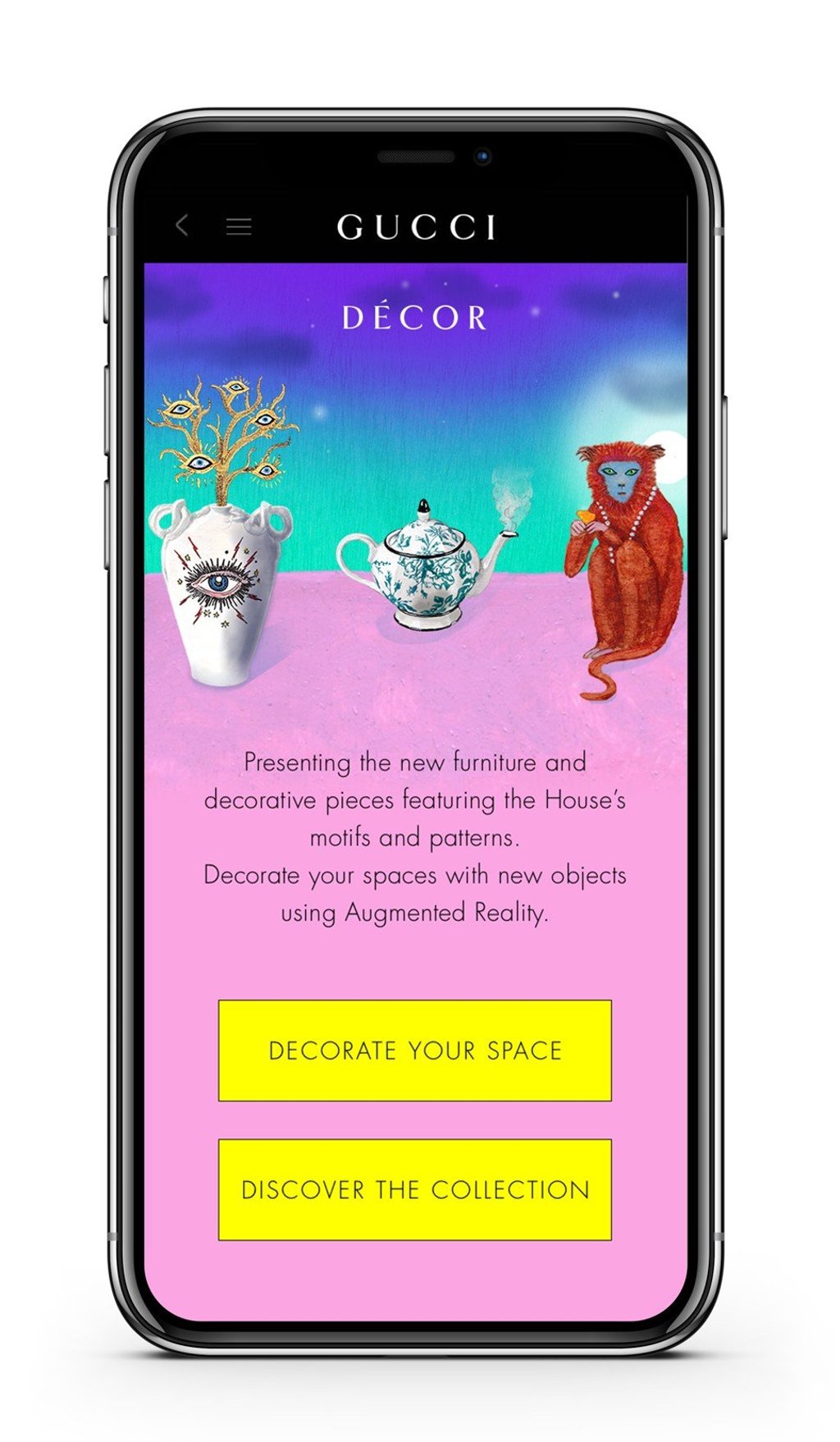

From Alibaba to Gucci, how Jack Ma’s ‘new retail’ model puts China ahead of the game

Powered by the use of analytics, new supply chain strategies and technological innovation, the concept has transformed the shopping world

Move over, New York, London, Paris and Milan. Once centres for retail innovation in European and US markets, and keenly followed by luxury retailers and industry power players, these global cities are now being beaten to the post by China.

The past 10 years have seen China rise to become a leading force in e-commerce and a pioneer of the “new retail” model – a concept introduced in 2016 by Jack Ma, founder and chairman of e-commerce giant Alibaba, which owns the South China Morning Post.

Powered by the singular use of analytics, new supply chain strategies and technological innovation, it is a veritable ecosystem of innovative technologies, experiments with analytics and retail-as-a-service business models. Its widespread application has meant that China has reinvented itself, looking beyond the limitations of the old model, and gaining an edge over global competitors. Perhaps the biggest advantage of this highly tailored approach is that it takes into consideration the needs of the buyer, forming a specialised blueprint for a retail revolution. It opened the door for an enhanced consumer experience, which puts satisfaction at the forefront of its operating model.

China is now the poster child for the changing dynamics of the retail industry, and the focus of international luxury brands that want a slice of the burgeoning market.

Its strategies are simple and direct, such as using WeChat – China’s most popular social media platform – to run exciting customer-specific campaigns.

Kering, a global luxury group based in Paris, is one such company. Grégory Boutté, its chief client and digital officer, explains that Kering always addresses “the specificity of each geography”, which means that China remains “always top-of-mind when it comes to digital and innovation”. To that end, Kering has “a dedicated team based in Shanghai”.