Pre-owned luxury watch market in Hong Kong grows slowly, but WatchBox hopes its time has come

Vintage luxury watches are popular in the US, but Hongkongers have long been averse to buying second-hand goods. WatchBox, with its online watch trading platform and a bricks-and-mortar shop, believes it can change opinions

Hong Kong has long prided itself on being the world’s leading market for luxury watches, and despite tough competition from China and the United States, the city still accounts for 13 per cent of Swiss watch sales, according to the latest monthly figures from industry body the Federation of the Swiss Watch Industry (FH).

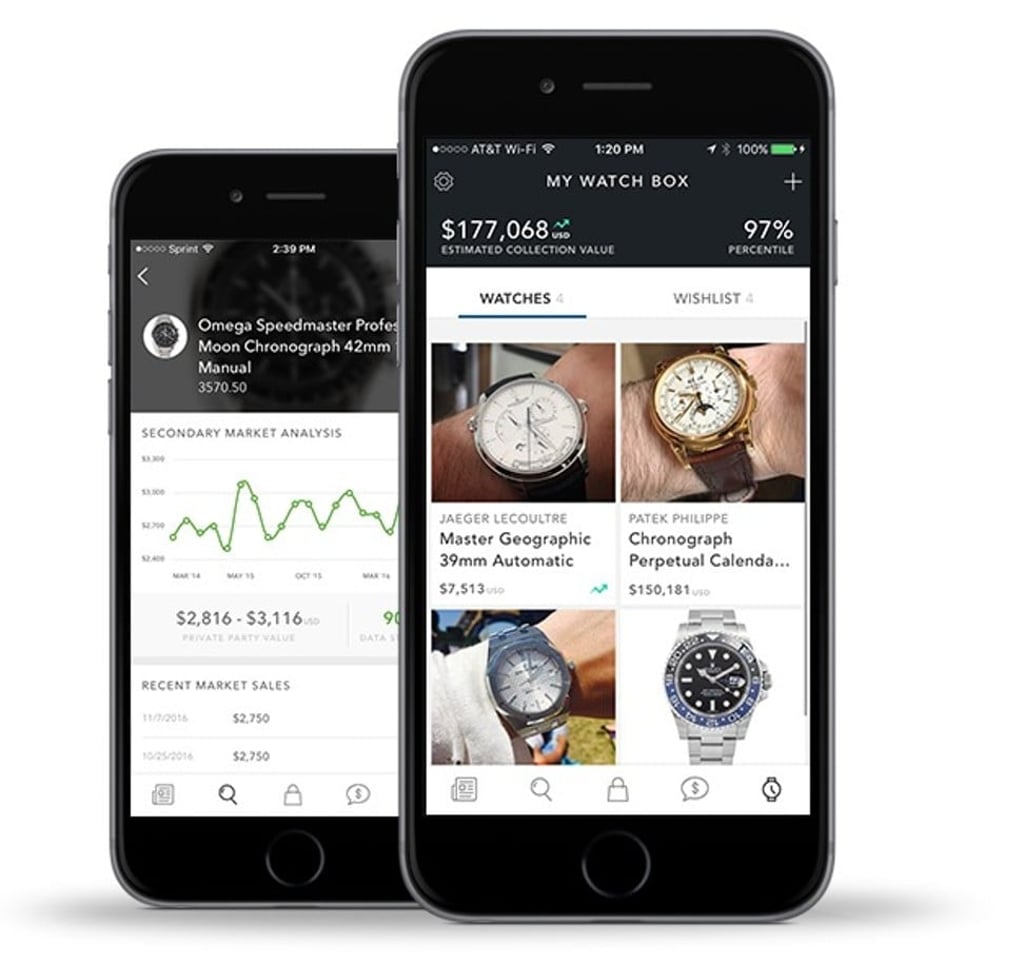

The market for new watches remains strong, but Hong Kong has had a lukewarm relationship with pre-owned timepieces. American “re-commerce” online retailer WatchBox is the latest company hoping to tap into the city’s lust for luxury watches, as well as a more buoyant environment for luxury goods, to change the image of pre-owned watches.

Tay says the company’s push into Hong Kong will combine its easy to use e-platform for consumers to buy, sell and trade watches, with a more traditional showroom on Duddell Street, Central, near other luxury watch retailers.

Hong Kong’s status as Asia’s ‘watch hub’ draws luxury pre-owned trading platform Watchbox

In Hong Kong, pre-owned watches can be found in abundance up and down Nathan Road in Kowloon, with tourists looking for a bargain, but for the most part the second-hand market is dominated by independent retailers and operates under the radar with little or no advertising, no-frills window displays and an anaemic online presence.