Taiwan’s hi-tech export orders resume rise as world gears up for AI, unvexed by interest rate pressure

- Worldwide demand for components that speed up artificial intelligence computations is growing, and it likely helped Taiwan’s cause in January

- Orders by value topped US$48 billion last month, and these also include semiconductors, electronics for cars, and electric vehicle components

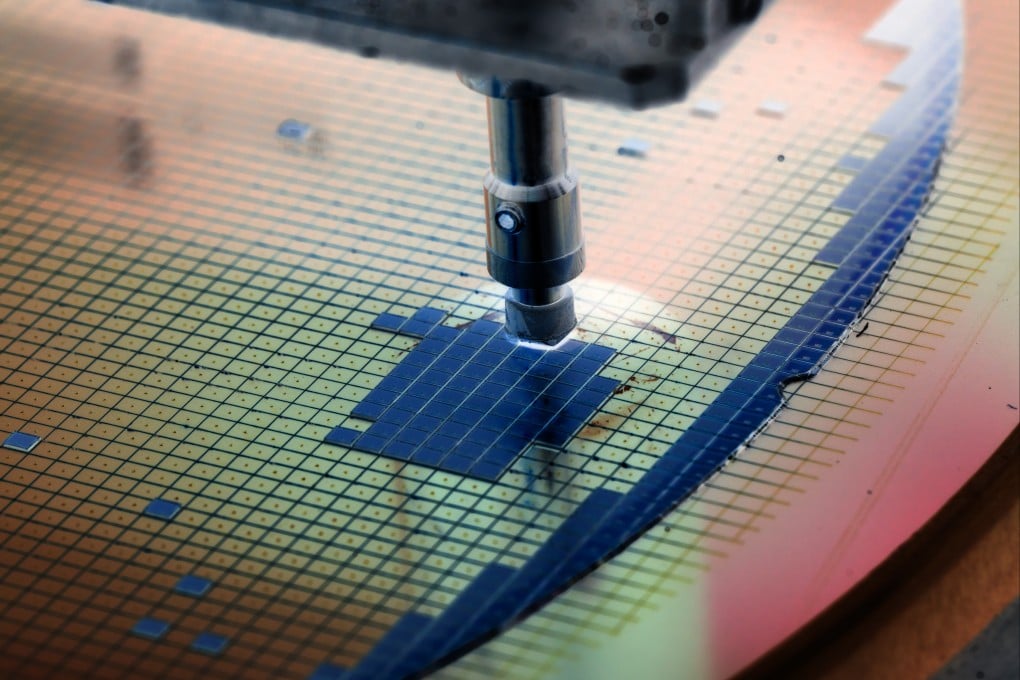

Global tech production hub Taiwan has reported a monthly gain in its all-important export orders due to growing demand for AI-related devices, and the rise came despite persistent pressure from high interest rates.

The value of orders firmed by 1.9 per cent to US$48.42 billion last month, year on year, the Ministry of Economic Affairs said on Tuesday.

The island, whose economy relies on the production of tech hardware and is regarded as a bellwether for the global health of consumer electronics, had reported 14 straight months of year-on-year declines in export orders before the figure edged up by 1 per cent in November. Orders then fell again in December.

Further evidence of a rise in worldwide demand for components that speed up artificial intelligence computations probably helped Taiwan’s cause in January, according to analysts.

AI has become the next big thing in Taiwan’s exports and industrial development

“Orders for AI products keep rising,” said Hu Jin-li, a professor with the Institute of Business and Management at National Yang Ming Chiao Tung University in Taipei.