How reading impact investment book The Blue Sweater changed the life, and career path, of banker Katy Yung

- The book, by Jacqueline Novogratz, founder and CEO of global non-profit impact fund Acumen, approaches social investment with an entrepreneurial focus

- Reading the book gave banker Katy Yung the courage to set up a community of impact investors in Hong Kong

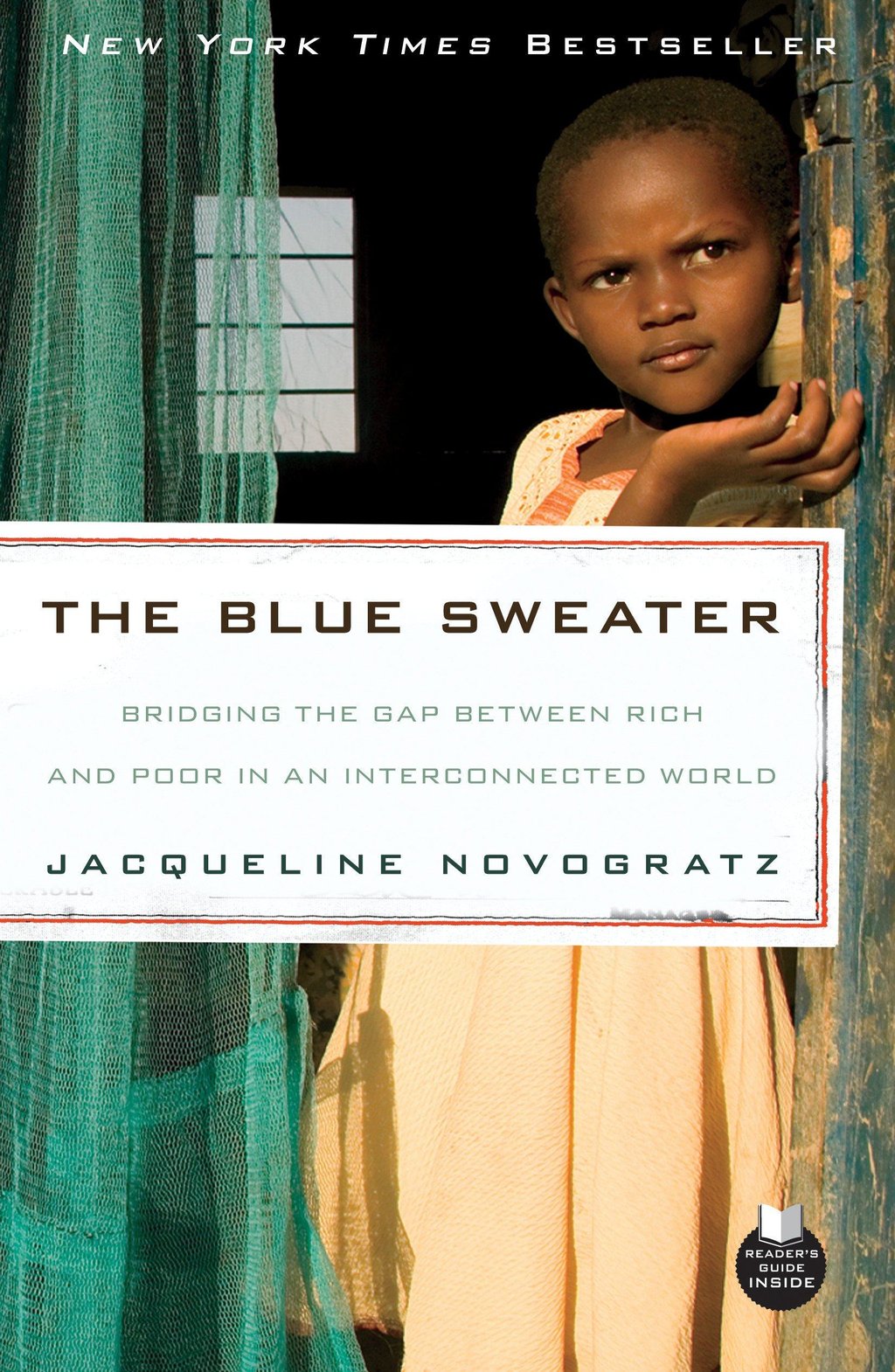

In The Blue Sweater: Bridging the Gap Between Rich and Poor in an Interconnected World (2009), Jacqueline Novogratz, founder and CEO of global non-profit impact fund Acumen, tells the story of her career as a banker turned impact investing pioneer, describing the shortcomings of traditional philanthropic methods in combating poverty and detailing her attempts to approach the issue with an entrepreneurial mindset.

Katy Yung, managing partner of the Sustainable Finance Initiative, a Hong Kong-based community of impact investors, tells Richard Lord how it changed her life.

I picked up the book when it had just been published, when I was deep in Wall Street finance. I found it because I was doing my own research into impact investing.

If you think about impact investing, Jacqueline Novogratz is one of the big names; she really defined the impact space in the early days. The term “impact investing” was only coined in 2007. Before that it was very much about microfinance or philanthropy – there wasn’t a term for it.

The book was a breath of fresh air. At lunchtime I would go and sit outside next to Prince’s Building in Central, Hong Kong and read it. It was fascinating that there was a whole world out there that combined investing with making a difference. In college, I had been very interested in doing good.

Now, with my job in banking, I also understood mainstream capitalism. But I was struggling to plug myself into the social enterprise scene in Hong Kong, which was not well developed at the time.