How to make money in the art market: top collectors reveal their secrets

Do your creative homework, know your weaknesses and aim high, and you might just hit the art market jackpot

Andy Warhol once said, “Making money is art.” But what about making money from art?

A boom in the global art market has delivered some eye-popping returns in recent years, drawing new investors to an asset class that offers cultural as well as financial appreciation.

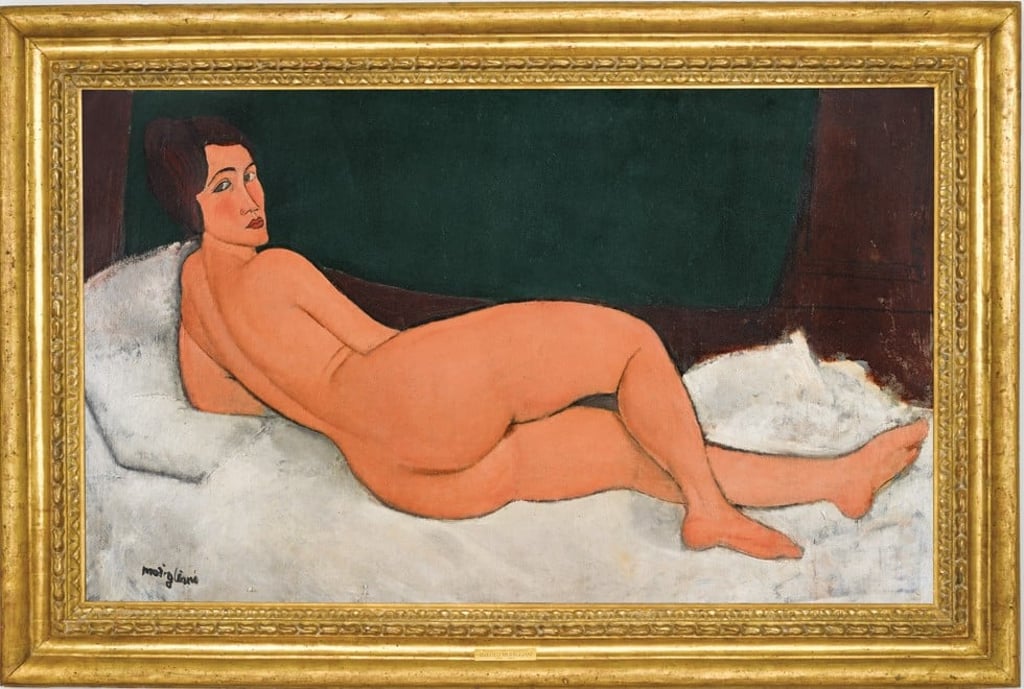

Irish horse breeder John Magnier will get at least US$150 million for a painting of a nude by Amedeo Modigliani, which will be auctioned at Sotheby’s in New York on May 14, thanks to a third-party guarantee. Magnier paid US$26.9 million for the work in 2003.

When I start with a new client, half my job is to say no, especially to people from finance who think because they can master one market, they can master any market

But the market is opaque, unregulated and sometimes extremely illiquid. Gallery owners and auction houses charge commissions of 25 per cent or more, sometimes negotiable, and art buyers must avoid the pitfalls of forgeries, fakes and rapidly changing tastes.

“In the art market, there are no rules. That’s why it is such a minefield and why it has such opportunities,” says Wendy Goldsmith, a London-based adviser in modern and contemporary art. “When I start with a new client, half my job is to say no, especially to people from finance who think because they can master one market, they can master any market.”