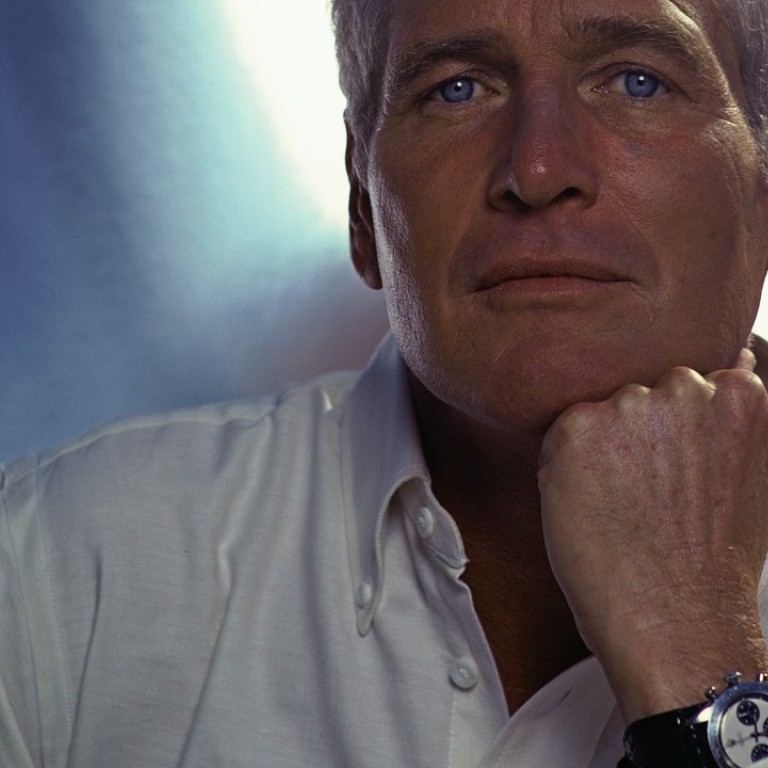

Why Paul Newman’s Rolex shows vintage watch demand is alive and ticking

Sam Hines, Sotheby’s global head of watches, tells STYLE how collectors of rare luxury timepieces are sending prices spiralling around the world

Over the past year, vintage watches have been fetching outrageous prices at auction.

The record, for now, stands at US$17.8 million – a bid made in December 2017 for a Rolex Daytona that used to belong to the late American actor Paul Newman.

To find out why this is happening, we sat down with Sam Hines, a watch expert par excellence and Sotheby’s global head of watches.

On the table in front of us are a few examples of timepieces that Hines says are setting the vintage luxury watch-market ablaze.

Among the objects, I recognise a couple of Rolexes, a Patek Phillipe Nautilus and an Audemars Piguet Royal Oak.

Hines turns a green box towards me: it’s a vintage Rolex Daytona, one of the hottest watches on the market.

He says that, until recently, auction prices for vintage Daytonas had been fairly stable; they were selling at around US$25,000 to US$30,000 for about a decade. But suddenly, just last year, they quadrupled in value, with prices rising to US$100,000 or more.

Much of this boils down to fashion, Hines says.