Hong Kong’s bike-sharing industry due for a shake-out, with six start-ups burning money and public opposition mounting

Entrepreneurs and global operators have rushed into the crowded bicycle rental business in Hong Kong, but all face issues of theft, vandalism, a lack of parking spaces and abandoned bikes that have angered the public

Bicycles left piled on top of one another or blocking paths, poor cycling etiquette, theft and vandalism have dogged Hong Kong’s bike rental start-ups – the latest addition to the city’s nascent sharing economy – over the past 12 months.

The problems are nothing new, having been seen with bike rental start-ups in China, many of which have gone out of business. According to the Transport Ministry, by February this year more than 20 had failed.

Among the casualties was Wukong Bicycle in the western metropolis of Chongqing, which folded in June last year amid reports that 90 per cent of its 1,200 bikes had gone missing.

Here’s how Wukong became the first bike-sharer to close in China

Now the Hong Kong market looks ready for a shake-out of its own.

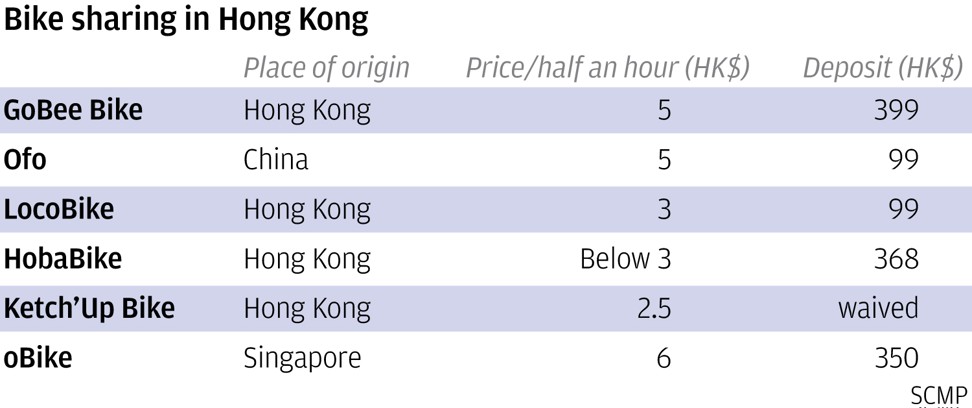

Hong Kong-based GoBee Bike pioneered the concept in the city when it launched in early 2017. Little more than a year later, there are six start-ups renting out bicycles in Hong Kong, all of them competing for business in the city’s New Territories – an area much more rural than Hong Kong Island and Kowloon. Between them they have put more than 17,000 shared bikes on the roads.

The Hong Kong operations of GoBee, which already this year has announced a withdrawal from France and Italy after large-scale theft and vandalism of its bikes, will reportedly be taken over by Ofo, the Beijing-based bicycle rental company that entered the Hong Kong market last December. The two are the biggest players in Hong Kong, controlling 10,000 bikes between them.

Industry players say the current operational model – relying on dockless parking – makes the business unsustainable because users can park bikes anywhere, something which has stoked publichostility towards these services.

China bike-sharing firm Ofo’s CEO rebuffs offer and rallies employees to ‘fight till the end’

Talks are being held with housing estate managers and public transport providers with a view to providing more fixed parking spots for cyclists; operators are also discussing the possibility of using 58,000 underutilised government bicycle parking spaces.

Joseph Sung Yin-bong, founder and CEO of HobaBike, which joined the fray in June last year with 3,000 bicycles, says the industry is burning money.

“If the problem of indiscriminate parking continues, the whole industry will go under,” he says. Theft and vandalism of bicycles is not the only problem.

“The cost of getting manpower to retrieve bikes parked in a disorderly way is too high. We rent out the bikes for less than HK$3 (US$0.40) per half an hour, but it costs up to HK$50 to retrieve a bike from a remote area,” he says.

Should Hong Kong look to Singapore to make its bike-sharing scheme a success?

Sung says operators are in talks with the government – which is also opposed to dockless parking – to improve their operational model. However, talks have been slow.

One idea being raised is imitating Singapore. The city state this year introduced a “three strikes” rule that bans cyclists from renting if they are found to be serial indiscriminate parkers.

HobaBike has yet to break even, but Sung says bike sharing has an important role to play in Hong Kong because it aspires to become a “smart city” with a robust sharing economy.

Sung believes users should be able to pick up bikes from fixed parking spots near their homes.

“Hong Kong homes are very small and don’t lend themselves well to bike ownership,” he says.

