Vietnam company finding a silver lining to US-China trade war, due to Asian supply chain shift

- Vinasolar, owned by Shanghai-based Yize New Energy, started production in Vietnam in 2014, after the United States and EU put tariffs on solar panels

- Now it is seeing a huge surge in orders, as other Chinese companies look to avoid US tariffs by exporting materials for assembly in Vietnam, then onto America

A Chinese company is discovering a silver lining to US President Donald Trump’s trade tariffs, which are redrawing the Asian supply chain.

“We are planning to expand our production line this year as we are receiving more orders from Chinese companies,” said Zhang Kai, vice-general manager at Vinasolar, in an interview in his office in Vietnam’s Bac Giang Province. Zhang said the company also has higher orders from other countries.

The solar tariff battle started in 2012, when the US imposed tariffs of up to nearly 250 per cent on solar panel imports after an investigation found that the Chinese government was subsidising Chinese panels that were flooding the US market. China denied that it had subsidised solar panels for export.

The following year, the European Union announced that it would impose a tariff of 12 per cent on the import of solar panels, cells and wafers from China. The EU ended restrictions on the sale of solar panels from China in September last year in a move that EU producers said “would lead to a flood of cheap imports”.

But the US did not back down. In 2014, Washington announced a second round of anti-dumping duties ranging from 27 per cent to 78 per cent on imports of most solar panels made in China. It also added anti-subsidy duties ranging from 28 per cent to 50 per cent on Chinese solar panels to offset the financial support the Chinese government gave to manufacturers.

Then, in February 2018, the US government implemented “global safeguard tariffs” – placing a 30 per cent tariff on all solar panel imports, except for those from Canada, in addition to the existing duties, after Trump signed a Section 201 action, which would last for at least four years and could be extended to eight years.

This led to a drastic reduction in Chinese solar panel exports to the US, a market which had previously been dominated by Chinese players. China produces 60 per cent of the world’s solar cells and 71 per cent of solar panels. Six of the world’s top 10 solar panel manufacturers are Chinese owned.

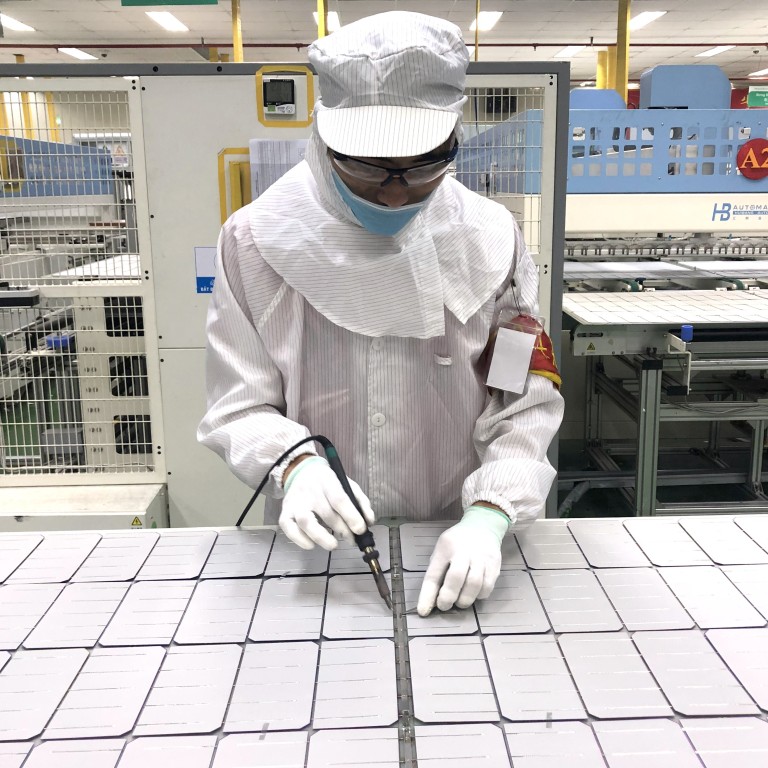

in the middle of all this, Vinasolar was established to be an original equipment manufacturer (OEM) based in Ho Chi Minh City. The company started producing solar panels for big Chinese manufacturers, then exporting the finished products to the US and Europe bearing “Made in Vietnam” labels that enabled them to avoid the tariffs.

According to a report by China Chamber of Commerce for Import and Export of Machinery and Electronic Products (CCCME) in May, after the 301 investigation, China’s exports of photovoltaic products to the United States dropped 28.9 per cent in the first quarter of 2019. The total export from China to the US had the capacity to generate 10 megawatts of energy, which is virtually zero.

All of the successive duties and tariffs placed on Chinese solar panels were added to the existing costs. It meant that by the time the Section 301 tariffs came in, Chinese panels were not affordable for US buyers.

“Due to the impact of various trade protection measures in the United States, the door to the export of Chinese photovoltaic products to the United States has been closed,” the CCCME report said.

Meanwhile, in the first quarter this year, according to the report, Vietnam was the number one destination for Chinese solar panels, accounting for 16.8 per cent of China’s solar exports, worth US$739 million. That was an increase of 24,000 per cent, year-on-year.

The staggering rise shows that Chinese companies are using Vietnam as a tariff workaround: selling their parts to companies in Vietnam for finishing and assembling, significantly altering the goods so that they meet country of origin standards, then exporting to the US market and the end consumer.

Vinasolar has been making hay while the sun shines. Its import business has grown significantly and it has developed sufficient production capacity in Vietnam to export products bearing its own logo, about 70 per cent of which go to the US.

After scouting manufacturing conditions in several Southeastern Asian countries, the parent company, Yize New Energy, chose Vietnam for its relatively low tariffs and proximity to China, Zhang said. The decision is reaping a huge dividend.

The company now employs about 4,500 Vietnamese and 100 Chinese employees. The top management team is all Chinese, while there is a small number of Vietnamese middle managers.

Due to the influx of Chinese manufacturers moving production to Vietnam because of the trade war, Vinasolar is now finding it harder to recruit good workers. Over 90 per cent of its employees are production line worker and the competition for such staff is heating up.

“The recruitment difficulties are still manageable at this moment, and we are also preparing for future challenges,” Zhang said.

On Tuesday, Vietnam’s Ministry of Planning and Investment announced that the country had received US$9.1 billion in foreign direct investment (FDI) in the first half of this year, up 8 per cent from a year earlier. Most of the investment went to manufacturing, processing and real estate projects.

Hong Kong continued to be the top source of FDI with US$5.3 billion, accounting for 28.7 per cent of total investment, followed by South Korea with US$2.73 billion or 14.8 per cent of total investment.

Given that most of Hong Kong’s traditional manufacturing base had migrated north into Guangdong over the past several decades, it is fair to assume that much of the new investment in Vietnam represents manufacturers moving production from China.

“When we started five years ago, the supply chain was far from mature. But Vietnam has been developing over the past few years, there are manufacturers that are [now] producing some of the industrial components for us,” Zhang said.

Update: This story was updated on June 27 to reflect the number of Chinese workers employed by Vinasolar