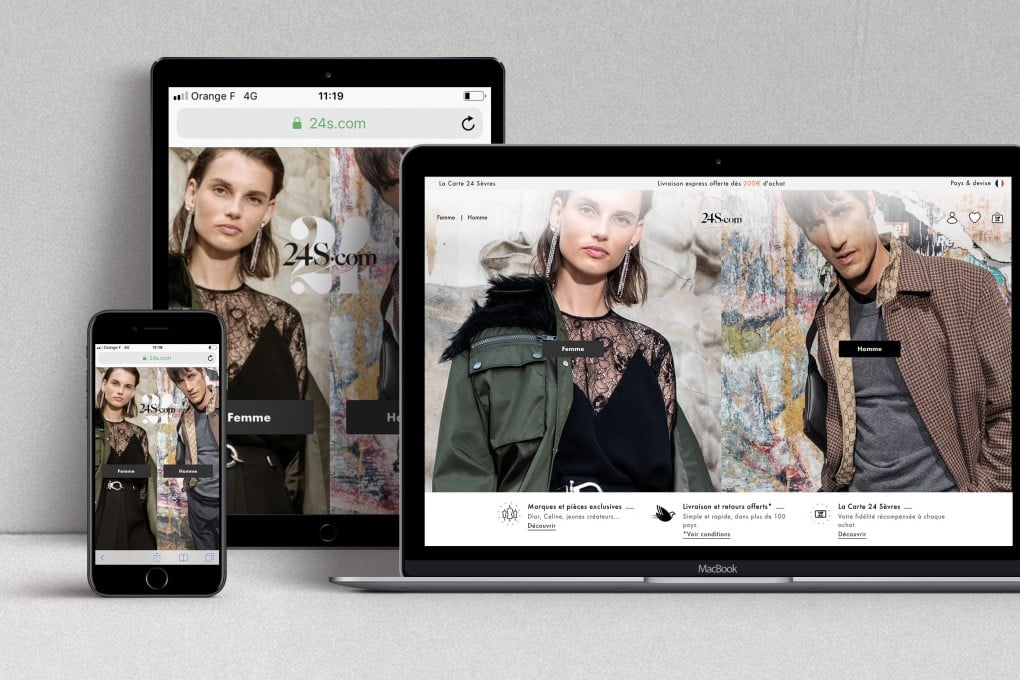

LVMH late to e-commerce, but luxury giant sees it as an advantage – CEO of its 24S portal says, ‘In terms of technology you can be more agile’

- Seeing where rivals such as Yoox Net-a-Porter and Farfetch succeeded and where they failed helped Eric Goguey plan e-commerce strategy for 24S

- He sees being based in Paris as an advantage, and is in no rush to enter ‘most complex’ China market, stressing need to understand customers and respect brands

As the market leader in its sector, luxury group LVMH has created the blueprint for how to build – and run – a luxury brand in the 21st century. The company’s acquisitions of family-owned brands and its success at turning them into well-oiled luxury machines have put LVMH at the forefront of the recent growth and innovation in the luxury arena.

There is one important segment of the luxury economy, however, where LVMH has lagged behind: digital sales, which according to consultancy Bain & Company will account for about 25 per cent of the global luxury goods market by 2025.

Truth be told, in 2000 LVMH did make an early foray into online sales with eluxury.com, an e-commerce website for luxury goods that was run as an afterthought and folded in 2009.

But according to 24S CEO Eric Goguey, an LVMH veteran who before launching the site had been in charge of online sales at LVMH-owned beauty retailer Sephora, being late to the game has been an asset rather than a hindrance.