China creating ‘unfair competition’ for foreign players, German firms say in survey

- A survey released by the German Chamber of Commerce in China has found a two-thirds majority of businesses believes it faces ‘unfair competition’

- Lack of market access and other disadvantages could depress enthusiasm, weighing down an already fraught trade relationship in run-up to chancellor’s visit

German businesses in China have reiterated their calls for a level playing field, with two-thirds of those surveyed seeing themselves in “unfair competition” when operating there – findings which add to pressures on Beijing from foreign investors over persistent struggles related to market access and overcapacity.

“Chinese and German companies are increasingly becoming close competitors – both in China itself and in global markets. This is the reality that German companies must prepare for,” said the report, released on Wednesday afternoon.

“The sluggish development of the Chinese economy coupled with the emergence of local competitors has made the issue of unfair competition in China more pronounced.”

Two-thirds of the 150 companies surveyed from February 22 to March 6 said they face “unfair competition” operating in China, Germany’s largest trading partner, reflecting the latest difficulties perceived by foreign businesses in the country – a topic likely to take precedence in the German leader’s meetings next week.

The German businesses surveyed – 29 per cent from the manufacturing sector and 20 per cent from carmakers – said they are most confident in their product quality, technological leadership and strength in innovation compared to Chinese competitors. However, they see weaknesses in cost efficiency, time to market readiness, and innovation speed when measured against local firms.

China-Germany ties are resilient despite EU push to ‘de-risk’: Beijing envoy

Market access – particularly access to lucrative networks like government authorities, universities, and public tenderers – were seen by respondents as the most pressing competitive disadvantages.

Maximilian Butek, executive director of the German Chamber of Commerce in East China, said the survey showed a change in approach by German companies. “They now invest,” he said, “not for the sake of growth, but rather to remain or become more competitive”.

Over 52 per cent of those surveyed said their primary competitors were private Chinese companies, 37 per cent named other foreign companies and 11 per cent said Chinese state-owned companies were their strongest rivals.

Butek noted the survey results showed 11 per cent of German carmakers said they see their Chinese competitors as leaders in innovation, and 58 per cent of them expect Chinese carmakers to take on that role over the next five years.

“Why do you need to protect an industry where local companies are fully empowered to compete with international markets?” he asked.

The most frequently mentioned downsides to heightened competition within China were increased cost pressures, reduced profit margins and lower market share, but 79 per cent of the respondents said they still plan to keep up their investments.

Beijing has attempted to bring in foreign investment to buoy confidence after a slower than expected economic recovery last year. A number of foreign chambers have flagged market access, vague regulations and tensions with the US as top concerns when considering new or deeper involvement in China.

Bilateral trade for goods between the two economies crested €250 billion (US$271.5 billion) in 2023 according to official figures – with China retaining its status as Germany’s top trading partner – but that sum represented a decrease of 15.5 per cent from the previous year.

However, German direct investment in China rose to a historic high of €11.9 billion last year, according to a report from the German Economic Institute (IW) think tank.

Berlin has been on the forefront of several of the economic and trade issues that have contributed to increasingly frosty relations between the West and China.

Those tariffs have not yet manifested, but the automotive trade is still inching in China’s direction. Imports of Chinese vehicles and parts to Germany jumped 75 per cent in the first half of the year while trade the other way slumped, according to another IW report from last September.

“A lot of [German] companies report that competitors are offering products below their production price,” Butek said. “The only way to tackle these challenges is to become more competitive.

“But we cannot do that if the competition is unfair. We also have to make sure that we generate enough profits in China, which we can invest in [research, development] and innovation to become better,” he added.

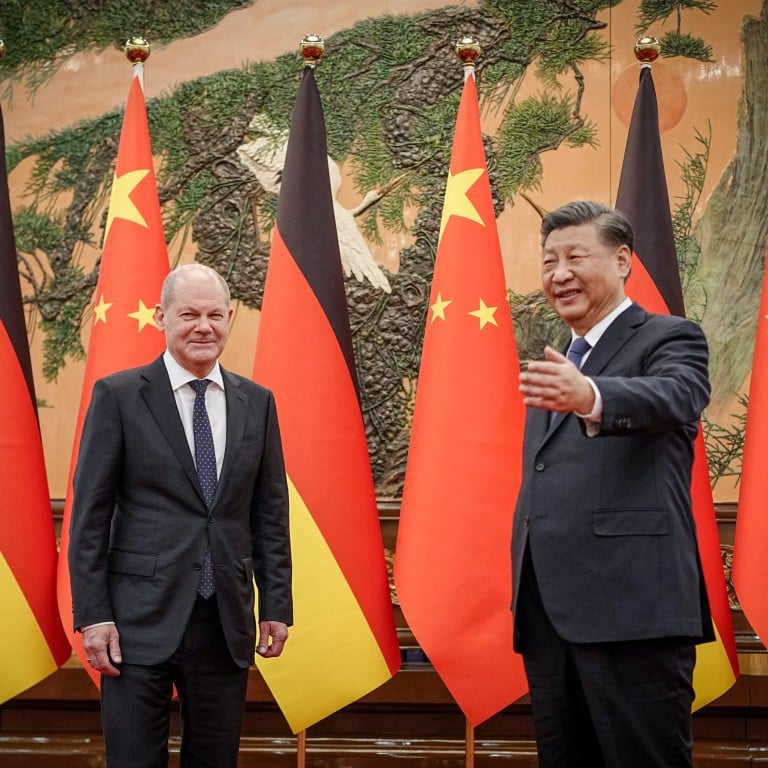

Scholz will hold talks with President Xi Jinping and Premier Li Qiang in Beijing on April 16 as part of a four-day trip to China, said his chief spokesman Steffen Hebestreit on Monday. The chancellor will arrive in Chongqing on Sunday and visit a German-operated hydrogen facility before travelling to Shanghai and Beijing.

There are a lot of issues which cannot be solved overnight, and they also cannot be solved just on one visit

Butek said he expects the chancellor to explain to the Chinese government the challenges the German business sector faces.

“There are a lot of issues which cannot be solved overnight, and they also cannot be solved just on one visit,” he said. “Therefore we hope that new dialogue formats can be initiated between the two governments with their respective resources and ministries.”

A German business delegation including Roland Busch, chief executive of Siemens, BMW’s Oliver Zipse and Bayer CEO Bill Anderson will accompany Scholz, according to a report from Reuters.

The trip will be Scholz’s second sojourn in China as chancellor, following his first visit in November 2022.