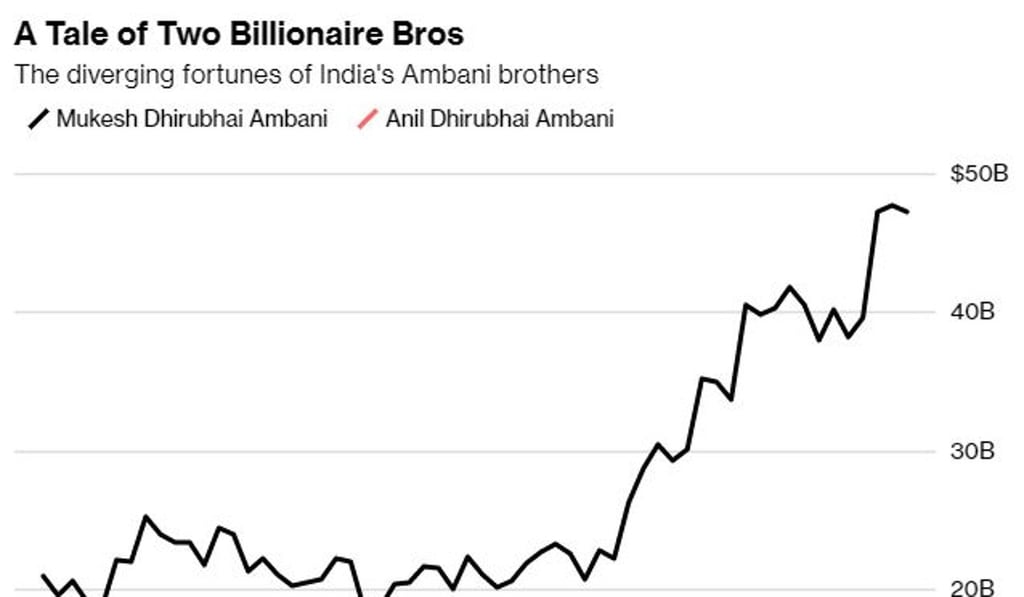

Why one Ambani is making US$40 billion more than his brother

Wealth of Mukesh Ambani – now Asia’s richest man – has reportedly surged to US$43.1 billion, while his brother’s has fallen by half to US$1.5 billion

Over the past year, the fortunes of the two brothers at the helm of India’s wealthiest dynasty have grown distant – to more than US$40 billion apart.

Elder sibling Mukesh Ambani, 61, toppled China’s Jack Ma as Asia’s richest man, after driving a telecommunications revolution in India that propelled his petrochemicals conglomerate Reliance Industries into the US$100 billion club.

His personal fortune has grown to US$43.1 billion, according to the Bloomberg Billionaires Index, US$5.2 billion ahead of Ma – executive chairman of the e-commerce conglomerate Alibaba Group, owner of the South China Morning Post – and just ahead of Microsoft’s former chief, Steve Ballmer.

Meanwhile Anil Ambani, two years his junior, has had a difficult year, with some of his businesses suffering legal and liquidity challenges that roiled stocks, cutting his personal fortune by almost half to US$1.5 billion, according to the index.

Neither the brothers nor their groups responded to questions for this story regarding their wealth or business operations.

The tale of the two brothers’ diverging fortunes began 16 years ago, when their rags-to-riches father Dhirubhai Ambani, whose life inspired a Bollywood film, died of a stroke without leaving a will.

The industrialist, who started out as a petrol-station attendant in Yemen, had built a vast business empire, financing huge factories by selling so many shares to small investors that stockholder meetings had to be held in a soccer stadium.

A feud between his two sons following their father’s death dogged the group until their mother, Kokilaben, stepped in to broker a truce in 2005.

Mukesh got control of the flagship oil refining and petrochemicals, while Anil got the newer businesses, such as power generation and financial services.