Explainer | China-Australia trade: what’s the state of relations after 3 years of ups and downs?

- Relations soured in 2020 after Canberra asked for a probe into the origin of the coronavirus and Beijing fired back with unofficial bans on Australian products

- But the tide appears to have turned, with two recent trade-minister meetings and a relaxation of import curbs

After no in-person talks since 2019, the trade ministers from China and Australia met twice in May, highlighting how relations between Beijing and Canberra continue to thaw after years of frosty diplomatic wrangling.

Australian Minister for Trade and Tourism Don Farrell first travelled to Beijing for a meeting with Chinese counterpart Wang Wentao on May 12 before the pair reunited in the US city of Detroit during an Asia-Pacific Economic Cooperation (Apec) meeting later in the month.

Relations between China and Australia turned sour in 2020 after the then-Morrison administration asked for a probe into the origin of the coronavirus with other world leaders.

Beijing responded with unofficial bans on Australian products, including lobsters, coal, cotton and logs, while it also imposed official import tariffs on wine and barley.

But what is the state of play in relations between Australia and its largest trading partner?

Wine

The duties – higher than the preliminary tariffs – were due to be applied for five years, after the Chinese commerce ministry reiterated a decision made in November 2020 that the domestic wine industry had been hurt by the dumping of cheap Australian wine.

Barley

At the start of June, Farrell said that China’s review into the tariffs was heading in the “right direction” and that the process was “close to completed”.

Before the tariffs, trade had ranged between A$1.5 billion (US$1 billion) and A$2 billion a year.

Lobsters

Australian lobsters were caught up in the unofficial bans after Canberra called for an international inquiry into the origin of Covid-19 in 2020.

Since November 2020, legal imports of live Australian rock lobsters into China have fallen to virtually zero.

In 2019, before the ban was put in place, more than 90 per cent of Australian rock lobsters were exported to China, and figures from the Australian agriculture department showed that the market was worth about A$750 million (US$517 million) a year.

Coal

Coal was another commodity caught up in the unofficial bans after Canberra called for an international inquiry into the origin of Covid-19 in 2020.

In March 2020 – before China’s unofficial ban on Australian coal – imports of coking coal had reached 4.36 million tonnes, while 5.65 million tonnes of thermal coal entered the Chinese market, according to official data.

Cotton

China imported 20,000 tonnes of Australian cotton in 2022, compared with 400,000 in 2019, according to Chinese customs data.

China’s foreign minister to visit Australia in July for ‘reciprocal visit’

Logs/timber

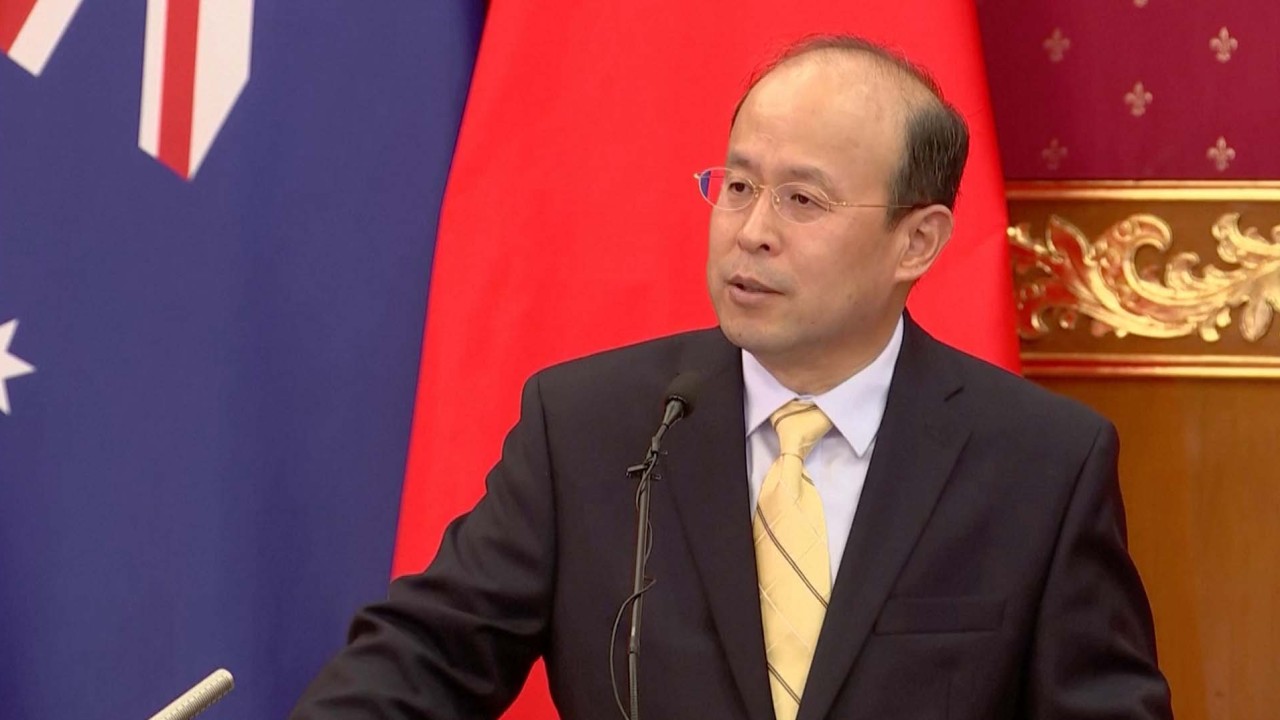

Chinese ambassador Xiao Qian said in May – days after Australian trade minister Farrell returned from a trip to Beijing – that China would resume imports of Australian timber.

What is the outlook for China-Australia relations?

Wang also accepted an invitation from Farrell to visit Australia, during their meeting in Beijing in May.

.JPG?itok=J8tgfPmW&v=1659948715)