China to develop ‘national team’ of state-owned giants, but efficiency concerns linger

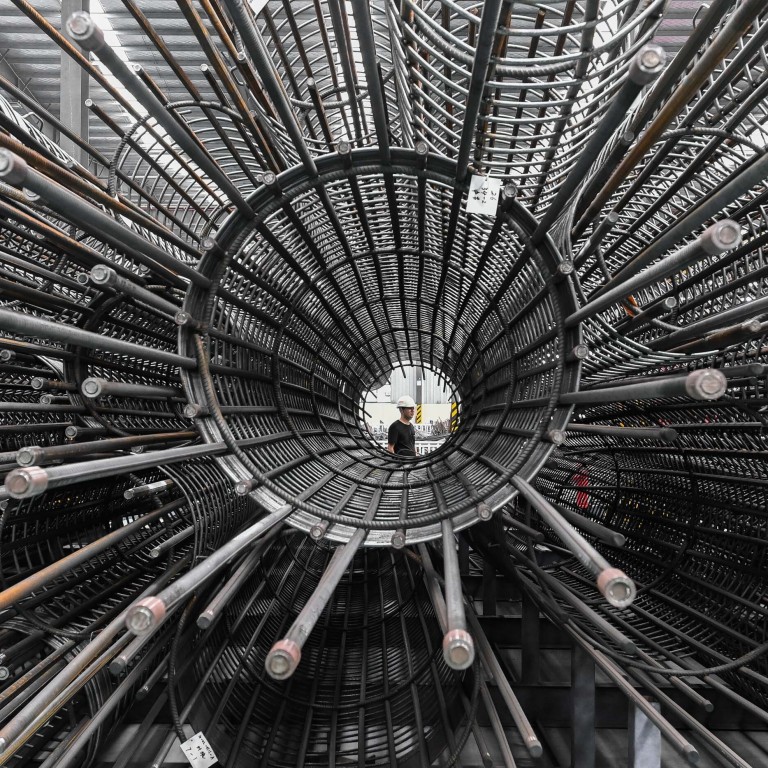

- China Baowu Steel Group became the world’s largest steelmaker last week, when it announced output hit a record 100 million tonnes this year

- The company’s success has highlighted Beijing’s goal of creating a ‘national team’ of globally competitive, innovative state-owned enterprises

Chen Derong, the chairman of China Baowu Steel Group, broke into tears last week as he announced the company had produced a record 100 million tonnes of steel this year.

It was a “dream come true,” Chen said, as the Shanghai-based mill surpassed ArcelorMittal, an Indian-Luxembourg multinational, to become the world’s largest producer and highest-earning steelmaker.

“Central government SOEs must be the ‘national team’ that can provide solid support for economic and social development,” Hao Peng, head of the State-owned Assets Supervision and Administration Commission (SASAC), said at the agency’s annual conference on Friday, just two days after Baowu celebrated its accomplishment.

We must build a group of industrial champions, a group of technologically-innovative pioneers, a group of leaders in specialty fields

“We must build a group of industrial champions, a group of technologically-innovative pioneers, a group of leaders in specialty fields, and a group of enterprises that can guarantee supply of basic [materials and goods],” he said, while outlining priorities for 2021.

The combined assets of China’s 97 central government-owned enterprises are expected to reach 69 trillion yuan (US$10.5 trillion) this year, an increase of 45 per cent from five years ago, according to data released by SASAC, which oversees the firms. The average annual growth of revenues and profits were 5.6 per cent and 8.9 per cent, respectively, over the same period.

About half of the SOEs – including China Mobile, the China National Petroleum Corporation and Baowu – are on Fortune’s list of the world’s top 500 companies.

When firms owned by provincial and local governments are included, the value of state-owned assets rose to 233.9 trillion yuan at the end of 2019, a jump of 11.2 per cent from a year earlier, according to the Ministry of Finance. Net assets after subtracting liabilities stood at 64.9 trillion yuan.

