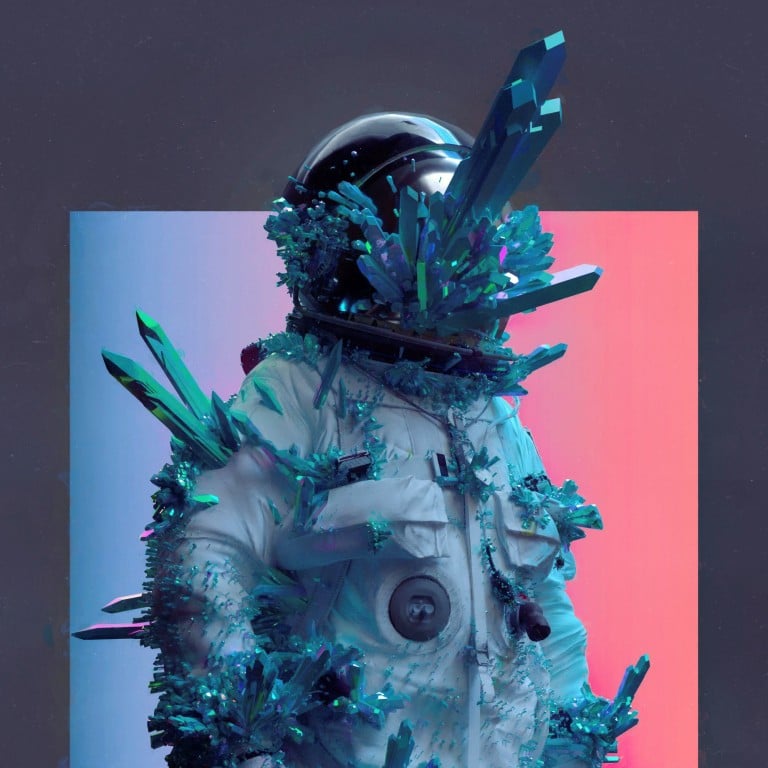

Opinion / Beeple’s US$69 million NFT art sale: what brands can learn about pricing luxury goods beyond all expectations from this once-in-a-lifetime Christie’s auction

This article is part of Style’s Luxury Column.

When Christie’s sold one of the most expensive artworks of all time by a living artist for US$69.3 million, many could not believe the outcome – including, apparently, the artist who created it and the auction house that sold it.

