China seeks stronger economic ties with Saudi Arabia beyond crude oil as Middle East seeks ‘ideal partner’

- China has stepped up its diplomatic and economic efforts in the Middle East beyond traditional oil and gas cooperation, particularly with Saudi Arabia

- There is an opportunity for China to focus on the Middle East, with the United States seen to have been pivoting towards Indo-Pacific region, analysts said

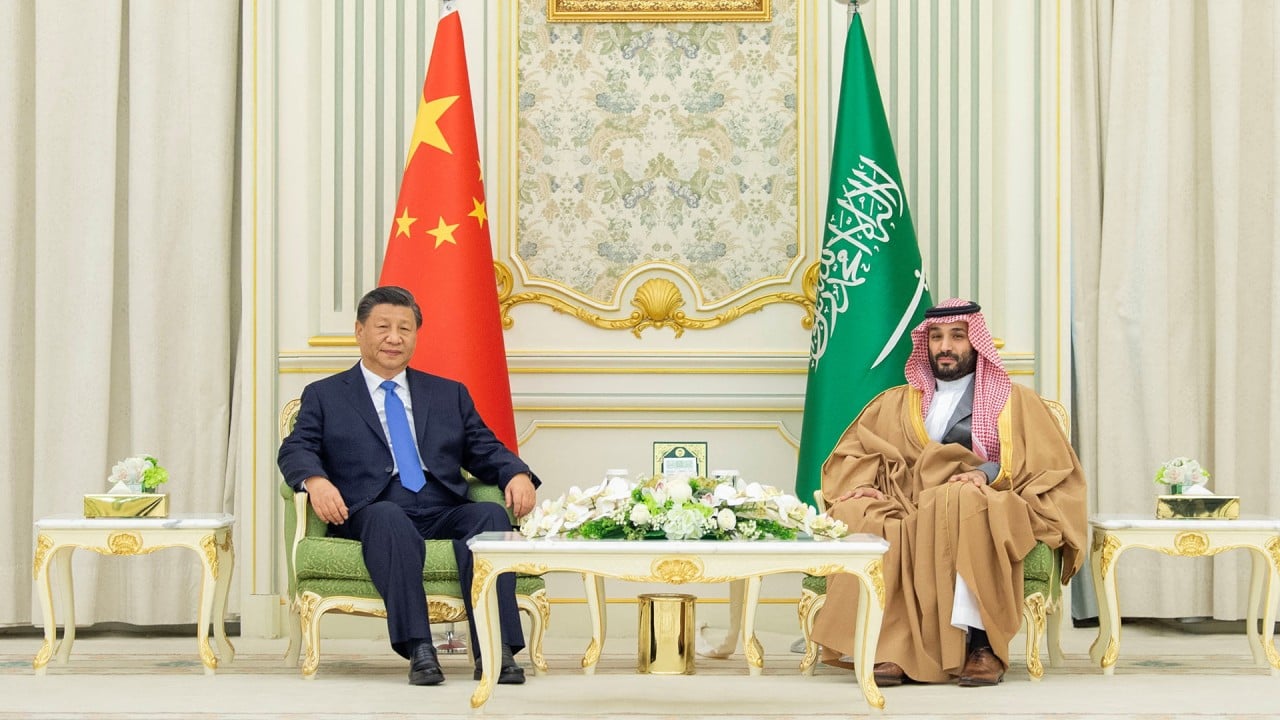

China’s swift progress to improve diplomatic and economic ties with Saudi Arabia has added green energy, finance, infrastructures and information technology to traditional oil and gas cooperation as the Middle East seeks an “ideal partner” to aid its development, according to academics and analysts.

Beijing’s focus on the Middle East through Saudi Arabia will also help China fill the void left by the United States, which is seen to have been pivoting towards the Indo-Pacific region, they added.

He played up China’s “huge market and opportunities for cooperation”, while also welcoming further investment from Saudi Arabia.

A secure supply of oil is China’s most critical interest

“A secure supply of oil is China’s most critical interest,” said Oliver John, a non-resident scholar at the Washington-based Middle East Institute.

“From Aramco’s perspective, China is a critical and growing market … taking over a quarter of Saudi crude exports.”

Saudi Arabia was China’s largest crude oil supplier last year, with shipments of 87.5 million metric tonnes (641 million barrels), or 17.2 per cent of national crude imports, customs data showed.

What does the Russia-Ukraine war mean for China’s energy security?

But China can also play a vital role in Saudi Arabia transitioning from “traditional energy” – like oil and gas – to a low-carbon economy involving more renewable energy, said Wang Yiwei, an international relations professor at Renmin University in Beijing.

“The Middle East has to find an ideal partner to develop artificial intelligence, the digital economy, new energy and space exploration,” he said.

“The United States puts more focus on the Indo-Pacific now and it doesn’t pinpoint on the Middle East, which needs to ‘look East’ to fulfil its development wish.”

Saudi Arabia’s economic and industrial diversification programmes, that date back to the 1980s, will also offer scope for cooperation beyond oil, according to Zha Daojiong, a professor at Peking University’s School of International Studies.

Which 8 nations are using China’s yuan more, and how will it affect US dollar?

“Renewable energy is an area in which Saudi’s pursuit and the Chinese capacity can fit in neatly,” he said.

“In addition to the solar and wind power industries, green hydrogen is another promising area of collaboration.”

China’s relations with the Arab states and Gulf Cooperation Council (GCC) are set to play “a strategic role” after Beijing prioritised the development of its connection with Saudi Arabia, particularly its diplomacy in the Middle East, the state-backed Xinhua News Agency reported after Xi visited the region at the end of last year.

John at the Middle East Institute added that Saudi Arabia and the United Arab Emirates are interested in Chinese information technology to support their economic diversification and various smart cities projects.

“They are also looking for Chinese investments in key sectors, particularly in indigenous production capabilities,” he added.

“For example, Aramco, the Public Investment Fund and Baosteel just signed an agreement to establish the first integrated steel manufacturing plant in the GCC in Saudi Arabia.”

The joint venture complex, which is expected to be located in the port city of Ras al-Khair, was signed between the public petroleum and natural gas firm, Saudi Arabia’s sovereign wealth fund and the Chinese state-owned iron and steel firm in May.

China will engage with the Middle East states economically and try to resolve their differences, if possible

The multilateral development agency is jointly funded by the BRICS countries of Brazil, Russia, India, China and South Africa.

“China will engage with the Middle East states economically and try to resolve their differences, if possible,” said Fazal Shahid, an international relations lecturer at the National University of Modern Languages in Islamabad, Pakistan.

China’s progress in the Middle East also ties in with its Belt and Road Initiative, Beijing’s ambitious development strategy unveiled by Xi in September 2013.

“It’s the 10th year anniversary of the Belt and Road Initiative this year,” added Wang at Renmin University.

“China and the Arab world have established a mechanism to cooperate, which combines the development of energy and finance, and includes using yuan to trade oil transactions.”