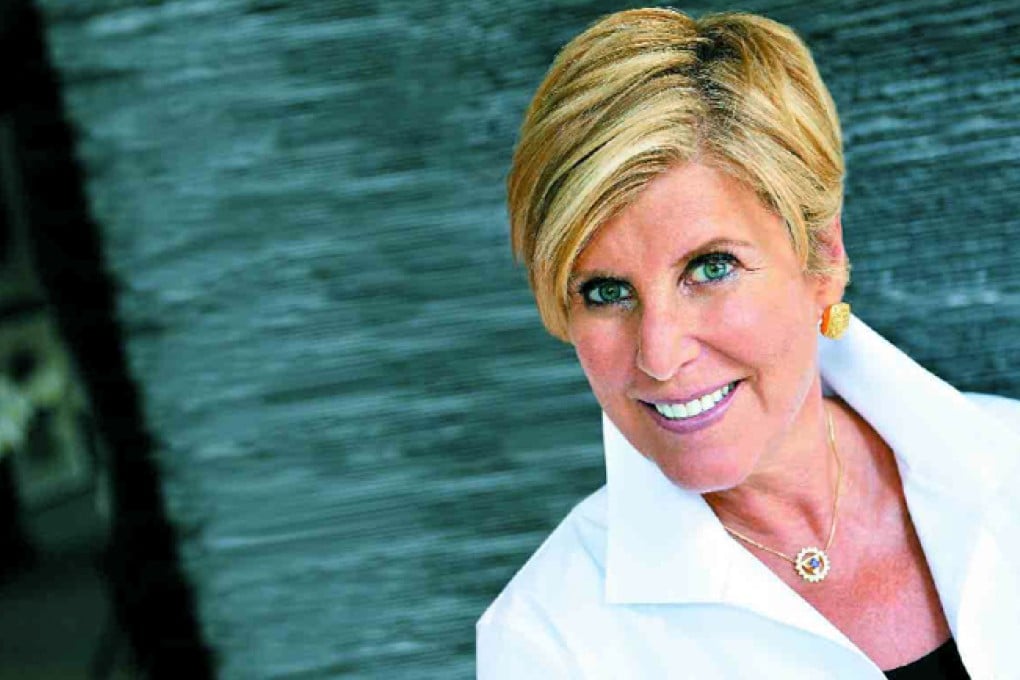

Suze Orman talks money

Financial guru, writer, producer, speaker and multimillionaire Suze Orman trades tips with Anna Healy Fenton on a recent trip to the city

With interest rates at next to zero, it's the million-dollar question. Where should retail investors put their money? "It's very, very difficult to invest right now when no one knows what's going to happen in Europe," says Suze Orman, America's favourite finance guru, famous for her no-nonsense advice on CNBC's The Suze Orman Show.

"They're kicking the can down the road in Europe and it will backfire on them," she adds. "I personally would avoid Europe or taking any risk whatsoever." The American stock market has obviously been a very nice return, but Europe will affect everything if it blows," she cautions.

Orman is in Hong Kong to have a haircut, with celebrity crimper Kim Robinson, en route to Australia where she is taking her financial self-help gospel to Melbourne's I Can Do It! weekend retreat. She's been invited as one of several leading motivational speakers. Her topic: The Eight Qualities of a Wealthy Person - Learn how to create a life of spiritual and material abundance.

But before the enlightenment starts she's banging the drum for individual stocks or Exchanged Traded Funds (ETFs), a favourite subject of hers since her 1999 book Courage to be Rich. "Now people are starting to talk about them," she says, with thigh-slapping satisfaction.

However, she inserts a caveat ahead of coming US tax changes. "High-yielding dividend stocks have been extremely popular but if the US government is stupid enough - you can underline that word stupid - to let capital gains tax expire, to let dividend tax expire …" she's getting steamed up at the prospect of dividend tax, now 15 per cent, rising to ordinary income tax levels soon. "You are going to see a mass exodus of those dividend-paying stocks. Who's going to buy them, when municipal bonds, at least in the US, make more sense?"