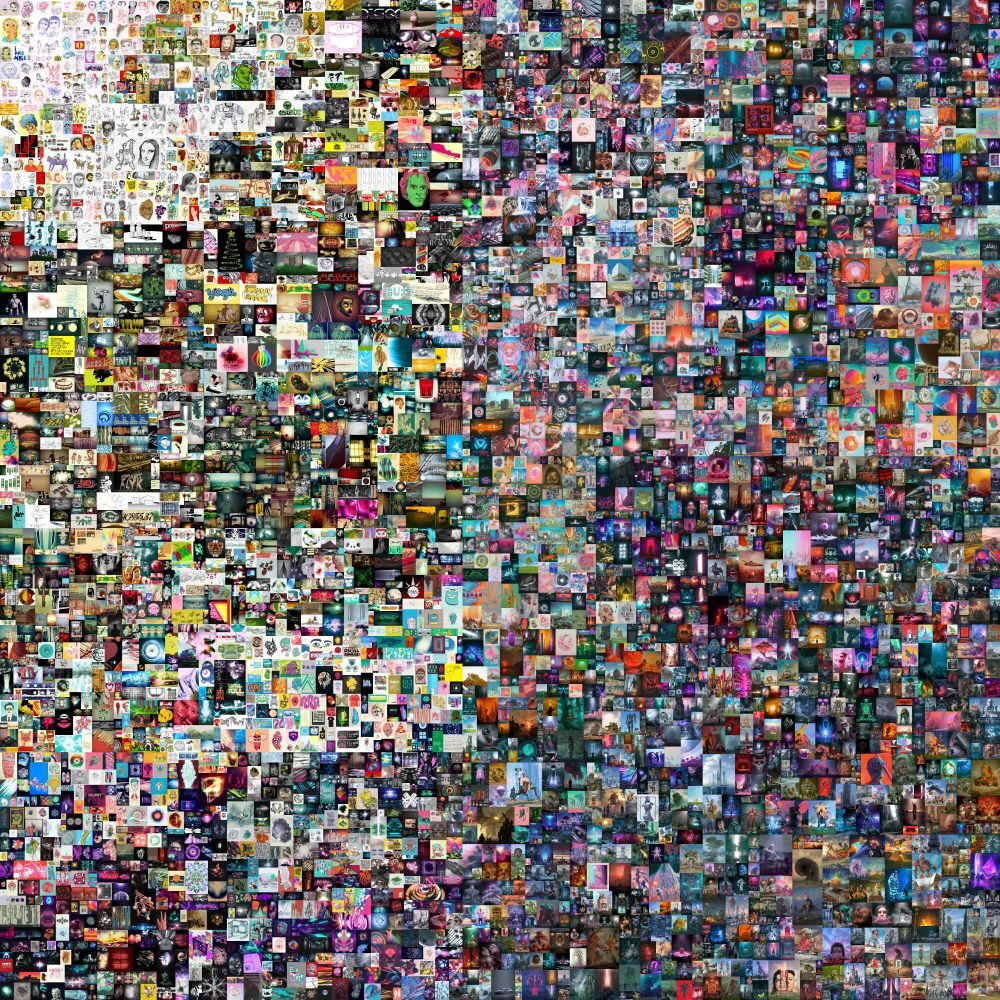

Beeple’s Everydays: The First 5000 Days, a virtual collection of 5,000 images, was listed at just US$1,000 for the initial bid. Never before has a piece of art exploded in value by nearly 7,000 times in a matter of minutes – a sure sign that no one reckoned with the value of the lot going under the hammer.

So how can we explain the price point that one Indian blockchain entrepreneur was prepared to pay for Beeple’s work? A closer look reveals that this art sale has all the ingredients employed to market (and justify the prices of) the most desired luxury products.

What if everyone else in the category is wrong in terms of their pricing? You then benchmark yourself against brands that may be undervaluing their value creation. As a result, you are wrong, too

This approach is practically always wrong when it comes to luxury. The strategy only works for mass market brands where the reference price theory gives us indications on the willingness to pay. Luxury has completely different, counterintuitive rules. Hence, intuition with regard to luxury pricing will almost always misguide you. The US$1,000 starting price for Beeple’s artwork is a great example. Even an experienced auction house like Christie’s was seemingly completely off.

Instead, what luxury brands need to do is estimate the added luxury value their brand delivers. And this value does not depend on the product or the competition, it depends on the perceived value the story creates. This is another counterintuitive element: in luxury, the story always creates more value than the product. This is why luxury is so elusive and difficult to manage. And this is why most luxury brands price wrongly and often leave millions, in some cases billions, of dollars in profit potential on the table.

One question luxury brands should ask themselves: what if everyone else in the category is wrong in terms of their pricing? You then benchmark yourself against brands that may be undervaluing their value creation. As a result, you are wrong, too.

This is the crown jewel, the most valuable piece of art for this generation

This is a critical component. Before the use of NFT, anyone was able to copy any digital art, making it practically impossible to create lasting value to a buyer. Even if you had paid for digital art, anyone else could claim that they had the original, too. In the “real world”, this is what fake artworks are. However, given the ease with which a digital artwork could be copied, there was no way to create an artwork of extreme value virtually. NFTs change this.

The buyer of the digital artwork, according to Channel News Asia, said: “This is the crown jewel, the most valuable piece of art for this generation.” The extreme value created by the story explains why it now ranks third among the three most valuable artworks ever sold by a living artist, after pieces by Jeff Koons and David Hockney.

- Digital artwork Everydays: The First 5000 Days sold for an incredible US$69 million, but was only listed by Christie’s for US$1,000 – was it all a stunt?

- Jeff Koons and David Hockney are the only living artists to command higher sums, while Bugatti and Hermès have created similarly exclusive stories