The way ahead is asset spread

Sell Thailand, the Philippines and Indonesia to invest in China, finance guru Marc Faber tells Martin Merz

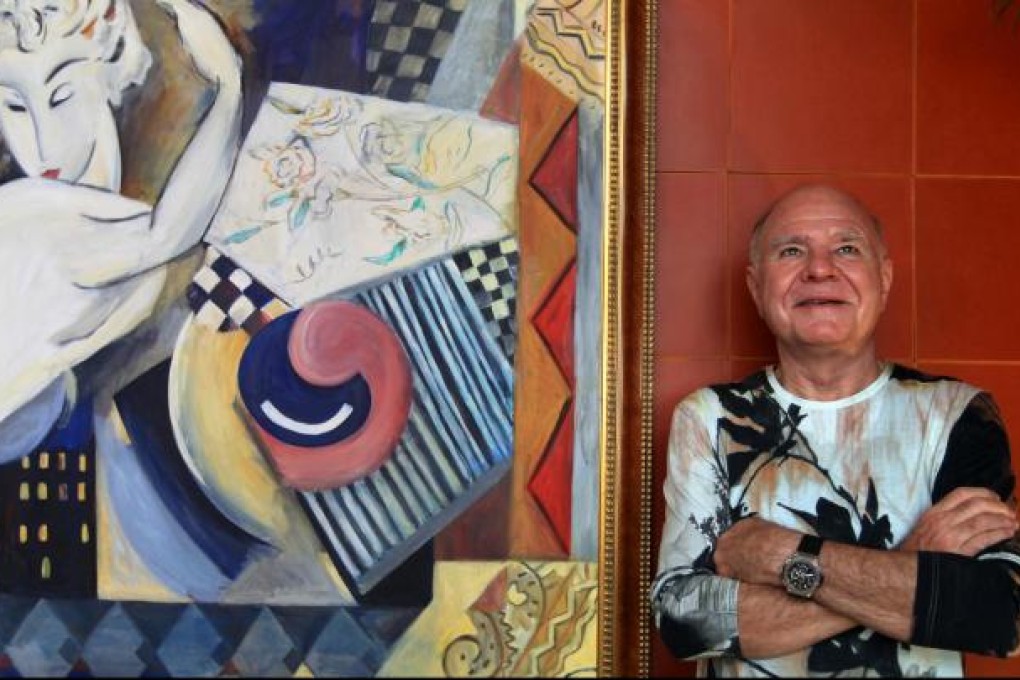

Legendary bearish investor Marc Faber, aka Dr Doom, shares his signature insights on gold, art, cash and inflation

I advocate that investors diversify their assets because we don't know what the world will look like in five years' time. People should have some real estate, some equities, some bonds and some gold. The weighting will depend on market conditions, but at all times I would advocate some diversification as it allows you more flexibility. If one asset class goes really wrong you still have the others and they are not all that closely correlated. Then you can further diversify real estate and equities in different sectors of the market and geographical locations.

Yes, I also have real estate, but there are management issues. You have to watch it and property rights are not well protected in many places. But the idea of owning real estate globally is a valid point.

The brand has been diluted because some people have now also adopted the name. There is also a Rolling Stones song called Doom and Gloom. I will sue them for copyright violation.