Explainer | Why Rolex sports watches such as the Rolex Oyster Perpetual are so hard to find and pre-owned models cost twice as much as new ones

- Stainless steel watches such as the Rolex Daytona and Rolex Oyster Perpetual are in such demand, even official dealers have none to sell

- Pre-owned Rolex watches sell for twice the listed price, or more, of new ones as the global leisurewear trend pushes up sports watch prices in general

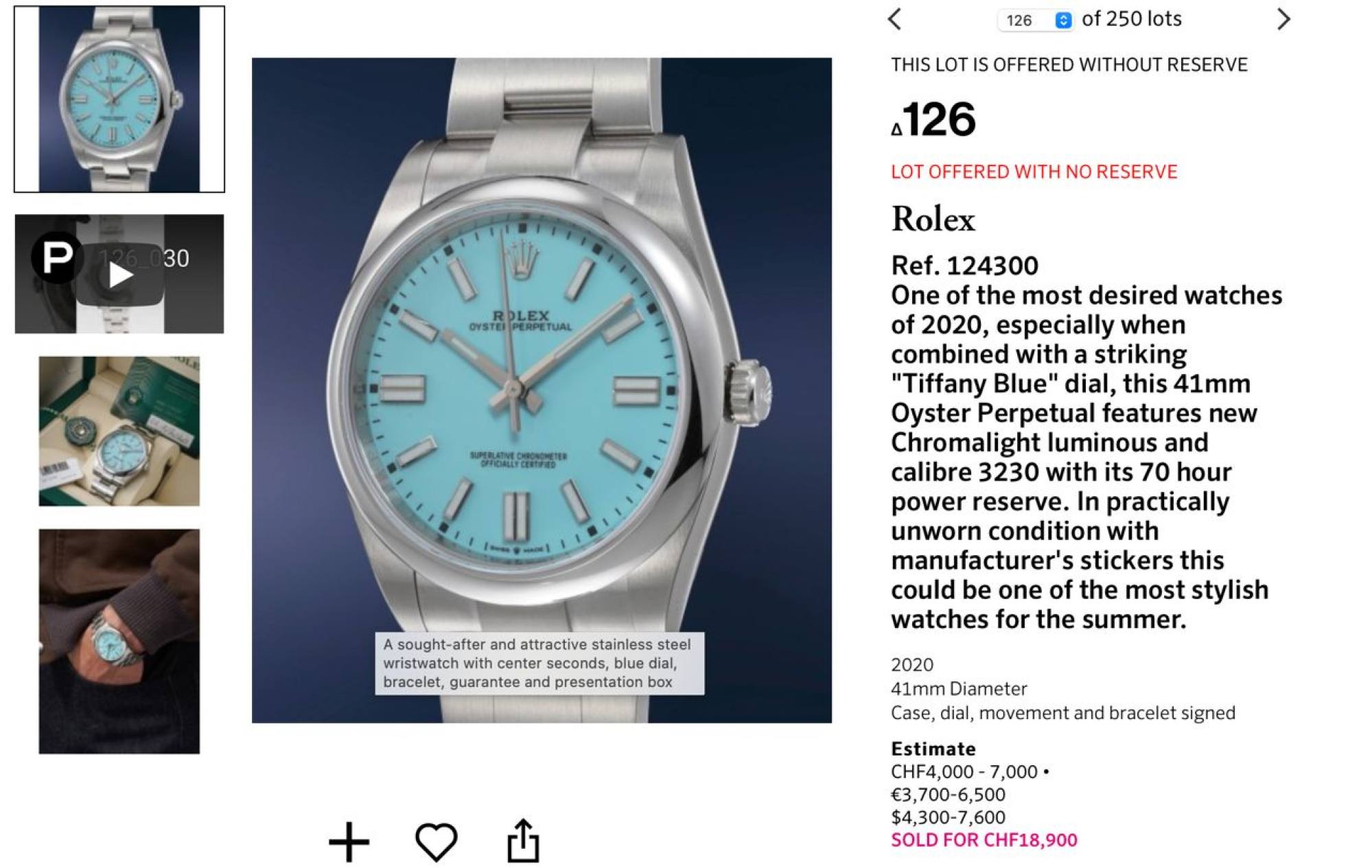

A Rolex Oyster Perpetual stainless steel sports watch with a Tiffany blue dial was described in the auction catalogue as having the manufacturer’s stickers and being in “practically unworn condition”. It sold in early November for 18,900 Swiss francs (US$20,700), four times the Rolex catalogue price of a brand new watch of the same type.

