China’s rare earth dominance to continue as US investment lags: analysts

Beijing’s long-term strategy pays off as Washington scrambles to respond, a new report finds

In contrast, the US is paying the price for decades of underinvestment, obsolete policies and the absence of a coherent strategy, according to a report by the New York-based business intelligence firm Strategy Risks.

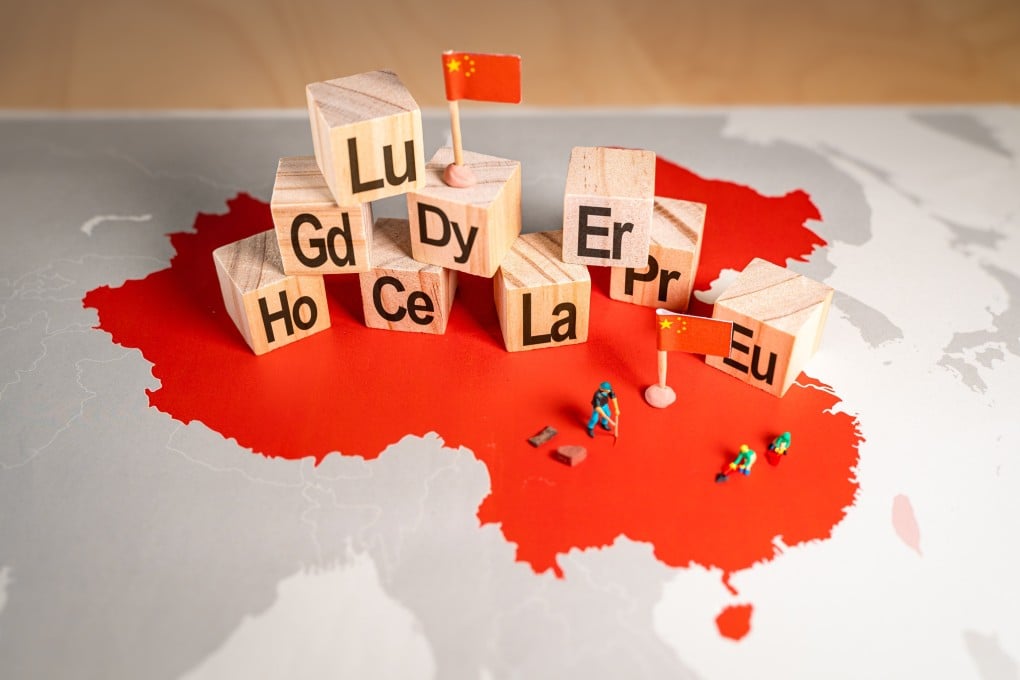

The warning came as Beijing increasingly leverages its dominance in the global rare earth supply chain – particularly during recent trade negotiations with the Trump administration.

Despite growing US efforts to close the gap, analysts at Strategy Risks said the country was still not doing enough to reduce its reliance on Chinese rare earth exports in the near and medium term.

“Although the US is addressing its vulnerabilities in this sector through initiatives intended to strengthen production and materials processing, America remains dependent on imported minerals from China, due to a comparative lack of raw mineral deposits and government investments,” they wrote in the report on Monday.