4 ways the art world needs blockchain: NFTs spurred an explosion in digital art, Christie’s and Sotheby’s make crypto sales, and platforms like Arcual put artists back in the art ecosystem

- Christie’s New York made the first blockchain sale – the Barney A. Ebsworth collection in 2018 for US$318 million – before Beeple’s US$69 million NFT sale changed the industry forever

- Artworks can be registered with Artory, Codex or Verisart, while NFT collections from CryptoPunks, CryptoKitties and Bored Ape are sold on marketplaces such as OpenSea, Rarity and Solana

Put simply, blockchain is a secure and transparent electronic ledger that is digitally distributed, decentralised, open source and public. Each block in a chain contains three things: the data, the hash (a unique set of numbers and letters created by an algorithm) of the block, and the hash of the previous block in the chain. If any of the blocks are tampered with, the blockchain would be broken, part of what makes blockchain technology so secure.

1. Auction house sales

In 2018, Christie’s New York became the first auction house to make a sale on a blockchain platform, selling the Barney A. Ebsworth collection of more than 90 artworks for US$318 million with all of its transactions recorded entirely via the blockchain-secured registry, Artory. This new technology allowed potential buyers to view a complete transaction history of the works in the auction before bidding, while collectors who registered their artworks could do so anonymously without storing their information on the database.

