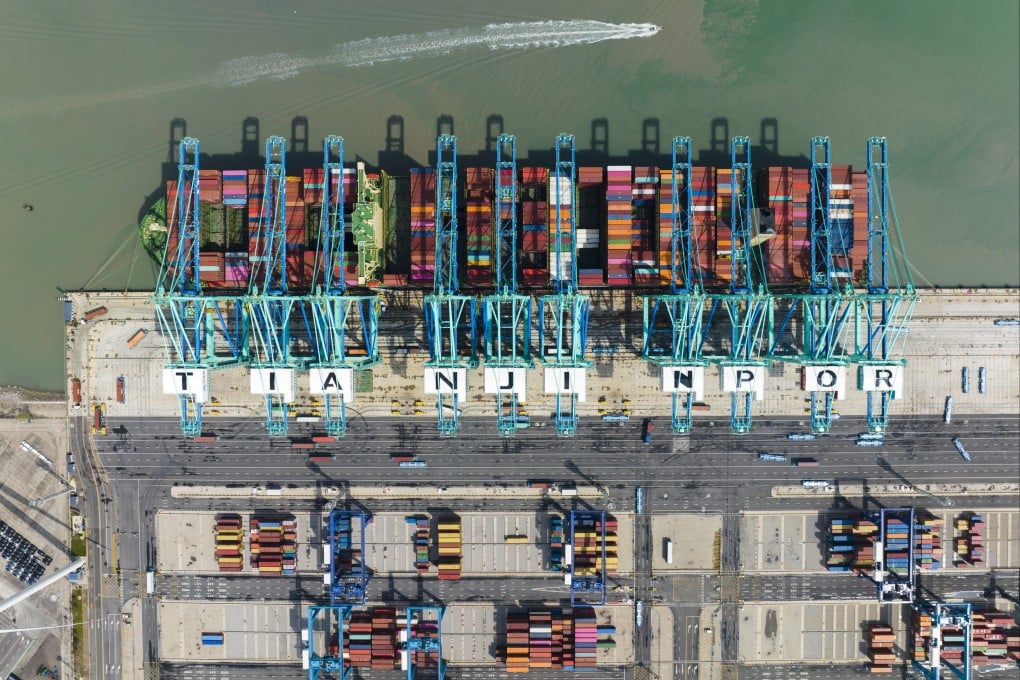

China trade: ‘surprise’ exports surge led by Asean shipments, fall of imports eases

- China’s overall exports rose by 14.8 per cent in March compared with a year earlier, while imports fell by 1.4 per cent last month

- Shipments to the Association of Southeast Asian Nations (Asean), China’s largest trade partner, soared by 35.43 per cent, year on year

China recorded robust export growth in March, backing up Beijing’s pledge to shore up trade to support the overall economic recovery, although the surge came with an official warning that “severe and complex” headwinds remain.

Exports significantly beat expectations and rose by 14.8 per cent from a year earlier to US$315.59 billion, ending a run of five consecutive months of declines, data released by China Customs on Thursday showed.

The surge was mainly driven by a sharp increase in shipments to the Association of Southeast Asian Nations (Asean), China’s largest trade partner, which soared by 35.43 per cent, year on year.

“The strong export growth is likely due to strengthened ties with [emerging market] countries and the continued healing of the global supply chain,” economists at Goldman Sachs said.

China’s export growth soared in March. This came as a surprise to the market. Analysts unanimously expected export growth to stay negative in March

Factories running at full capacity having “caught up with the accumulated orders from the past” after coronavirus outbreaks in December and January depleted inventories was also a factor, said Zhang Zhiwei, chief economist at Pinpoint Asset Management.