Bought new from an authorised retailer, this model should cost about US$4,900 – at the lower end of the Rolex range. Yet Rolex stainless steel sports watches are almost impossible to find at authorised watch dealers, and “nearly new” models sell for big premiums at auction, often in multiples of the catalogue price.

Meanwhile, unauthorised resellers in the grey market also sell so-called “new in box” models, nearly always without guarantees, for well over the Rolex catalogue price.

In a Hong Kong store of one of the world’s largest official Rolex retailers, the shop assistant shakes his head. He regrets he has absolutely no stainless steel men’s Rolex sports watches to sell.

No Rolex Daytonas, or Rolex Sea-Dwellers or even the basic Oyster Perpetual, the entry-level Rolex still nominally in production. None of the massive chain’s other outlets has any of these models either, he says, and no, there’s no waiting list.

“We do not have those watches,” he says. “We have no information.”

The scarcity of our products is not a strategy on our part

Watch enthusiasts are grumbling about the “flipping” and “scalping” of these increasingly elusive Rolex sports models.

Some buyers have complained they feel pressured by stores to buy a high-end Rolex watch just to get on the waiting list for a new sports model, and many authorised retailers don’t even have a waiting list.

Meanwhile, there has been a proliferation of unauthorised resellers and platforms selling pre-owned watches – though buyers have to be wary of paying for pre-owned watches that have been damaged or altered in some way and might be difficult to return to the seller.

Recent analysis by market research company Bernstein compared the list price for new Rolexes with the prices of pre-owned models on an online platform, Chrono24.com. The prices on the platform were usually about double the price asked for new watches.

A new Rolex GMT, its latest steel watch with a distinctive blue/black bezel, for instance, was priced at the equivalent of US$10,765 by Rolex, while a pre-owned one was going for US$20,250 on Chrono24.com.

A Sky-Dweller Steel had a Rolex list price equivalent to US$16,150 and was selling for US$30,500 on the same website; and Rolex listed the Daytona Steel for the equivalent of US$14,313 compared with US$33,170on Chrono24.com.

Hong Kong’s pre-owned luxury watch space just got more ‘hype’

Luca Solca, a senior research analyst at market research firm Bernstein, says the demand for Rolex sports watches has been driven by a broader global trend of informality and casual living now seen in streetwear and footwear, as evidenced by the increasing popularity of sneakers.

“I believe the same is happening in watches: sport styles are up while elegant styles are down, same as with suits,” he says, adding there has been a similar surge in demand for sports watches made by a few other brands.

Stainless steel Rolex watches are soaring on the wings of fashion. A Daytona or a Sea-Dweller, says one collector, makes a statement: “I am wealthy. I can afford this watch. I am also sporty, active and practical – and in tune with the current trends.”

One of the few independent Swiss brands, Rolex is not a listed company and is not required to release financial statements which might offer a glimpse of its marketing strategy.

It is also difficult to determine how many new Rolex watches are released for sale each year (thought to be at least 800,000). But in September this year, Rolex released a rare statement regarding the scarcity of some of the stainless steel models.

“The scarcity of our products is not a strategy on our part,” the statement said. “Our current production cannot meet the existing demand in an exhaustive way, at least not without reducing the quality of our watches – something we refuse to do, as the quality of our products must never be compromised.”

It went on to say that all Rolex watches are developed and produced at four sites in Switzerland, and assembled by hand. “Rolex watches are available exclusively from official retailers,” the statement said, “who independently manage the allocation of watches to customers.”

While Solca doesn’t think authorised dealers are selling new models for auction on the pre-owned market (and so doubling their profits), he does think being in the “inner circle” increases the chances of buying a new Rolex stainless steel sports model.

“If you are a regular customer and buy frequently at a certain store, it is conceivable that you will get priority when products are available,” he says. “Those watches are sold for personal use, though – people in the inner circle who abuse the system, and then resell their watches, risk being booted off it.”

Solca believes Rolex is “investing to expand capacity”, and in its September statement Rolex said it was increasing production capacity “as much as possible and always according to our quality criteria”.