Why US-China tensions and demand for hi-tech products spells good news for Taiwan’s economy, despite coronavirus

- Taiwan’s government has forecast the economy to expand 3.83 per cent in 2021, following strong growth this year

- Growth will be supported by demand for hi-tech exports and Taiwanese companies reshoring from China

While growth is expected to return to much of the world next year, Taiwan is likely to be one of the few economies that expands in both 2020 and 2021.

The government’s Directorate-General of Budget, Accounting and Statistics has forecast gross domestic product (GDP) to expand 2.54 per cent this year and 3.83 per cent next year, despite the global economic shocks from the Covid-19 pandemic.

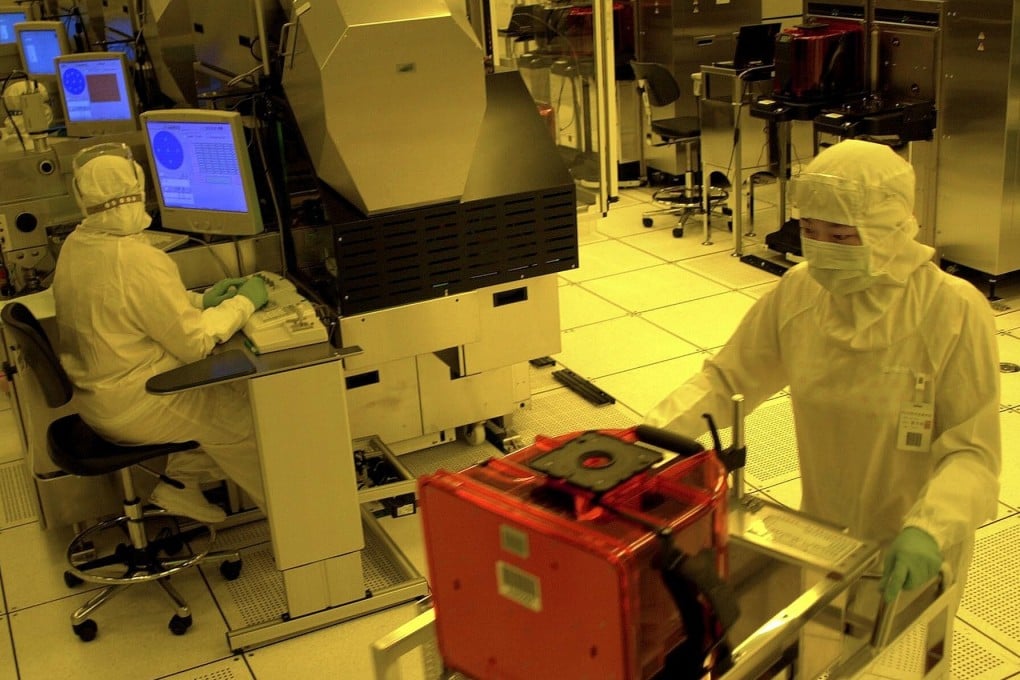

The self-ruled island is expected to enjoy brisk shipments of consumer electronics, including PCs, gaming devices, 5G mobile phones and computer chips, as lockdowns and fears over the spread of the coronavirus mean people go out less often, analysts and officials said.

03:42

Coronavirus: How did Taiwan keep local Covid-19 transmissions to zero for over 200 days?

“Rising domestic production capacity, spurred by the continuing investment of dominant semiconductor manufacturing and reshoring companies, will support Taiwan’s export and investment growth,” the directorate-general said late last month in a statement.