Australian rare earth firm ASM signs South Korea deal as West tries to counter China’s dominance in critical minerals

- Australian company ASM has signed a memorandum of understanding with two regional governments in South Korea to build a rare earth processing plant

- The agreement comes amid an international race to secure the critical minerals, with Western countries trying to counter China’s dominance in supply

Australian rare earth producer ASM has strengthened its supply chain by closing a deal with two regional governments in South Korea where it will build its first processing plant for the critical mineral amid a global rush to secure supply chains.

ASM, which has a long-term resource of zirconium, niobium, hafnium and rare earths in a mine in the Australian state of New South Wales, signed a memorandum of understanding for the plant with the Chungcheongbuk-do (Chungbuk) Provincial Government and Cheongju-si (Cheongju) City Government on Tuesday.

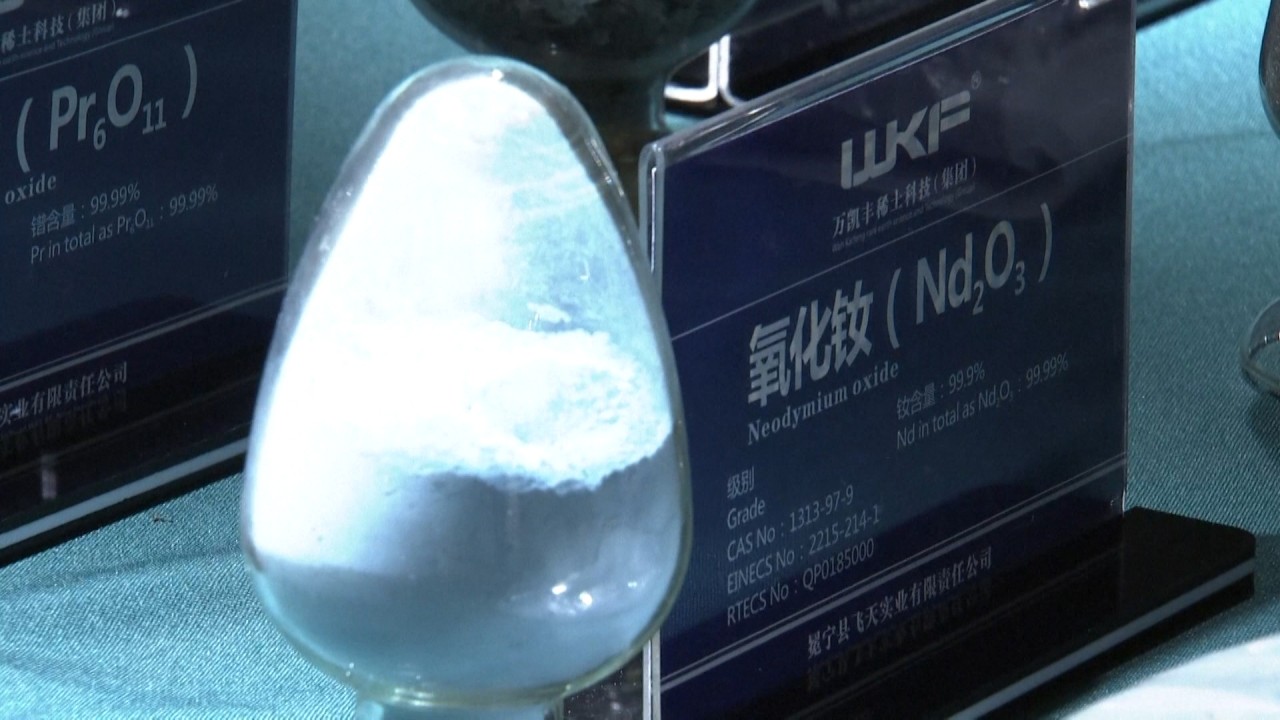

The deal includes licences, permits and a grant that will allow ASM to position its factory near important Korean manufacturing companies, including LG Chemical and Samsung SDI, that need the processed metals. The new plant will initially produce high-purity neodymium-iron-boron powder and titanium powder.

ASM’s relationship with South Korea to secure a rare earth supply chain dates back to 2019 when it first invested in the clean metal processing technology of local firm Zirconium Technology Corporation. But a wider global focus on rare earth and critical metals supply has gained traction recently amid concerns that China could restrict its export of the minerals to the United States.

While Biden’s order does not mention China, the directive was seen as an effort by the White House to reduce reliance on China.

Beijing in turn has been quick to back up its control over the critical metals.

01:44

Amid US-China trade war, China aims to elevate its domestic rare earth industry

China’s rare earths production has declined modestly since it introduced new laws to curb exports late last year and after it introduced new quotas in January to lower the domestic mining and refining of rare earth metals to reduce environmental damage, causing concerns over a global shortage in supply.

