China unveils plan to keep officials’ noses clean in campaign to control financial risk

- At a meeting of China’s Politburo, a plan was reviewed to keep officials accountable as the country moves to mitigate financial risk

- As troubles mount in the system, with property market and local governments feeling the heat, Beijing emphasises need for firm hand

China’s Politburo – a high-level decision-making body of the country’s Communist Party – reviewed a pilot accountability mechanism for financial de-risking on Monday, the latest offensive in Beijing’s campaign to address deep-rooted hazards in the financial system and the crisis-plagued property sector.

“[The plan] is aimed at entrenching the party’s leadership and consolidating the responsibilities of regulators, financial institutions and local authorities in the financial field,” according to a readout of the meeting from Xinhua.

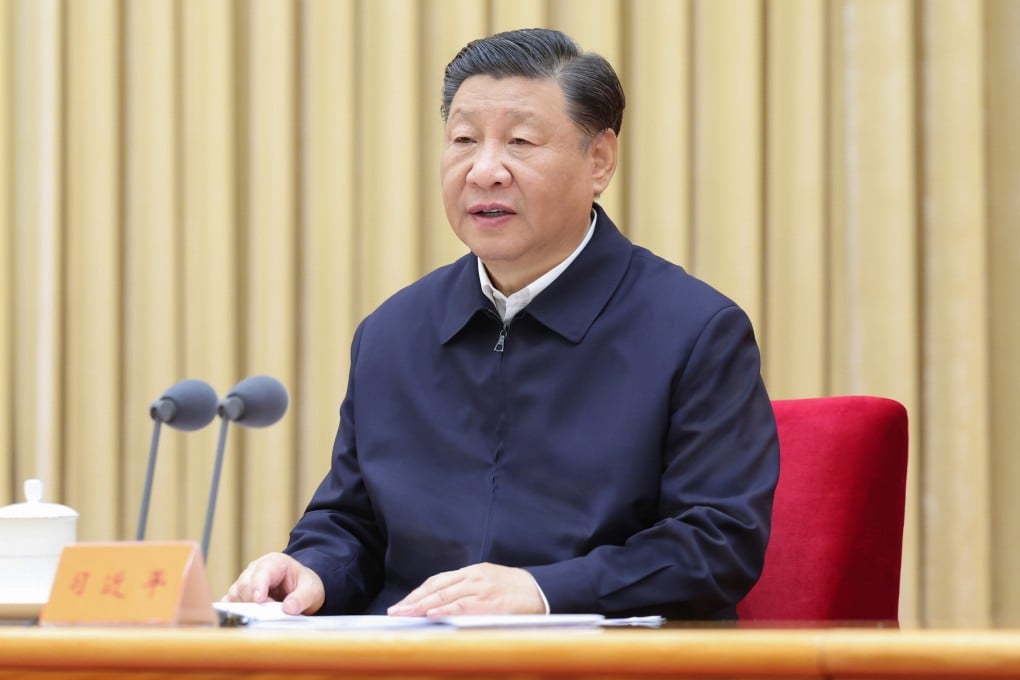

At the meeting, chaired by President Xi Jinping, cadres at all levels were urged to establish a “correct concept of performance” for the implementation of directives on financial supervision and risk management.

More stringent implementation, oversight and punishment was also encouraged to ensure financial regulation has teeth.

The situation has become so rampant that Beijing feels the need to set up such an accountability mechanism to rein them in