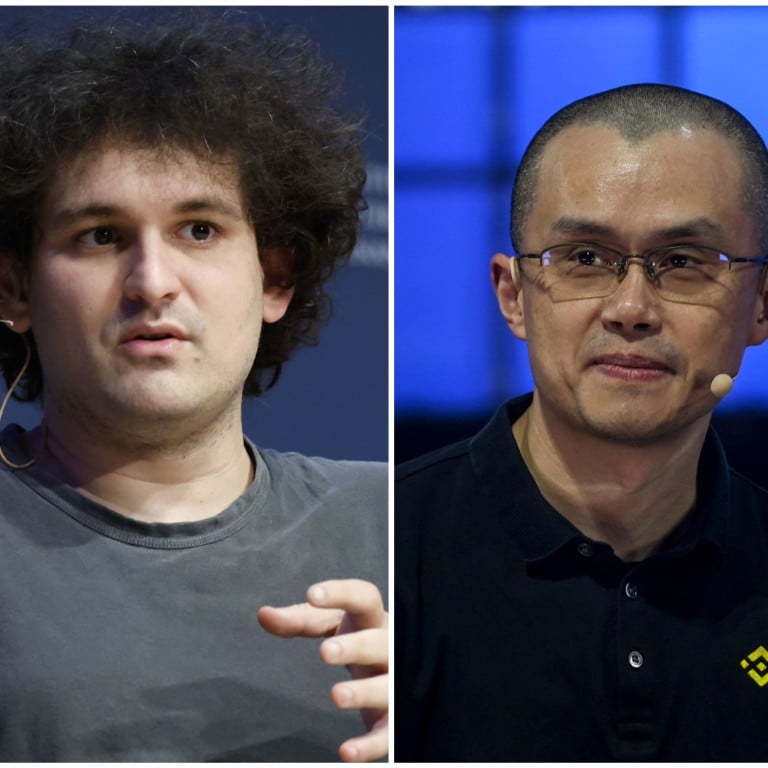

Crypto war: Sam Bankman-Fried’s feud with Changpeng Zhao explained – the ex-FTX CEO’s fallout with the Binance tycoon caused a multibillion-dollar crisis and has seen his net worth drop by 94 per cent

- Binance CEO Changpeng Zhao lost patience with Sam Bankman-Fried’s lobbying in Washington DC and, after selling all of FTX’s cryptocurrency, sparked the company’s bankruptcy

- Bankman-Fried, known for enjoying beanbag power naps in his office, now faces a slew of investigations into misuse of customer funds – but said ‘it could be worse’

Sam Bankman-Fried regrets the feud that may have cost him his crypto empire.

The clash between the two is key to understanding one of the most dramatic collapses ever in the crypto world. Let’s take a closer look …

How the feud between Changpeng Zhao and Sam Bankman-Fried started

Zhao and Bankman-Fried started friendly: Binance, a rival cryptocurrency exchange, invested in FTX in 2019. However, the relationship soured when Bankman-Fried, 30, pushed for regulation of the crypto industry, something Zhao, 45, opposes.

The New York Times reported that Bankman-Fried used his growing influence in Washington DC to criticise Zhao in private meetings.

“I was pretty frustrated at a lot of what I saw happening, but I should’ve understood that it was not a good decision of me to express that,” Bankman-Fried told The New York Times.

The dispute between the two billionaires came to a head in early November when Zhao announced that Binance would sell all of its FTT holdings, a cryptocurrency created by FTX.

“We gave support before, but we won’t pretend to make love after divorce … we won’t support people who lobby against other industry players behind their backs,” Zhao tweeted.