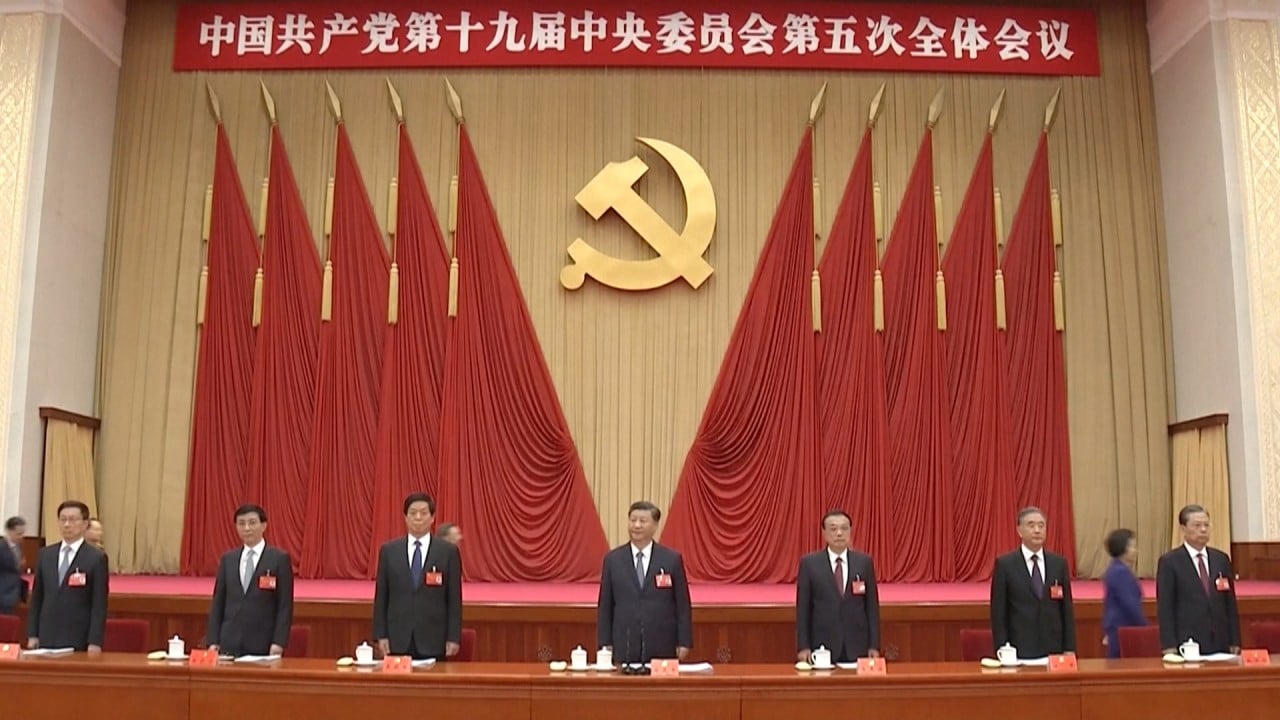

03:05

What happened at the Chinese Communist Party’s major policy meeting, the fifth plenum?

“It is the first time that the goal of building a national team has been released in detail,” Li Jin, chief researcher at the China Enterprise Research Institute, wrote recently, referring to the SASAC annual conference and the plan to build industrial champions.

“The introduction of new performance appraisal indicators shows that the authorities will be problem and goal oriented.”

SASAC said it will start evaluating the productivity, net profits and R&D intensity of state enterprises from next year.

Both private Chinese companies and foreign firms have long complained that SOEs benefit from unfair advantages, including access to bank loans, government financial backing and preferential market access.

01:28

China builds over 4,000km of railway in 2020

Nevertheless, China‘s SOEs are often criticised for their low productivity and competitiveness.

Even so, the ability of state-owned firms to quickly resume production this year after the coronavirus pandemic shut down large parts of the country has reinforced Beijing’s belief in their importance to the economy, especially as it pursues a new “dual circulation” strategy that aims to boost self reliance in the face of rising external uncertainties.

We have invested too little in high-end technologies, strategic industries and high-quality public services

But to ensure their continued competitiveness, China’s top leaders have said state firms need to focus on key sectors of the economy and improve efficiency and productivity, particularly in the tightly controlled energy, railway, telecoms and public utilities industries.

“The assets of central SOEs in sectors such as petrochemicals, power, telecommunications, national defence, machinery and construction account for more than 90 per cent of the [SOE] total. Those industries face overcapacity,” Ji Xiaonan, former head of the supervisory committee at SASAC, said at the fifth SOE management forum held in Beijing earlier this month.

“We have invested too little in high-end technologies, strategic industries and high-quality public services.”