What is the ‘great Rolex recession’ – and is it really here? Amid fears of an economic downturn, buyers scale back on splurging on luxury watch brands from Patek Philippe to Audemars Piguet

Since late 2022, Wall Street has been rife with predictions for the Federal Reserve’s interest-rate increases to wreak havoc in the US economy and stock market.

The US central bank’s aggressive monetary tightening over the past five quarters is seen as a key reason for the slump in watch prices. Higher interest rates have fuelled fears of an economic downturn, spurring investors to scale back luxury spending and boost savings. The downturn in the crypto market, also precipitated by rate rises, has also hurt demand for watches.

The costliest timepieces have suffered the worst declines. Those in the US$50,001 to US$100,000 price bracket slumped over 15 per cent in the past 12 months, while the US$10,001 to US$20,000 group fell 10.4 per cent, according to WatchCharts data. The US$5,001 to US$10,000 band saw a 6.8 per cent drop.

Luxury watches have underperformed stocks since March 2022, when the Fed started raising interest rates. The S&P 500 index of US large-cap shares is up by about eight per cent since then.

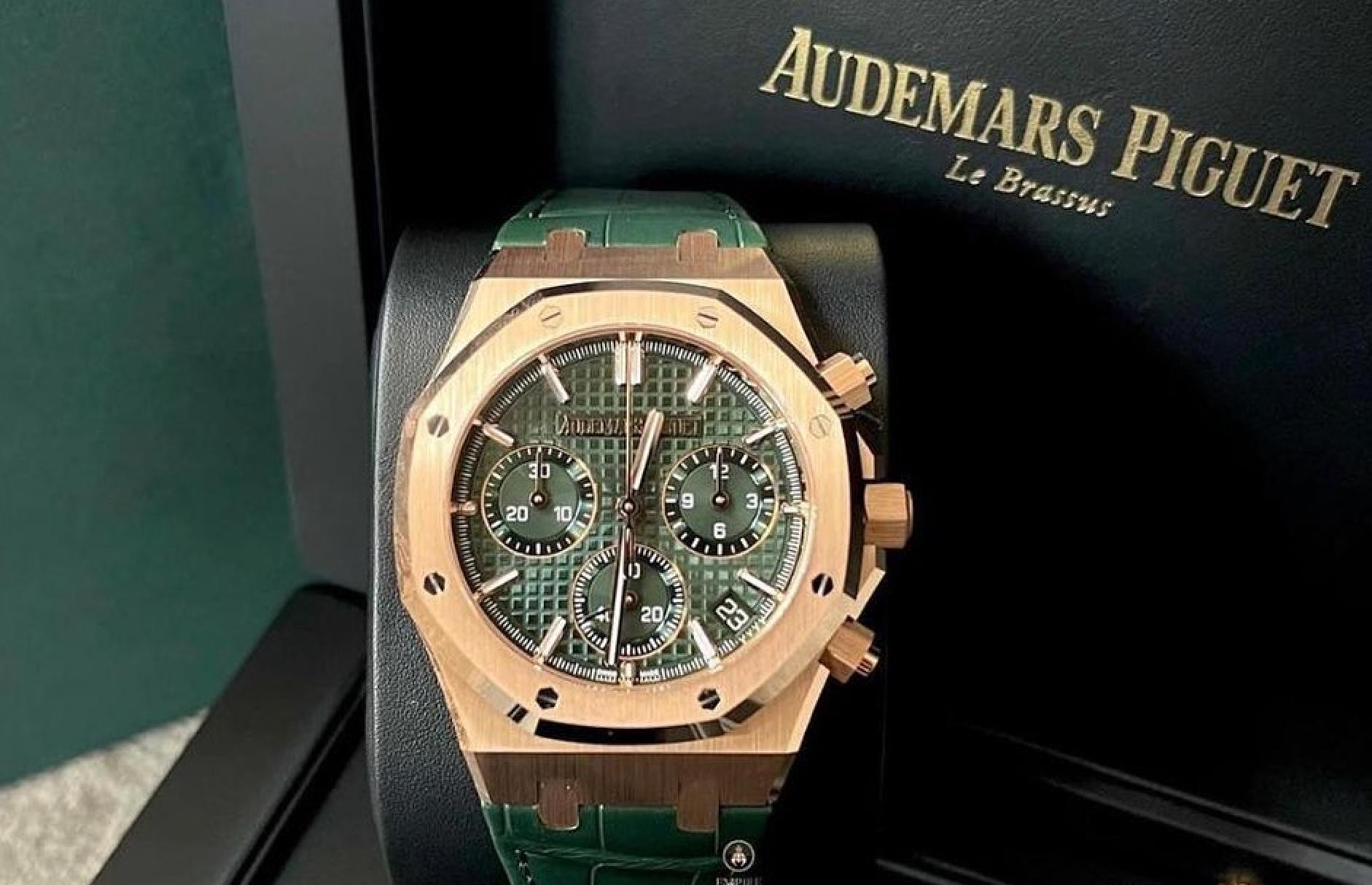

Certain chronometer brands have felt the bite more than others. The Rolex Market Index, which tracks the top 30 most valuable models, is down 12.5 per cent from a year ago, while the Patek Philippe index lost 18 per cent. However, Audemars Piguet saw the sharpest losses, down almost 20 per cent year-on-year, WatchCharts data show.

Despite the declines over the past year, prices have climbed considerably higher over the longer term, outperforming the stock market. The Rolex index is up by more than 55 per cent from five years ago.

“Luxury watches have performed well, especially over the long term, in comparison with traditional investment categories. From August 2018 to January 2023, average prices in the second-hand market for top models from the three largest luxury brands – Rolex, Patek Philippe and Audemars Piguet – rose at an annual rate of 20 per cent, despite broader market downturns during the pandemic, compared with an annual rate of eight per cent for the S&P 500 index,” BCG said in a report published earlier this year.

- The second-hand luxury market is currently experiencing a demand slump as higher interest rates spark fears of an economic downturn, prompting spenders to splash less on luxury goods

- Prices for Rolex, Patek Philippe and Audemars Piguet have plunged, since the pandemic boom which saw surplus cash being spent on the timepieces, as well as NFTs and meme stocks