Other rare earth producing countries like Australia have also been seeking to boost the resilience of their supply chains, particularly since the start of 2020. Australia launched a Critical Minerals Facilitation Office aimed at funding projects to extract rare earth minerals and to create downstream processing in the country.

Shortly after the office was launched, officials expressed interest in supporting and funding ASM’s rare earth project in New South Wales.

In January, Australian-listed Lynas Corporation, the largest producer of rare earth outside China, signed a deal with the US Department of Defence to build a rare earth separation plant in America.

Australia’s Critical Minerals Facilitation Office has partnerships with two of Australia’s Five Eyes intelligence alliance members, the US and Canada, as well as with India, Japan and South Korea.

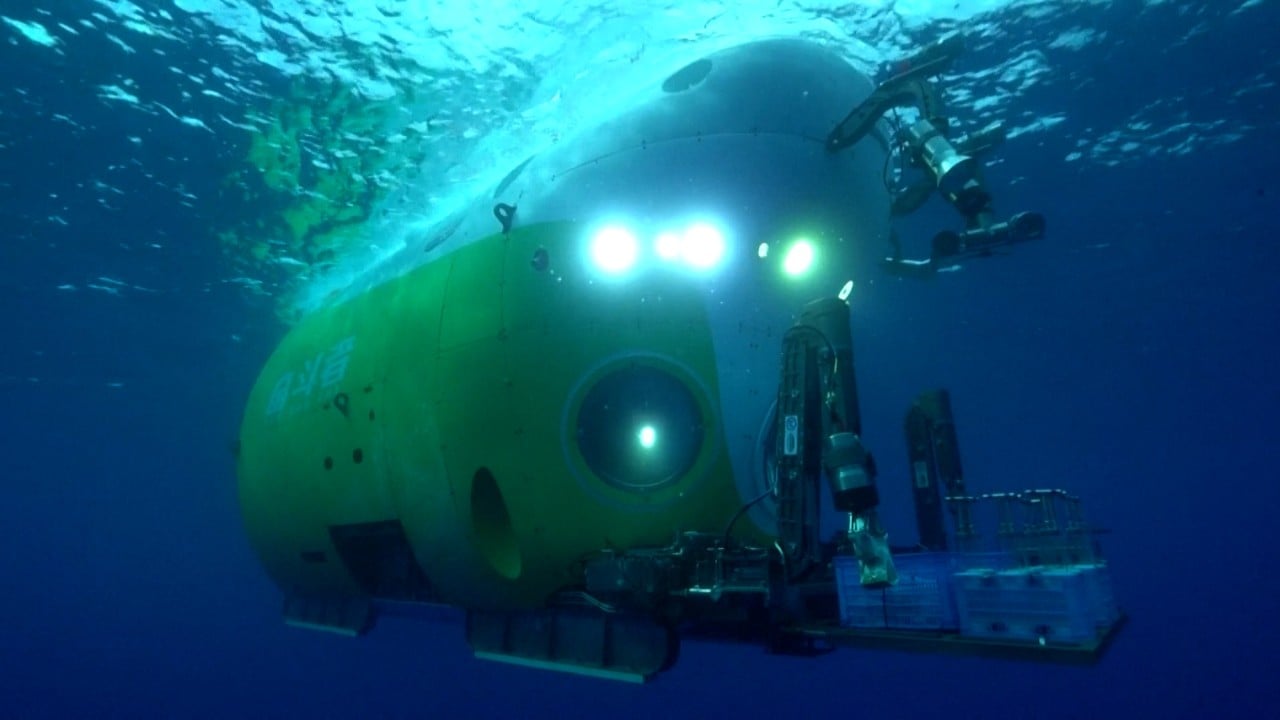

02:41

Chinese manned deep-sea submersible gets rare look at deepest ocean depths, the Mariana Trench

Last week, London-based think tank Polar Research and Policy Initiative published a report recommending the Five Eyes alliance of Australia, Britain, Canada, New Zealand and the US explore the feasibility of sourcing critical minerals, particularly rare earths, from Greenland.

“Greenland holds about 38.5 million tonnes of rare earth oxides, and is believed to have enough rare earths to meet at least a quarter of global demand in the future,” said the report written by Dwayne Menezes, who is also the director of the secretariat of Britain’s all-party parliamentary group for Greenland.

As Britain, Canada and Australia already account for 27 of the 41 companies currently holding mining licenses in the Arctic island country, it would be relatively easy for the Five Eyes to forge a broader relationship, according to the report, titled,The Case for a Five Eyes Critical Minerals Alliance: Focus on Greenland.

It also recommended the Five Eyes alliance form a separate Five Eyes Critical Minerals Alliance to develop “integrated, secure, stable, sustainable, reliable and resilient supply chains of minerals critical to their national and economic security” and “to reduce their import reliance on China for these minerals”.