US-China relations: companies in South China have no appetite for decoupling, but expect tensions to grow, says AmCham

- Firms surveyed by AmCham in South China are more positive about US-China ties in 2021 than previous years, although most think frictions will grow

- But 95 per cent say they have no intention to decouple from China, with more than 60 per cent saying the country is still their No 1 investment destination

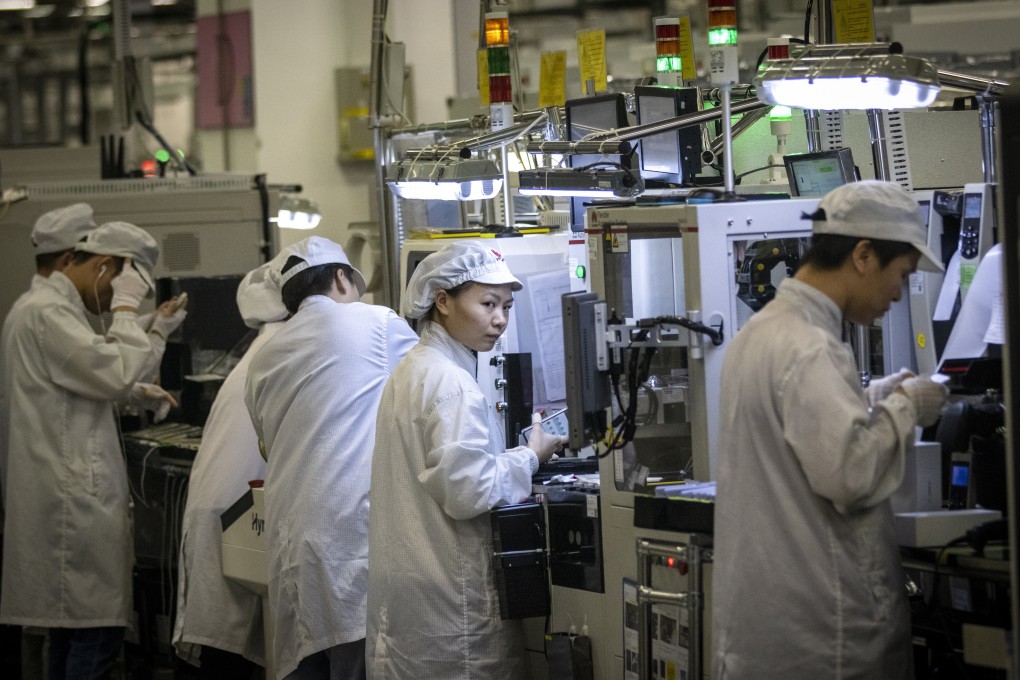

Most small and medium-sized companies operating in China’s south plan to stay in the country despite concerns that frictions between Beijing and Washington are likely to grow this year, according to a new survey from the American Chamber of Commerce in South China.

Although companies are slightly more positive about the relationship in 2021 than previous years, some 86 per cent of businesses believed the US-China trade dispute is “very likely” or “probably” likely to expand, said the special report on the state of business in South China, one of the country’s main growth engines.

The survey, conducted between September 23 and December 22 last year, canvassed the views of 191 companies mostly from the United States or mainland China, with 12 per cent from Europe and the remaining 18 per cent come from Japan, Korea, Southeast Asia or Oceania.

There is a general consensus within the business community that the Biden administration will view the US-China relationip through a different looking glass

“There is a general consensus within the business community that the Biden administration will view the US-China relationship through a different looking glass,” Dr Harley Seyedin, president of AmCham in South China, said in a statement.