How to stop family tensions undermining a shared business

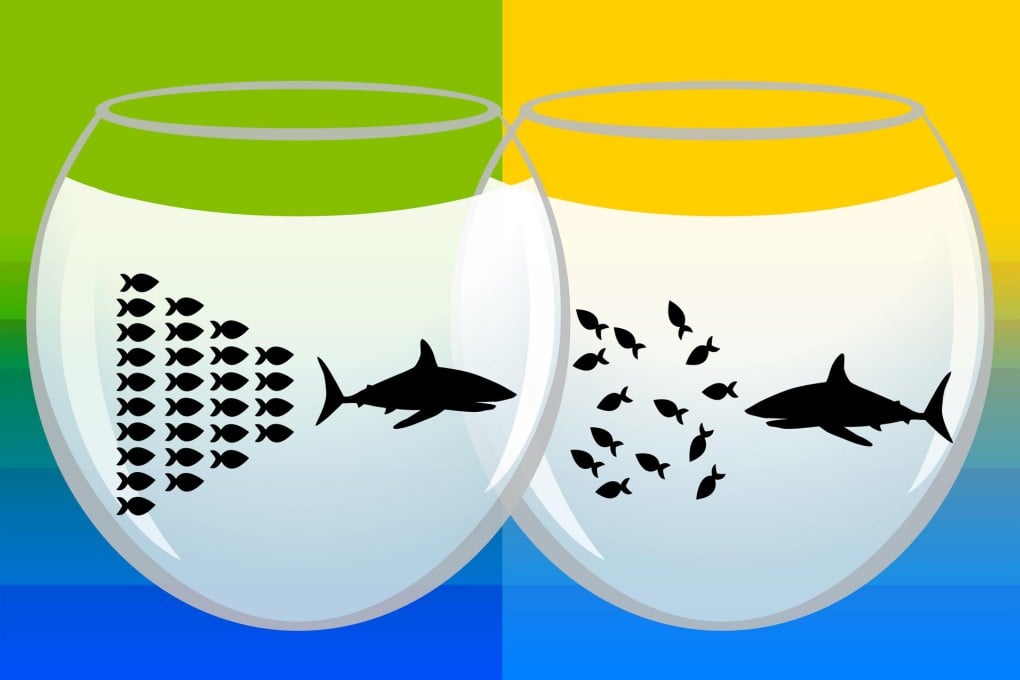

In-fighting can affect a company's success

Not all business owners make good managers. In cases of family businesses, where poor communication, personal dynamics, emotional factors, and historical family tensions can undermine business operations, the problem can become acute.

This is particularly so if litigation occurs on a divorce or a forced exit of a family member, or even on a succession to the next generation unless adequately planned for.

There are various ways to mitigate tensions associated with family operations. But three topics require special focus: adequate documentation and implementation, objective advice and exit procedures and related valuation issues.

Sound documents are needed to address future tensions and avoid unnecessary operational failures. A business road map enshrined in a shareholders agreement, company constitutional documents and employment or service agreements is vital.

Without these protections, disputes may arise (especially on a sale to a prospective buyer). Family discord may lead a buyer to put the acquisition in the "too hard" basket. Also, unless a major topic such as succession planning is provided for, the unexpected death of an important family member may threaten the business.

Such documents, once drafted and signed, should not be ignored (which is frequently the case). The settled documents must be followed or updated in practice - otherwise they may become inadequate and the expectations of some family members will not be met.

This point is borne out in one recent English case where the court was confronted with a family business under the pressure of a divorce. Some family members insisted on adhering to agreed governing documents but others did not.