Closure of Ralph Lauren Hong Kong flagship store probably won’t be the last given city’s poor retail climate

Four years ago Ralph Lauren was talking up China market as important long-term driver of growth, and expansion soon followed in Hong Kong. Now label has joined other big fashion names in closing a flagship store in the city

“We are in the midst of transforming our presence in China, a region that we believe will become an important driver of growth for us over the long term,” Ralph Lauren said in 2012 after the fashion conglomerate of which he was then CEO announced plans to open 60 stores in greater China by 2015.

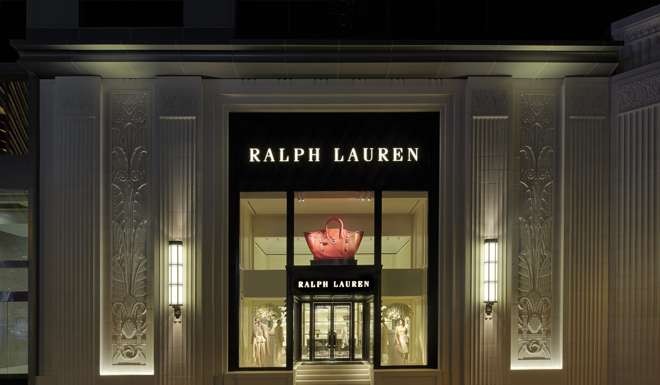

A year later, Ralph Lauren launched its first men’s flagship store in Asia in Landmark Prince’s in Central, and in October 2014 it unveiled an enormous “mansion” store at Lee Garden Two, presenting accessories, watches and jewellery as well as men’s and women’s fashions.

Fast forward two years, and the 20,000 sq ft store in Causeway Bay is no more, having closed suddenly earlier this month.

Contacted for comment about its abandonment of the space in Lee Garden Two, a representative of the brand said the closure was “part of our strategic and financial plan”, adding: “We are redeploying assets to focus on new concept stores and transition away from unprofitable formats and locations.”

We are redeploying assets to focus on new concept stores and transition away from unprofitable formats and locations

Ralph Lauren is “combining men’s and women’s flagships in the recently renovated Prince’s Building location, as well as remaining focused on providing our customers with the authentic style and luxury shopping experience they expect from us”, the spokeswoman said.

The move is part of a new strategy from Stefan Larsson, who worked for Swedish fast-fashion retailer H&M for 15 years and who replaced Lauren as CEO in late 2015 (Lauren remains executive chairman and chief creative officer). The restructuring will, according to reports, cut more than 50 stores and 1,000 jobs worldwide and save the publicly traded company between US$180 million and US$220 million a year. Its share price has been under pressure in the past 12 months, twice falling below US$85. Ralph Lauren shares closed at US$108.19 on Monday, down more than 9 per cent on their US$119.59 close on December 7, 2015.

Ralph Lauren’s sudden exit from its Causeway Bay flagship is the latest high-profile fashion closure to have occurred or been flagged in 2016. American fast-fashion label Forever 21 has announced it will close its multi-storey Causeway Bay flagship store. British label Paul Smith closed its Times Square store and Abercrombie & Fitch is set to leave its prime location in the Pedder Building in Pedder Street, Central – although, with a flailing brand reputation, poor sales and that famous HK$7 million monthly rent to pay, the move by Abercrombie & Fitch came as no surprise. Italian luxury clothing and accessories label Tonino Lamborghini also shut more than 10 stores and in-store counters in the city earlier this year.

Although the “umbrella revolution” protests in 2014 that were a factor in a downturn in Hong Kong’s retail sales have long ended, political turmoil continues and visitor numbers, having dropped, have not fully recovered. Competition for high-spending Chinese consumers has been stiff, with destinations such as Japan, South Korea, Milan and London stealing some of the traffic from Hong Kong.

However, Louis Vuitton and Versace are definitely in the minority.

With little sign of major recovery, Hong Kong’s economic outlook uncertain and retail sales continuing to fall, the fashion industry is on tenterhooks and braced for tougher times ahead. Since I wrote about Gucci’s rent dispute with its landlord Hongkong Land in 2015, there have been a spate of big-brand store closures, and threats by more prestige brands to shut up shop if rents aren’t adjusted.