China steps up anti-corruption drive as Evergrande crisis puts spotlight on financial risk

- The Central Commission for Discipline Inspection will carry out ‘deep-level’ anti-corruption investigations to ‘prevent systemic financial risk’

- Twenty-five organisations will be put under the microscope, including the nation’s top financial regulators and asset management firms

China’s top anti-corruption official will launch a nationwide audit of major financial firms and regulators to eliminate risk in the sector, following debt crises at state-owned financial conglomerate Huarong and private property developer China Evergrande.

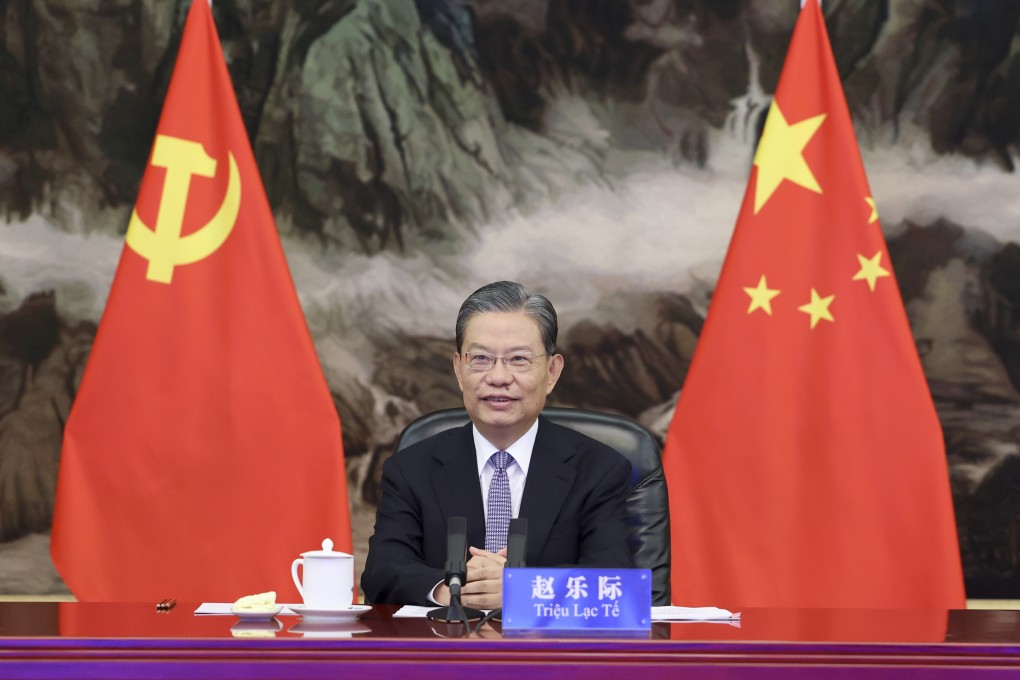

Zhao Leji, secretary of the Central Commission for Discipline Inspection, announced at a conference on Sunday “full-scale disciplinary inspections” to safeguard the healthy development of China’s financial sector.

Twenty-five organisations will be put under the microscope, including the People’s Bank of China (PBOC), China Banking and Insurance Regulatory Commission (CBIRC), China Securities Regulatory Commission and the State Administration of Foreign Exchange.

China’s “Big Four” state-owned banks, sovereign wealth fund China Investment Corp, the Shanghai and Shenzhen stock exchanges, and the country’s asset management companies will also be audited.

“We’ll check whether party chiefs [of financial regulators and companies] deviated from their political obligations,” said Zhao, who is a member of China’s top decision-making body, the Politburo Standing Committee, and has been the country’s anti-graft chief since 2017.

02:28

Angry protest at headquarters of China Evergrande as property giant faces liquidity crunch