South Korea’s economy facing ‘perfect storm’ as Japan trade dispute continues and exports plunge

- South Korea’s exports for the first 20 days of August fell 13 per cent from a year earlier, pointing to a ninth successive monthly decline

- Semiconductor sales fell 30 per cent, while exports to China fell 20 per cent, suggesting joint headwinds of global electronics slowdown and US-China trade war

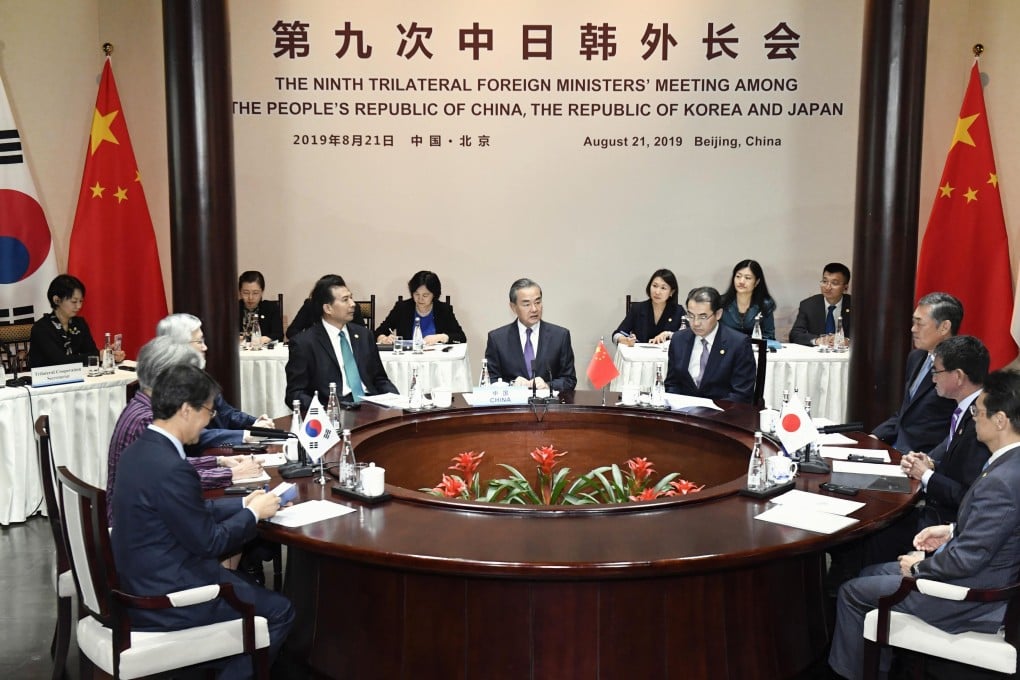

As the foreign ministers of China, Japan and South Korea gathered for trilateral talks in Beijing on Wednesday to improve relations, a stark reminder came of the perilous situation South Korea’s economy is in.

Exports for the first 20 days of August fell 13 per cent from a year earlier, signalling a ninth successive monthly decline. Within the headline figure, two numbers illustrate the “perfect storm” facing the country: sales of semiconductors – one of its most valuable exports – fell 30 per cent, while exports to China – its largest trading partner – fell 20 per cent.

Both an exporting and electronics powerhouse, South Korea’s economy is disproportionately exposed to the US-China trade war and the associated technology war, as well as the slowdown in semiconductor demand stemming from the end to the electronics supercycle.

That South Korea has become embroiled in a trade dispute with neighbouring Japan adds more pressure at an already crucial time, and with Wednesday’s talks ending without any resolution, it created further woes on this heavily trade-dependent nation.

On Thursday, the situation with Japan escalated again, when South Korea announced that it would scrap a military intelligence sharing pact with its neighbour, adding further concern that the trade dispute would ratchet up another level.