What’s next for luxury brands in China after the 20th Party Congress? ‘Common prosperity’, continuing zero-Covid and rising nationalism – what they could mean

- Luxury brands have had to slash forecasts for their 2022 China sales after a rocky year. Are things looking any better after the 20th Party Congress?

- China’s middle class has seen its willingness to spend diminished by the zero-Covid policy, and the congress showed no sign of easing the its strictness

In 2021, despite the Covid-19 outbreak, China’s luxury sales surprisingly doubled compared with 2019 thanks to shoppers who, unable to go abroad due to travel bans, shopped domestically.

However, once the Omicron subvariant of the coronavirus started spreading, things took a turn for the worse.

The highly contagious strain gave the market a 2022 it never expected. With China’s dynamic zero-Covid policy, hundreds of cities have been through full or partial lockdowns, including fashion hub Shanghai.

Luxury brands slashed forecasts for their 2022 China sales from 18 per cent growth to 3 per cent, according to a report published in June after the Shanghai lockdown by Oliver Wyman, a consulting firm.

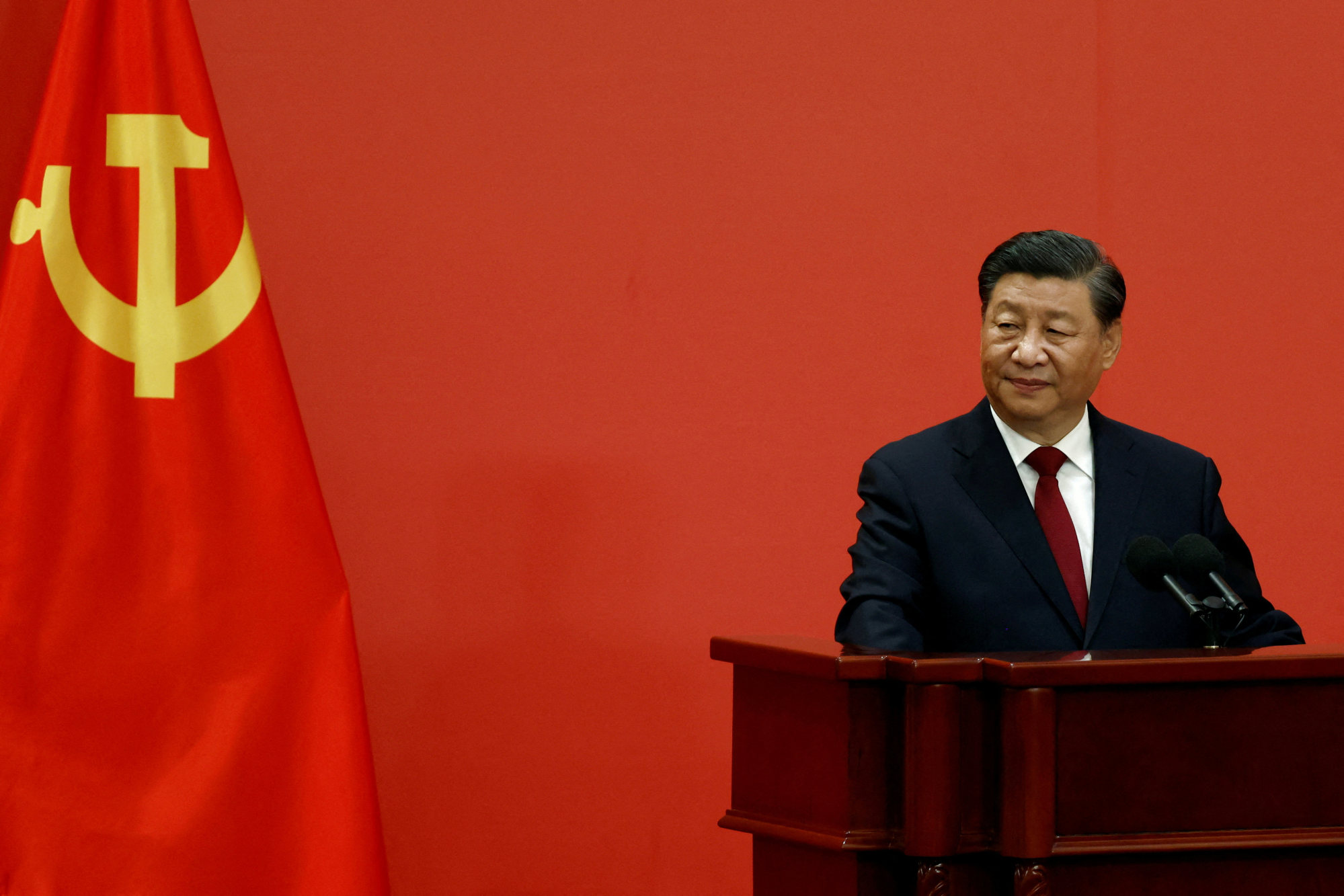

Brands hoped that good news would come at the 20th Party Congress, China’s twice-a-decade political event that sets a broad road map to the country’s future, economically and politically, which was held in October.

