Finance’s future rests with technology to create health, wealth and wisdom

- Modern banking was created to protect farmers from risk and is now helping shape a healthier society

Modern finance has its origins in medieval Italy. To protect and foster grain farmers, finance was arranged to start the growing process and cover a farmer’s losses. These exchanges can be traced back to Venice in the Middle Ages and Renaissance, and helped build an economy that became the hub of global trade. As the practice of money lending was institutionalised, the bank emerged. The word comes from banca, Italian for the benches where the trade took place.

What those Venetian moneylenders could not possibly imagine is that the money business would become so ubiquitous and so convenient in 2019. In Hong Kong, about 85 per cent of today’s consumer-bank interactions are through an ATM, mobile or online channels.

A pound of flesh, as demanded by Shylock, a Jewish moneylender and principal antagonist in William Shakespeare’s The Merchant of Venice, is no longer required. With a fingertip, today’s citizens are not just able to borrow money but also trade stocks, buy insurance and more.

Bespoke services

Online lending is hardly the cutting edge of financial technology, or fintech. Where financial services businesses can develop a competitive edge is surely in personalisation and customised user experiences.

“Advanced fintech solutions allow customers to gain instant access to their bank accounts and review real-time updated information online,” says K.C. Chan, Adjunct Professor of Finance at HKUST Business School. “Big data and predictive analytics will provide more efficiency and transparency in designing specialised financial products.”

Hong Kong’s former treasury boss adds that finance is evolving to become an instant tool for C-suite executives and also for consumers who will gain greater control of their money, and manage it at a lower cost.

Careful progress

In a sign fintech is maturing, healthcare is among its fastest-growing specialties. “Over the next few years, we will see more all-encompassing digital ecosystems for healthcare and the ability to experience a larger portion of the continuum of care via your phone,” says Shaden Marzouk, managing director of AXA, the Paris-based insurance firm. “Instead of waiting for lengthy periods at hospitals and clinics, users will be able to quickly deal with standard healthcare questions and issues via AI-powered chats.”

Big data and predictive analytics will provide more efficiency and transparency in designing specialised financial products.

The former neurosurgeon and United States Army major sees technology and finance opportunities in the delivery of care using telecommunications innovations, remote monitoring, and data and analytics. “Because our phones and wearables are becoming increasingly adept at helping diagnose and monitor our health, we now have more data that enables virtual forms of care.”

City of choice

Governments around the world can see the momentum in fintech and are pressing ahead with policies to attract talent. Hong Kong Cyberport is one of Asia’s most active centres for fintech start-ups, becoming increasingly competitive against neighbouring cities in mainland China such as Shenzhen and Silicon Valley in California.

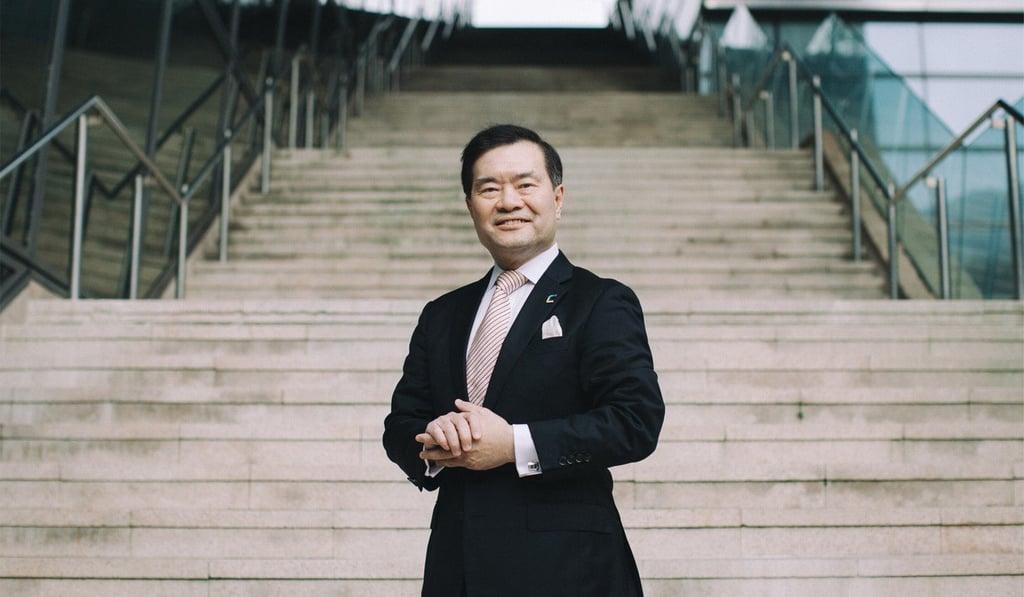

“Many people may not know that Hong Kong has been the No.1 destination for French talents for the past few years,” says George Lam, Cyberport’s chairman. “We have cyber security people from Israel. We have anti-hacking people from Russia. We have blockchain people from New York. We have fintech people from London. Hong Kong has really become the most international tech hub you can find in Asia.”

What makes Hong Kong special is its location that enables businesses to gain access to growth markets in Asia. “We have a saying at Cyberport, Plug and Play. Once you are plugged into Hong Kong, your business has access to the Greater Bay Area and markets in Southeast Asia,” says Lam.

Aside from its established legal structure and reliable infrastructure, Hong Kong’s financial system plays a key role in luring technology talents to relocate to one of the world’s top financial hubs. “Hong Kong’s mature capital market offers tremendous opportunities for start-ups to raise funds through securitisation,” says Lam.

“We have anti-hacking people from Russia. We have blockchain people from New York. We have fintech people from London. Hong Kong has really become the most international tech hub you can find in Asia”

Some of the start-ups based at Cyberport are already contributing to the ecosystem in Hong Kong. “Tech firms here are helping insurance companies cut costs in customer service and time, and also eliminating problems such as fraud and claim administration headaches. A lot of things have been solved by innovations that we see in Cyberport,” he says.

Healthy change

Compared to other areas of the financial services sector, the insurance industry might have been less responsive to the challenges of technology, but Marzouk senses the business is catching up quickly. “More people are trying telehealth for reasons ranging from medical advice, treatment of common illnesses and specialty consultations, and discovering that you can get effective, high-quality care that fits in with a busy lifestyle,” she says.

Over the next few years, we will see more all-encompassing digital ecosystems for healthcare and the ability to experience a larger portion of the continuum of care via your phone.

Her observation is in line with the views of Ken Lo of ZhongAn International. “Customers will no longer be restricted by manual operations or offline working hours but will enjoy better customer experience with easy access to financial products and insurance services at anytime, anywhere in the way they want,” says Lo, the founding member of the first online-only insurance technology (or insurtech) company in China, which has already partnered with 307 businesses to provide insurance products for 432 million of customers since the end of 2017. “The growth of business can hardly be imagined a decade ago.”

“With the emergence of big data analytics and artificial intelligence, traditional financial applications such as opening bank accounts and the Know Your Client process can take place online, which makes the existence of virtual banking possible,” says Chan.

All of which is not to say that old-fashioned finance is dead; finance is changing to become faster, quicker and easier. It’s as personalised as ordering a bespoke suit at a tailor’s.

Editor’s note: The Hong Kong Internet Economy Summit will be held on April 15-16 at the Hong Kong Convention and Exhibition Centre. Dr Shaden Marzouk, Dr Lee George Lam, Prof KC Chan and Ken Lo will speak at Fintech Forum on April 16.