LVMH’s Bernard Arnault isn’t the only billionaire to have dropped a fortune – 5 Chinese tycoons who also lost billions thanks to Covid-19

At this volatile time, with the world wracked by the Covid-19 pandemic, some of the world’s wealthiest men and women are losing billions. As they say on Project Runway, one day you’re in, and one day you are out.

CEO of luxury brand LVMH, Bernard Arnault, is one example. His net worth has plunged by US$30 billion, dethroning him after his only-recent crowning as the world’s richest man and dropping him back to third.

Arnault is not alone. In recent times, several Chinese billionaires – from a jewellery magnate to real estate gurus – also lost billions almost overnight. Here are five of the biggest losers in dollar terms.

Kylie Jenner vs Forbes – did she really lie about being a billionaire?

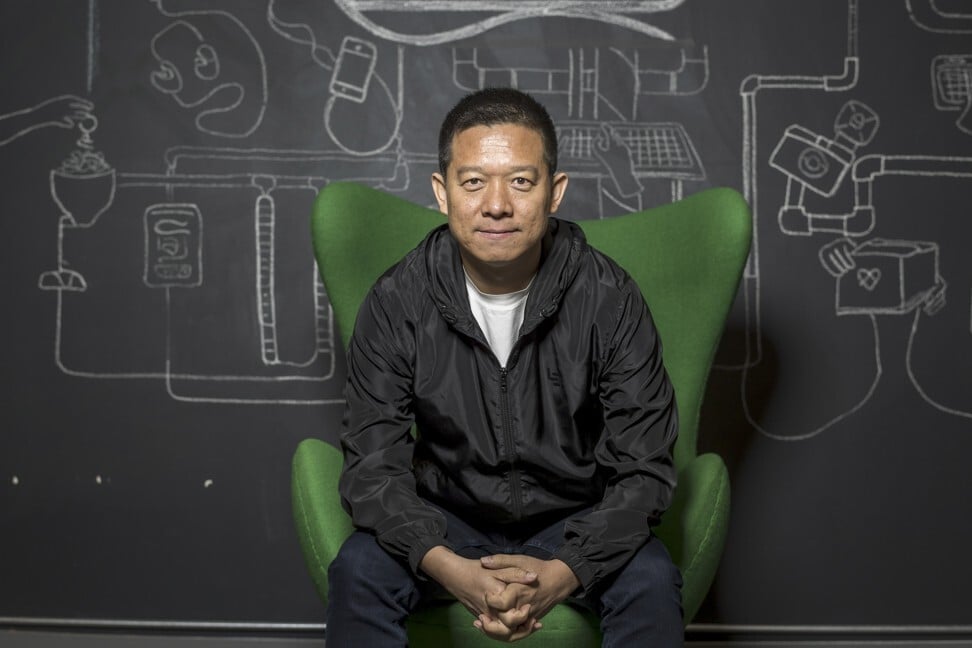

Jia Yueting

Jia Yueting founded Leshi Internet Information and Technology Corp (LeTV) in 2004 and has since grown it into the LeEco Group with interests in consumer electronics, film streaming and video as a service.

With the success of his company, Jia was listed as a billionaire on the Hurun China Rich List in 2016 with an estimated worth of US$6 billion.

After being rocked by a financial crisis in 2017, LeTV’s fortunes took a turn and Jia left for Faraday Future, a start-up working on electric vehicles based in Los Angeles. Faced with a series of lawsuits and debts back in China, he filed for personal bankruptcy in the US in October 2019.

Feng Xin

Sometimes the higher you go, the more painful the fall. This was particularly the case for Feng Xin, CEO of Chinese online video service provider, Baofeng Group.

In 2015, Baofeng Group had a market value of US$1.58 billion but Feng was able to jack that up to US$51.6 billion in just 40 days with 36 limit ups. The stunning rise in value was a game changer, especially since the first online video service provider in China, Tudou, was only worth US$34 billion at the time.

Mukesh Ambani, Jeff Bezos ... who will be the world’s first trillionaire?

However, Feng’s ambition to compete with his rival, Jia Yueting of LeTV, saw him take an over 65 per cent stake of British sports media company MP & Silva (MPS) in 2016 for US$727 million through a special purpose vehicle. The bankruptcy of MPS two years later left Feng and his investors entangled in a series of lawsuits.

He was detained by the police for attempted bribery in July 2019 and currently Baofeng Group is struggling with financial difficulties and has only 10 employees left. The company also received a letter of concern from the Shenzhen Stock Exchange in April 2020.

Xiong Xuqiang

Once Ningbo’s richest resident, Xiong Xuqiang is the founder of real estate company Yinyi Group, established in 1994. His efforts in building up the company over the next decade saw the group grow to encompass more than 20 subsidiary companies.

In 2018, his assets were worth US$42.6 billion, placing Xiong 95th on the Hurun China Rich List.

The turning point came in 2016 when Xiong decided to move the company into auto parts manufacturing. The 2018 decline in China’s automobile market caused Yinyi to suffer a full-year loss and led it to have to repay US$562 million as of April 2019.

Yinyi later filed for bankruptcy.

13 quotes from Bernard Arnault, CEO of LVMH

Zhou Xiaoguang

Zhou Xiaoguang had a Cinderella-like rise, hard work taking her from a simple peasant family background to a woman worth US$46 billion. As a teenager she started selling embroidery in the streets and then in 1995 she founded Neoglory Holdings Group with her husband, Yu Yunxin.

Over the next decade, Zhou was recognised as the costume jewellery queen and Neoglory became a leader in costume and fashion jewellery.

However, things went south when they expanded their business to real estate. The alleged dishonest disclosure of transactions, revenue and other dealings caused them to have to turn to Zhejiang government’s private sector rescue plan with billions in debts and overdue payments.

Li Zhaohui

Li Zhaohui used to be one of the richest owners in the steel industry of China’s Shanxi province but found himself buried in debt after a slump in his business, eventually having to declare bankruptcy.

Millennial Li was CEO of Shanxi Highsee Iron and Steel Group from 2004 to 2013. In 2010, his net worth was said to be US$1 billion and he was listed as the 275th wealthiest person in China by Forbes in 2013. He married actress Che Xiao, spending 50 million yuan on the wedding, yet the couple broke up after merely a year of marriage.

His downfall was blamed on his decision to branch out into other industries such as entertainment and equity investment. In 2013, the company’s debt reached as much as US$351 million because of overcapacity in the steel industry and a general business slowdown.

Want more stories like this? Sign up here. Follow STYLE on Facebook, Instagram, YouTube and Twitter .

Pandemic cost billionaire Bernard Arnault his title as the world’s richest man – here are 5 Chinese tycoons who also lost billions in double quick time