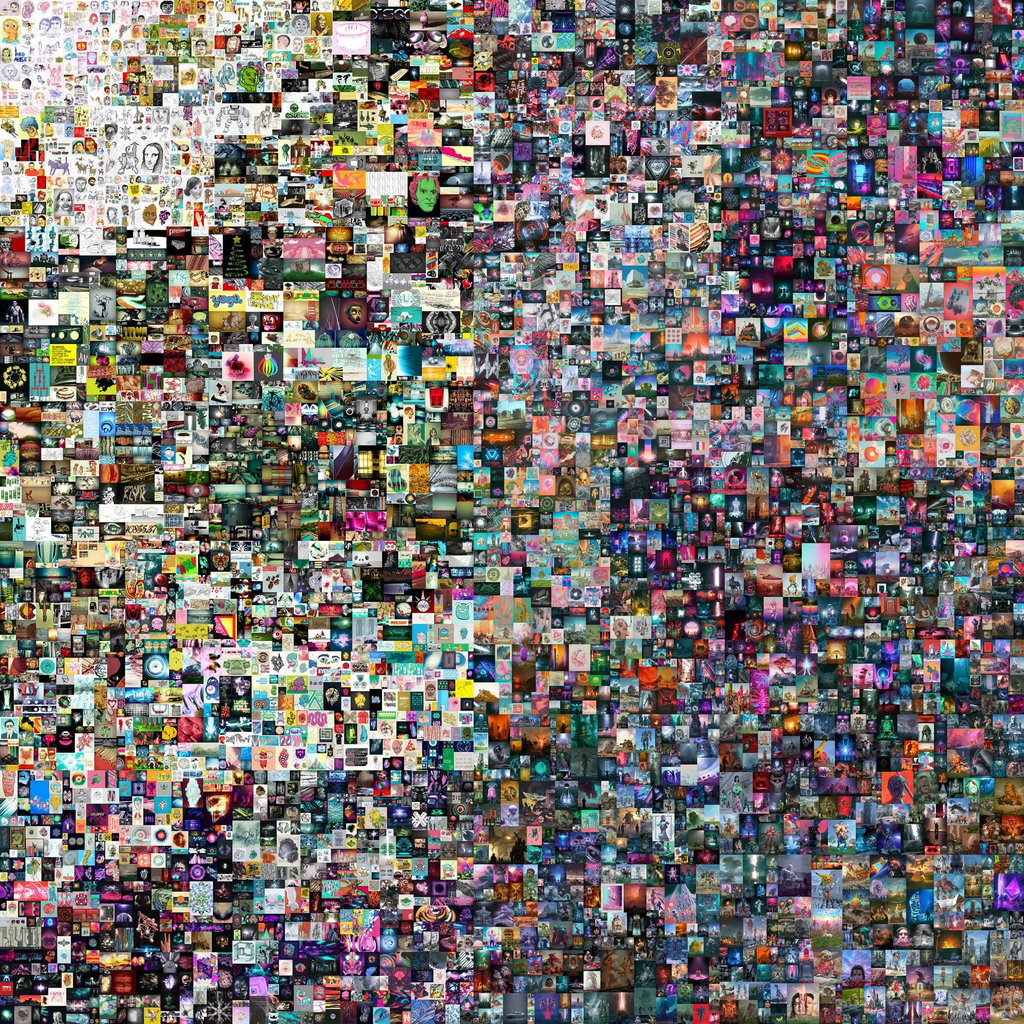

However, it wasn’t until March 2021 when blockchain really blew up, thanks to Beeple’s record-breaking US$69.3 million (£50 million) NFT sale of Everydays: the First 5000 Days in a Christie’s auction. Suddenly, everyone was buzzing about blockchain, NFTs and crypto art.

2. Keeping it (virtually) real

Blockchain today has many applications in the art world, a key one of which is verifying the authenticity and provenance of artworks. According to a 2014 report by The Fine Arts Expert Institute (FAEI) in Geneva, more than half of the artworks it examined were either forged or not attributed to the correct artist.

By registering art on the blockchain through companies like Artory, Codex or Verisart, data such as artwork details, records of past sales, repairs, transport, exhibition history, appraisals and image hashes are preserved on a single “block” that is secure and shareable. This way, buyers and sellers can track an artwork throughout its entire life cycle with its authenticity, origin and history verified.

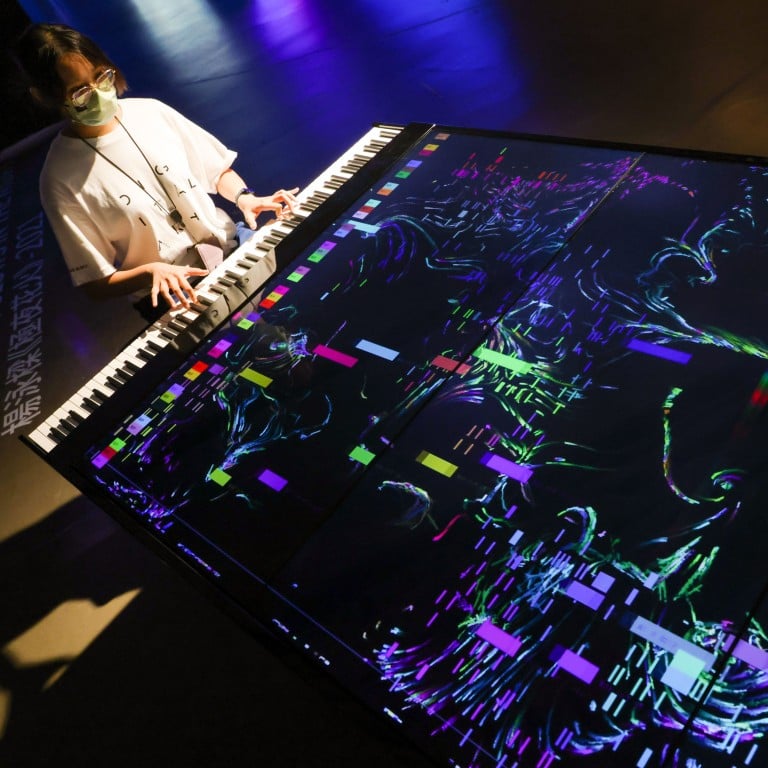

3. Art-focused platforms

New blockchain-based platforms have also emerged to give artists more control over their artworks. Last November, Art Basel and MCH Group announced the launch of Arcual, a new blockchain ecosystem co-founded with Luma Foundation, a Swiss non-profit that supports independent contemporary artists.