China urges ‘prudent’ yuan internationalisation as pace of adoption remains slow

- China’s efforts to boost international use of the yuan are still in progress, but prudence and caution have been advised

- With risk prevention the overall economic watchword, rash moves ‘for internationalisation’s sake’ discouraged by ex-officials, analysts

Beijing should promote the yuan’s use abroad next year by tapping deeper into emerging markets with loans and swap deals, but must also remain prudent and prepared to head off risks, former officials and analysts have urged.

The assessment came as financial regulators look to implement Beijing’s risk-prevention mandate and take a more pragmatic approach to expand the overseas influence of the Chinese currency.

“It’s nonsensical to push it merely for internationalisation’s sake, or for the frivolity of pursuing high rankings or bigger scale,” said Guan Tao, chief economist at BOC International, a Bank of China investment arm.

At a forum last month, he said the emphasis going forward had shifted to risk management and Beijing would not rush the process.

China, ‘pummelled’ yuan could feel ripple effects as Fed signals 2024 rate cuts

Guan, a former official with the State Administration of Foreign Exchange, added China’s financial opening must go hand in hand with the yuan’s broader use overseas and serve the real economy – those sectors that produce or trade in goods and services.

This rhetoric marks a shift on how the pace of the yuan’s internationalisation has been addressed, from an “orderly process” laid out in the political report from the Communist Party’s 20th national congress in October 2022 to a “steady, prudent and solid” one in the readout from the financial conference.

Beijing now appears to favour an incremental approach, tapping direct yuan financing tools to encourage wider use in all manner of transactions, from trade settlements to loans.

China is either the largest trading partner or among the major economic partners for 140 countries, so we should leverage this for the yuan

Hu Xiaolian, former deputy governor of the People’s Bank of China (PBOC), the country’s central bank, suggested last month that Beijing could explore a yuan swap mechanism to convert loans and debt denominated in US dollars.

“China is either the largest trading partner or among the major economic partners for 140 countries, so we should leverage this for the yuan,” she said.

Most of China’s emergency loans to developing countries are denominated in the yuan, like the Export-Import Bank of China’s deal with debt-ridden Sri Lanka.

The PBOC has also accelerated currency swap deals and designation of clearing banks overseas.

The yuan’s overseas use has increased rapidly after its initial internationalisation in trade settlements began in 2009.

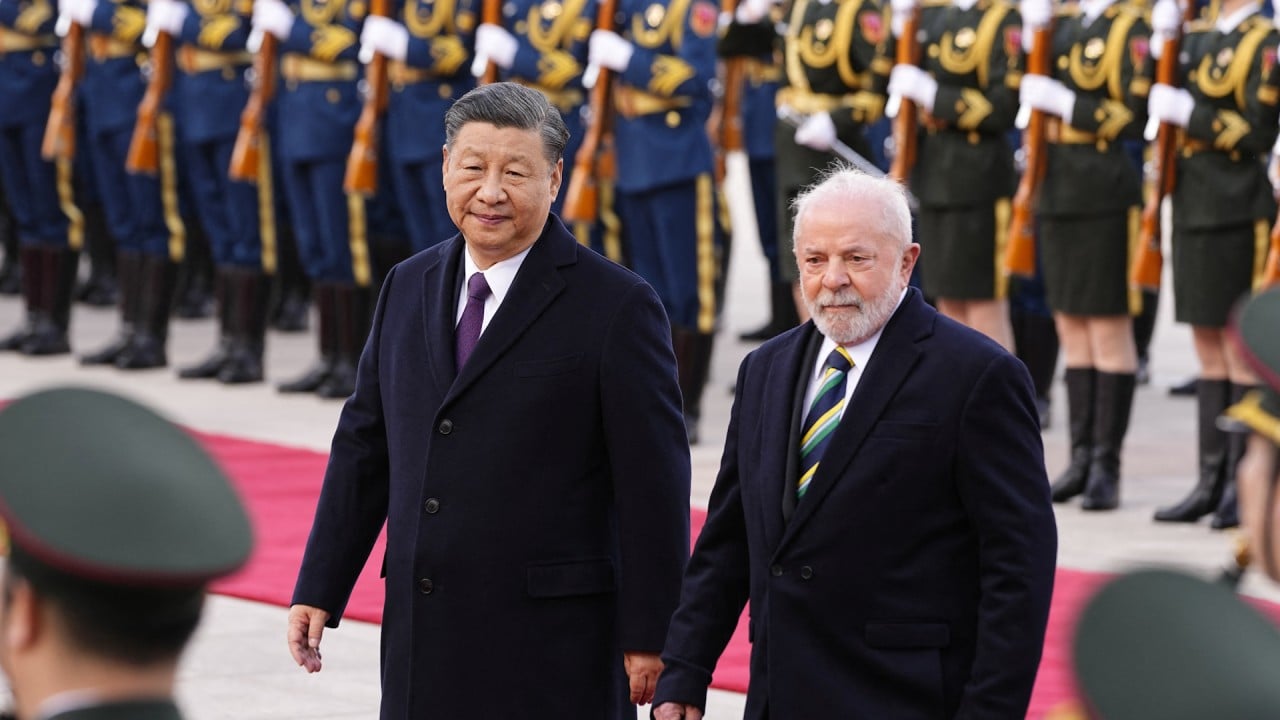

Brazil and the others in the Brics trading bloc – Russia, India, China and South Africa- have been using the yuan more frequently to conduct trade and investment.

This has been of particular benefit to Russia, as sanctions levied against it in the wake of the invasion of Ukraine make use of the US dollar or Euro all but impossible.

However, the yuan was still far behind the two currencies in all dimensions – proportional representation in payment, foreign exchange markets, commodity pricing and foreign exchange reserves.

Data from global interbank messaging service Swift showed that in November, the yuan edged past the Japanese yen to the fourth-most active currency for global payments by value, with a share of 4.61 per cent. But this was a mere fraction of the US dollar’s 47.08 per cent and the Euro’s 22.95 per cent.

In terms of reserve holdings by foreign central banks, yuan-denominated reserves accounted for 2.45 per cent of the global total by the end of June, according to the International Monetary Fund, lower than 58.9 per cent for the US dollar and 20 per cent for the Euro.