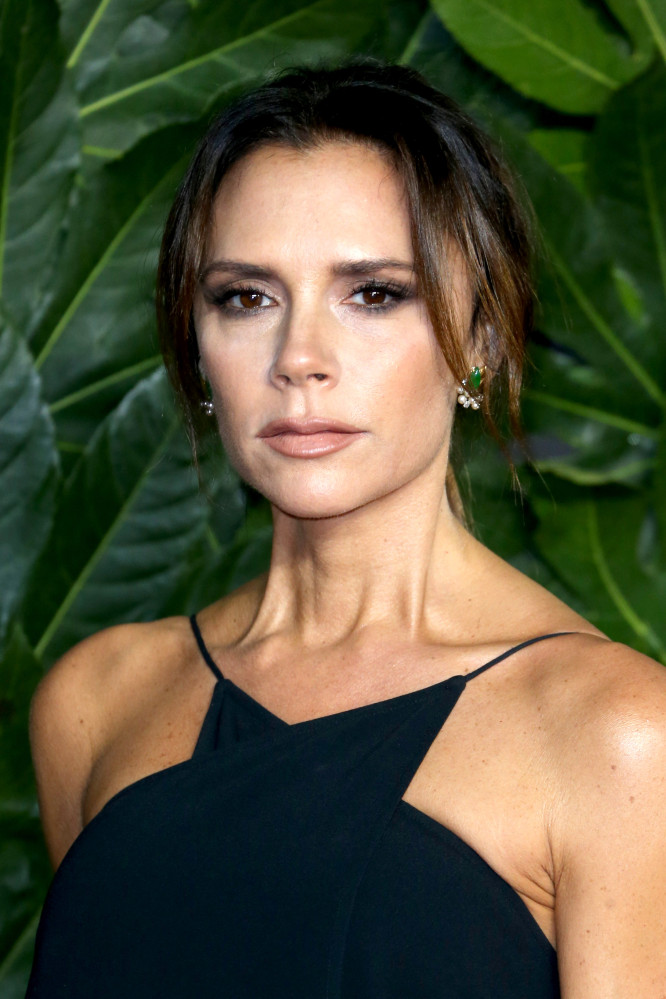

Explainer | Louis Vuitton, Chanel, Hermès have raised prices, Victoria Beckham is lowering them – the power of pricing and how luxury fashion is adapting to a disrupted world

- Victoria Beckham’s planned price drops and Mulberry’s existing ones speak to how fashion is adjusting to the global pandemic and changing lifestyles

- ‘Increasing prices confirms a perception of value, and increases the pressure to buy today – as tomorrow, prices could be higher,’ one expert says

Last month Victoria Beckham, the fashion designer formerly known as Posh Spice, announced that she would be lowering the prices of her range of chic dresses and sharply tailored separates.

In a move she described as a “rebirth” and an opportunity to “future proof” her namesake brand, the average price of her pieces will drop by around 40 per cent. That will be achieved by creating simpler silhouettes and using less embellished fabrics, as well as merging her diffusion line with the main one.

All of which begs the question: what’s in a price tag anyway? The luxury market has long played with the illusion of scarcity and exclusivity. Price bumps have long been part of that. Take the eternal allure of the Hermès Birkin bag, which remains desirable in part because of the folklore about it being so hard to buy one.

But both Beckham and Mulberry’s pricing moves speak to how fashion is adapting to a world disrupted by the global pandemic.

The real reason it’s so hard to get your hands on a Rolex watch

First there is the lifestyle shift Beckham spoke of when presenting her new direction: in the new world, some of us might prioritise easy-to-wear and versatile pieces over glamour, perhaps knits and sneakers over heels. Many of us are still spending more time at home and might be working differently, too.

The fashion industry as a whole has been forced to re-evaluate the way it produces and sells goods – this has included some brands changing how many collections they produce or when they release them, expanding into new categories and in Beckham’s case, reframing who your customer is.

As luxury consumers become more sophisticated, they are increasingly looking to justify their purchases with meaning and purpose

The recent haute couture and autumn/winter collections suggest that the idea of the “roaring 20s”, that is, a time of fun, fancy and fripperies after great hardship, is in full swing.

With the return of opulence and optimistic designs, there is a sense in fashion that after all this people will want to put on a party dress. What’s more, with travel still limited for some and sentiment running high, investing in meaningful luxury – for instance fine jewellery (a “hard luxury”) or heirlooms that will last and can be passed down - makes sense.

Athena Chen, Asia-Pacific senior strategist at forecasting firm WGSN, says the rarefied world of luxury has always been more than just about the cost, but there’s power in a price tag.

“Buying luxury is very much about enjoying symbolic utility from social recognition – luxury is all about the quality, exclusivity, and branding of a product or service being in line with what customers perceive as valuable and are willing to pay for,” she says.

“Markets that have recovered from the pandemic relatively faster have since seen a rebound in demand for luxury goods, such as China and Korea. And price hikes in these markets coming from Hermès, Chanel, Louis Vuitton and Bottega Veneta have actually increased demand for their products.”

She warns that price decreases can be detrimental on a brand’s value. “Driving down prices changes a brand’s value perception, which reduces that brand’s actual value, which is damaging for brands that position themselves as luxury.”

Luca Solca, senior research analyst for luxury goods at research firm Bernstein, agrees that price matters when it comes to how a brand is perceived, especially when it plays into the idea of something being hard to get.

“Increasing prices confirms a perception of value, and increases the pressure to buy today – as tomorrow, prices could be higher,” he says.

Raising prices is, then, a true power move, Chen says.

“To a certain extent, the price hike of brands and products also reflects their popularity in the market. Brands will only increase the prices for certain product lines and classic designs that have shown to have consistent high demand. With each price increase the brand will also gain a lot of publicity and entail numerous discussions among luxury consumers,” she says.

“These successive price increases point to the stratification of top luxury brands that have more power in the market to hold sway over consumers. This has also become a short cut for brands to deal with global market uncertainty post-pandemic and boost the bottom line for profits.”

In all of this, the impact of the pandemic on how luxury is perceived is continuing to evolve.

Sophie Hersan, co-founder and fashion director at Vestiaire Collective, says classic luxury fashion houses remain eternally desirable, with their value retaining over time – becoming, then, a true investment. She believes the pandemic is ushering in a shift in how luxury pieces are being bought and sold, including “an increased demand for second-hand and emphasis on sustainability”.

“Consumers now consider investing in high-quality pieces that are still going to be valuable 10 years from now rather than impulsively buying something from a fast fashion brand that will fall apart after a few wears,” she says.

Examining the ‘Markle effect’ on fashion brands as Meghan turns 40

Chen also foresees an increasing emphasis on aligning purchases with values.

“As luxury consumers become more sophisticated, they are increasingly looking to justify their purchases with meaning and purpose, digging deeper into the values of the brands they choose to connect with,” she says.

The funny thing about luxury is that at its pinnacle it’s always been about “money can’t buy” experiences, except, well, money does buy it.

“With luxury products now becoming increasingly accessible through various retail channels, true luxury is more about experiences that are unique and exclusive,” Chen says. “These may not even have a direct price tag attached to them, but are accessible only through channels and relationships that have been built up via long-term loyalty and investment.”