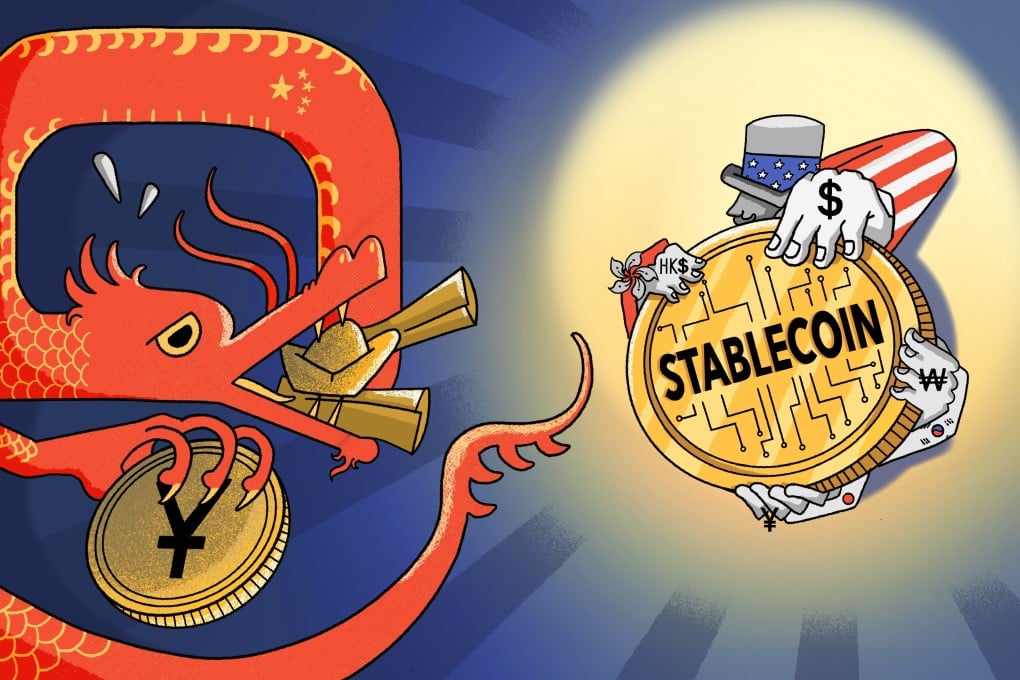

China’s stablecoin dilemma: why US dollar tokens matter – and how Beijing might respond

Beijing is wary of crypto but may be forced to act, as dollar-backed stablecoins risk deepening US power across global finance

Once a niche corner of the cryptocurrency world, stablecoins have surged into the global spotlight this year, prompting analysts and industry insiders to declare that the digital asset’s time has come.

Wall Street has taken note. In August, analysts from leading investment bank Goldman Sachs dubbed the past few months the “summer of stablecoins”.

Unlike highly volatile cryptocurrencies like bitcoin or ethereum, stablecoins are pegged 1:1 to fiat currencies like the US dollar or Hong Kong dollar, or to other reserve assets. Designed to live up to their name, they aim to combine the efficiency of digital assets with the reliability of traditional money – so long as the currency behind them remains strong.

But while stablecoins can, in principle, be pegged to any fiat currency, more than 99 per cent are backed by the US dollar or dollar-denominated assets – far outstripping the greenback’s roughly 50 per cent share in global payments and 58 per cent share in global foreign exchange reserves.