But did the congress promise a bright future for the world’s second largest luxury market?

The answer may lie in a series of topics addressed, from the re-emphasised “common prosperity” and “zero-Covid” to the support of nationalism and patriotism.

Common prosperity

On October 22, the Chinese Communist Party confirmed that the target of “gradually achieving common prosperity for all” had been written into the party constitution.

Though “common prosperity” was already in the constitution, the context is expected to be restructured and refocused, a sign of the country’s determination to pursue the goal despite the economic slowdown.

‘Aspirational consumers’ curb their appetite for entry-level luxury

The term is interpreted differently by various analysts – some see it is a “warning signal” to the rich while others think it is a good sign for boosting the middle class. Either way, the implications for the luxury market are huge.

“I believe that ‘common prosperity’ is about growing the equity of opportunity in China, rather than clamping down on wealth,” says Chloé Reuter, a founding partner at the Shanghai-based consultancy Gusto Luxe.

“It means the expansion of the middle class in China, and allowing social mobility.”

However, the wealthy are still the dominant power in the Chinese luxury market. According to Yaok, a Chinese luxury research firm, high-net-worth consumers’ share of luxury spending in China reached 80 per cent in 2021, up from 73 per cent in 2019.

“The bulk of our customers in China are not billionaires but the affluent and upper class,” said Jean-Jacques Guiony, chief financial officer at LVMH, which owns brands including Louis Vuitton and Christian Dior, in an October 2021 earnings call.

During the 20th Party Congress, it was emphasised that “common prosperity is not egalitarianism, and not ‘robbing the rich, giving to the poor’”, and the process “cannot be achieved overnight”.

Zero-Covid

But the middle class, whether it is expanding or not, also faces challenges, with its willingness to spend diminished by China’s zero-Covid policy.

Unlike some predictions, the 20th Party Congress showed no sign of easing the policy’s strictness, with many state-owned media outlets reiterating the importance of zero-Covid.

Uncertainty is what the luxury market fears the most, especially after the lengthy Shanghai lockdown earlier this year, which affected 25 million people in the city. Similar lockdowns have also taken place in cities including Chengdu, Shenzhen and Beijing.

According to Yaok, a Chinese luxury research firm, China’s luxury goods market will grow by 15 to 18 per cent in 2022. Though not a small number, it is much lower than the 37 per cent prediction it made in 2021, and the 45 per cent prediction made in 2020.

“There is no doubt that lockdowns and restrictions are impacting retailers and consumer sentiment,” Reuter says. “It is challenging for businesses to plan with no clear road map for a relaxation of the restrictions.”

A report by the Boston Consulting Group in 2021 also showed that the willingness of the average domestic consumer to save money has increased, while their demand for high-end products has significantly decreased.

If you’re not lucky, that Rolex Daytona you covet just became 5pc dearer

Reuter remains positive. “Across the country, sophisticated consumers still wish to experience and purchase luxury,” she says.

Mei Qianru, head of corporate affairs at Gusto Luxe, adds: “There is no doubt that the Chinese market is pivotal to the global luxury industry. When assessing the impact of [China’s] epidemic policy on the luxury industry, it is important to think calmly about whether the impact will be strategic in the long-term or operational in the short-term.”

Patriotism and nationalism

As relations between China and the West continue to be strained – especially with the United States – China’s adherence to patriotism will persist. This is another challenge luxury brands will face.

During the 20th Party Congress, President Xi Jinping re-emphasised that the country’s unification of Taiwan is a “historic mission”. The speech elicited one of the longest applauses in the meeting and will no doubt have stoked the flames of patriotism and nationalism already burning across the country.

In recent years, the Chinese younger generation, a target for luxury brands, has been vocal about companies that in their view disrespect their country.

“Luxury brands need to be aware that they are dealing with an increasingly confident China,” Mei says.

“Chinese consumers, especially the younger ones, are showing a firm stance in terms of cultural confidence, and international luxury brands need to really pay attention and respect such a trend while taking action.”

The country’s own fashion brands are gradually showing their competitiveness under rising nationalism.

‘It hurts our feelings’: why Chinese sportswear giant Li-Ning is under fire

In 2021, Li-Ning saw revenues hit 22.6 billion yuan in 2021, a 56 per cent year-on-year rise despite the pandemic. Nike, on the other hand, saw sales decline by 9 per cent in Greater China for the year ending May 31, 2022, the only region where the brand’s revenue fell.

Reuter says Western luxury brands need to pay attention to China’s rising domestic brands to look to build communities and loyalty under the country’s “unique digital ecosystem”.