The start-up has been talking to private housing estate managers eager to partner with HobaBike. “Some have approached because they are situated far from an MTR station and our shared bikes could be a last-mile transport feeder [option].”

For the industry to work, the number of users must be higher than the number of bikes.

LocoBike, with a 2,200-strong fleet scattered across the New Territories, is another player keen to shake up the industry. Launched in October, the start-up claims it has an average of more than 1,000 daily users. Despite the crowded market, and the barrage of negative news buffeting the sector, LocoBike says it will add another 2,000 bicycles to its fleet in the coming months.

The new version of its blue bike will carry hardware updates, and an upgraded app will provide more user-friendly information.

LocoBike CEO Ken Ching says the biggest problem facing the sector is too many bikes, “especially those … blocking streets, which have given the industry a bad name”.

Ninety per cent of LocoBike’s two-wheelers have sustained damage of one kind or another, he says. “For the industry to work, the number of users must be higher than the number of bikes,” Ching says.

Theft, vandalism force Hong Kong bike sharing start-up Gobee to retreat from Europe

“[We also have a dockless model and] it creates a lot of problems … for bike impoundment. Some housing estate managers charge us as much as HK$800 to retrieve a bike. With a ‘no bikes on campus’ policy, [the] Chinese University [of Hong Kong] often impounds our bikes.

“Some users privatise a bike by parking it near their home. So we have employed more than 20 patrolmen to retrieve these bikes in various districts.”

To discourage illegal parking, LocoBike has made use of big data, and adopts both penalties and discounts to encourage users to park at fixed spots.

“Our new app offers Transport Department information about areas where it’s forbidden to park. We have consulted housing estates and include some of them among the non-parking areas,” he says. “Punitive measures include freezing the accounts of repeat offenders.”

The current model of blindly launching thousands of new bikes onto the scene and directly competing with leisure cycling operators is obviously not working.

“Now that the company has been up and running for six months, there’s [a lot of] data we can analyse to improve the operation. For example, users’ geographical distribution and usage time data can help us allocate more bikes to popular areas,” he adds.

Kenneth Chau, founder of Ketch’Up Bike, which has 1,000 bicycles, says the company is looking for opportunities to cooperate with other industry players.

“We will upgrade our bikes and use more data management to improve our operation. One of the problems we face now is that some bikes are parked in the shade, and the lack of solar power will disable the bikes’ locks,” he says.

For all the teething problems the industry is facing, Chau says an increased user rate is a sign that there are good prospects ahead.

“We are collaborating with Sha Tin District Council to provide free bikes for staff at the Science Park to promote the culture of cycling,” he says.

Parkson Yip from Sharing Economy International, which runs sharing economy platforms, says his company plans to launch a bike-sharing trial scheme in the New Territories districts of Sha Tin, Yuen Long and Tuen Mun. Each district will be served by several hundred bikes.

What Hong Kong needs for better bike-sharing

Yip, who is the vice-president of strategic business development at the company, also advocates replacing the dockless model with fixed-spot parking.

“The current model of blindly launching thousands of new bikes onto the scene and directly competing with leisure cycling operators is obviously not working,” he says.

“Using a limited number of bikes to link up transport nodes with housing estates will not lead to overcapacity. The bikes will run fixed routes and can replace minibuses and buses. Private housing estates can reduce their shuttle bus services to save costs.”

Yip says the company also plans to launch a global platform allowing cyclists using different payment systems to take advantage of bike-sharing services globally.

China’s sharing economy headed for troubled waters as funding pinch signals end of easy money for start-ups

“Now, a Hong Kong user without WeChat Pay or other Chinese payment systems cannot rent a bicycle in China. The platform will link up local bike sharing providers as affiliates around the world [enabling everyone to be able to pay and ride].”

Yip even envisages the bikes of individual owners and bicycle rental shops being linked to the platform to achieve universal bike sharing.

“We can better utilise existing resources, and there’s no need to buy new ones. All the technology regarding bike sharing is in the locks,” he says. “We are in talks with a German lock technology company to [come up with a way] to let individual bike owners apply the lock so they can rent out their own bikes to earn money.”

While the smaller local players have lofty plans to shake up the Hong Kong bike-sharing ecosystem, the biggest operators – Ofo and GoBee Bike – are also said to be trying to improve their services.

Ofo and GoBee Bike declined Post requests for interviews, but Ofo has told Chinese-language media in Hong Kong it will ask the government to increase the number of parking spots available for bikes.

One thing is for sure: with at least one new player about to enter the market, and more resources being pumped into the competitive industry, the sea of blue, yellow, green, red and orange bikes will be a fixture in the New Territories for years to come.