, Wang’s company had a cumulative installed capacity of 1.1 gigawatts, or 5.2 billion kilowatt-hours of electricity, equivalent to the power generated by 2 million tonnes of coal. Since then, those numbers have respectively increased to 3.6 gigawatts, 102 billion kilowatt-hours, and 88.9 million tonnes.

Meanwhile, Rhodium Group warned that capacity utilisation rates for silicon wafers in China fell to 57 per cent in 2022 from 78 per cent in 2019, while production of lithium-ion batteries reached 1.9 times the volume of domestically installed ones.

Beijing is also facing strong pushback from the United States and the European Union, which have repeatedly raised concerns that their domestic companies have been squeezed out by low-priced Chinese products that have flooded in as manufacturers see overseas markets as the means to help them absorb excess capacity.

“This sets China, the EU and the US on a dangerous course of trade confrontation in 2024, with a high probability of trade-defence action cases,” Rhodium’s analysts said.

Meanwhile, no other country has been producing and installing as many new-energy generators as China, which has said it added nearly 217 gigawatts of photovoltaic capacity in 2023 – almost two-and-a-half times as much as in 2022 and accounting for more than half of the world’s new photovoltaic capacity.

“Capital, technology and talent are pouring into these industries. While receiving a big boost and seeing fast progress, exceptionally fierce competition is also under way. A large number of enterprises are set to fall in the next year or two, but this is a normal phenomenon, we all believe,” said Arnold Dou, a veteran engineer with inside knowledge of the new-energy industry.

He also noted how China’s EV manufacturers are engaged in a price war and frequently update their models, which he said helps cultivate the rapid development of other industries.

Compounding their conundrum, the upcoming US presidential election has resulted in leading candidates embracing the long-held bipartisan practice of appearing tough on China with no shortage of political grandstanding.

China’s EVs find greener pastures with free-trade partners amid US, EU barriers

Meanwhile, the EU is likely to impose retroactive tariffs following its anti-subsidy probe into China’s exports of electric vehicles. The EU’s commissioner for competition, Margrethe Vestager, said the bloc was “absolutely willing to use” its suite of trade tools to combat unfair competition from China.

Stephen Olson, a senior fellow at the Pacific Forum and a visiting lecturer at the Yeutter Institute of International Trade and Finance, said: “The EU will march to the beat of its own drummer and will not see any compelling reason to follow the US lead. It is fair to say, however, that the EU is growing increasingly comfortable with a more assertive approach to China’s trade practices.”

“When and where it suits its interests, the EU will seek to coordinate with the US on China trade policy, but the desire for a more confrontational stance is still not as advanced in the EU as it is in the US,” he added.

The US Department of Commerce has placed import duties on solar-panel makers that finish products in Southeast Asia to avoid tariffs on made-in-China goods, and Washington has barred EV battery materials from China as a “foreign entity of concern”.

“Strong measures such as revoking the permanent normal trade relations [PNTR] status, or introducing a new tariff column for China, are already on the radar of US politicians during the election year,” Rhodium said. The PNTR is a legal designation in the US for free trade with a foreign nation.

China’s domestic manufacturing imbalance could also compel a response from a broader set of countries, and if the situation continues, China may face intensified pushback from emerging markets, including Mexico and Brazil, Rhodium warned.

Tariffs imposed on Chinese products since the US-China trade war began in 2018 have had a limited impact on Chinese exports, but tech-containment moves under the Biden administration have dealt an impactful blow to Chinese trade with the US, said He Weiwen, a senior fellow with the Centre for China and Globalisation, a Beijing-based think tank.

Nonetheless, he said, “here is still a need for China to employ preventive tactics for the rainy days if Trump returns to power”.

Chinese ex-trade official slams US for ‘dismantling’ global trade

However, Zha Daojiong, a professor with the School of International Studies at Peking University, cautioned that “it would be unwise for China to match either US or EU policies towards it”.

“The past few years have shown that China, as a market, can be effectively replaced. A matching game will only accelerate the trend, which is harmful to China’s desire to avoid falling into a ‘middle-income trap’, which is arguably already discernible,” he added. “At the end of the day, it is an economy’s capacity to adjust to the ever-shifting and multidirectional flows of resources around the world that matter most.”

Along with many of his peers, Wang is acutely aware of overcapacity issues and is embracing an industrial reshuffle while looking for new opportunities to survive an upstream price war.

It means bigger profit margins for downstream participants, which would lead to a greater willingness to invest, he said.

“For example, a project that originally required 38 million in funding can now be started with only 30 million because component prices have dropped significantly. This will lead to more projects on the ground, such as in photovoltaic or wind power,” Wang said, speaking in yuan terms.

Everyone’s goal is to be able to survive so they can catch the next round of energy breakthroughs

A business executive in the semiconductor sector who spoke on condition of anonymity said China would be more capable of countering external pressure if it is able to utilise a higher proportion of renewable energy in its overall energy consumption.

“For China’s new-energy industry, the tipping point will be when all links in the industrial chain are cheap enough, by which time China will have established absolute advantages,” he said.

According to analysts at Wood Mackenzie, a provider of data and analytics for the world’s energy transition, China’s solar-production costs plummeted by 42 per cent last year, which was a much greater cost decline than was seen by Indian, European, and American manufacturers.

From where Wang stands, Chinese companies and investors are looking to seize upon those falling prices by scaling up production capacity, like his firm is doing.

“Everyone’s goal is to be able to survive so they can catch the next round of energy breakthroughs,” he added. “If China’s new-energy installations, including in its northwest region, are enough to meet national demand over the next 10 to 15 years, what [external pressure] will there be to worry about?”