Brazil mining giant Vale agrees deal with China port to expand iron ore handling capacity

- West III Project with Ningbo Zhoushan Port will allow Vale to optimise supply chain costs on long sea trips from Brazil and increase market share in China

- Shulanghu Port’s deep berths will be able to accommodate Vale’s giant Valemax iron ore carriers, which are as big as some skyscrapers

Brazilian iron ore mining giant Vale has struck a deal with Chinese state-owned port operator Ningbo Zhoushan Port to create additional capacity to handle iron ore shipments at Shulanghu Port as it moves to increase its market share in China.

The US$624 million project in Zhoushan, Zhejiang province, is particularly strategic for Vale as it increases the amount of iron ore the miner can ship to China.

The joint venture, known as the West III Project, will allow for the handling of an additional 20 million tonnes of iron ore a year at the port, which is located south of Shanghai. Vale’s participation in the project will increase its annual iron ore capacity at the port to a total of 40 million tonnes.

Vale and Ningbo Zhoushan, which is part of the larger Zhejiang Provincial Seaport Investment & Operation Group and one of China’s largest terminal operators, will have an equal stake in building, owning and operating the new port facility.

Vale dominates in the ownership of the supersized Valemax vessels – the largest that can dock at Chinese ports – allowing the miner to be more competitive by sending larger shipments of iron ore from Brazil.

The use of Valemax ships – also known as Chinamax vessels – is critical to Vale remaining competitive with its Australian counterparts, which have a shorter travel distance.

In a move to diversify its sources of the critical steelmaking ingredient amid its post-coronavirus economic recovery, China in July approved four new deepwater ports to host Valemax shipments.

The other three ports are at Rizhao and Lanshan cities, both also in Shandong, and in Ningde, Fujian province.

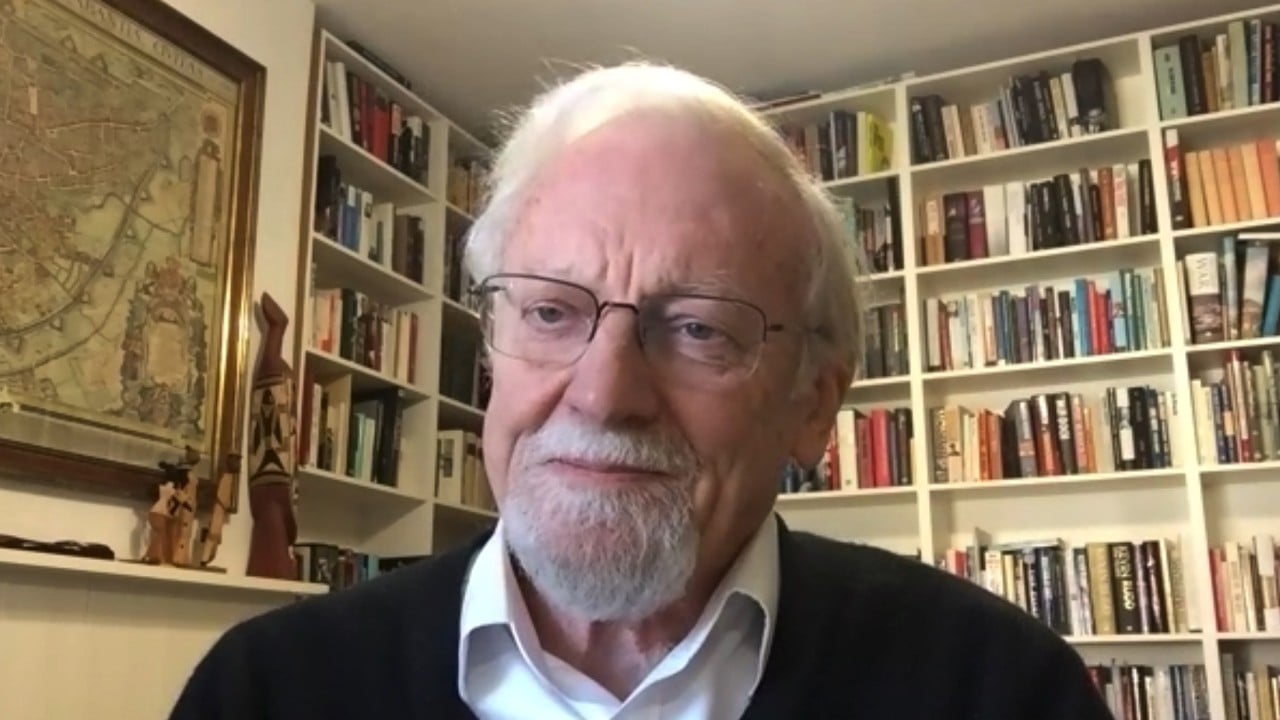

07:34

Australia and China cooperation too valuable for 'nonsensical' decoupling

The new three-year West III Project will include the acquisition of land for the port’s expansion, the construction of a new stockyard and two loading berths, subject to regulatory approval.

In Brazil, at the start of its supply chain, Vale is also in talks with local port operators to increase its ore export capacity.

It is negotiating with deep-berth port Alcantara Port Terminal on Brazil’s northern coast, close to its huge S11D iron ore project in the Carajás Mountains.

But those good fortunes could reverse as steel demand has begun to slow following China’s huge post-lockdown infrastructure and property building boom, and as iron ore inventories pile up.