Christie’s Hong Kong spring auctions set records for art, wine and watch sales, with Sean Connery’s Picasso reaching US$22 million

- Total sales revenue was up nine per cent on 2021, at US$428 million, with Zao Wou-ki’s painting 29.09.64 fetching US$35.6 million

- A Picasso from actor Sean Connery’s estate sold for US$22 million, while a live auction of almost 15,000 bottles of wine raised US$17 million (including fees)

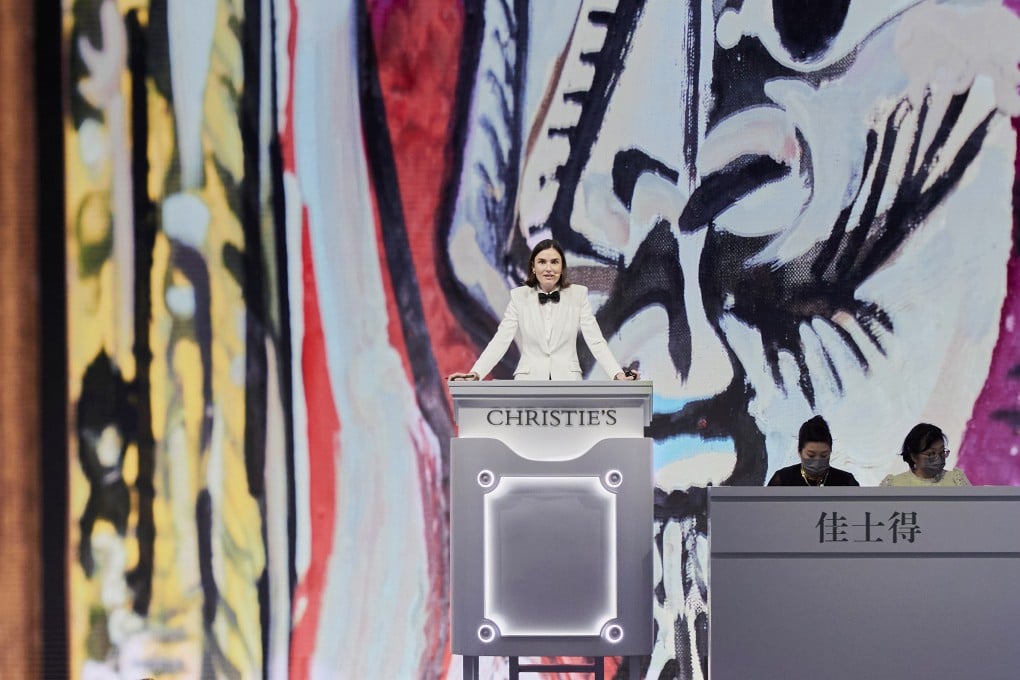

Total sales from Christie’s spring Hong Kong auctions, which coincided with the Art Basel Hong Kong art fair, reached US$428 million, 9 per cent higher than the spring sales in 2021, with a number of record prices set in the wine, watches and 20th and 21st century art categories.

However, paintings by Zhang Daqian, Claude Monet and a non-fungible token (NFT) by Takashi Murakami and Nike-owned collectibles brand RTFKT failed to sell, which the auction house’s Asia president, Francis Belin, blamed on China’s border closure and volatility in the cryptocurrency market.

“We think the works were rightly estimated. The Zhang Daqian, like the Monet, suffered from a lack of touring in mainland China. Collectors need to see the paintings themselves at this [price] level,” Belin said following the conclusion of the 20th/21st Century Art Evening Sale on May 26, which featured Monet’s Saule Pleureur (1919) with an estimate of US$12.1 million to US$17.2 million, and Zhang’s Temple by the Waterfall (1963), estimated at US$7.6 million to US$10.2 million.

Josh Baer, an art adviser in the United States, said that bids for Impressionist masterpieces would also suffer from the “market fatigue” that followed the US$2.5 billion auctions in New York earlier in May.

Despite concerns about China’s economic slowdown, Belin said recent indications suggest demand for art remains strong in China. “Our March auction in Shanghai was the highest grossing in history, with 95 per cent of the lots sold,” he said.