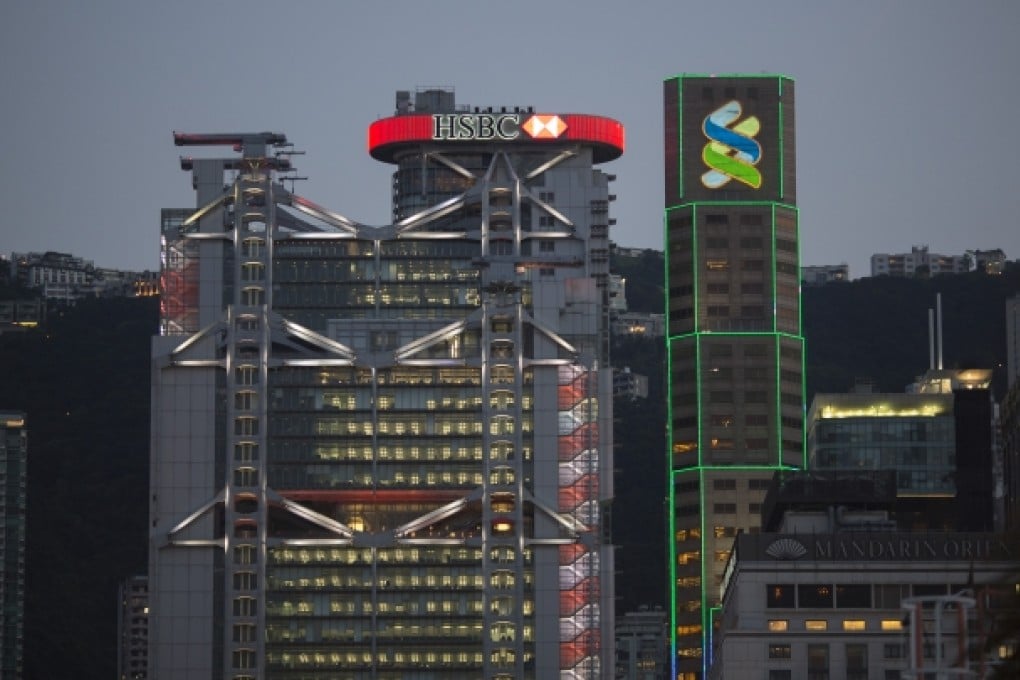

Moody's downgrades Hong Kong banking system to 'negative'

Agency downgrades system in city from stable, citing worries over exposure to mainland risks and negative real interest-rate environment

Moody's Investors Service downgraded the outlook for Hong Kong's banking system to negative from stable, citing concerns over persistent negative real interest rates and banks' growing exposure to the mainland.

But analysts said such worries were unfounded and that a loan exposure of 16.5 per cent to mainland enterprises could hardly be considered excessive.

Sonny Hsu, vice-president and senior analyst at the ratings agency, warned that the city's banking system is changing rapidly, as a negative interest-rate environment - which he expected to remain in light of monetary easing in developed economies - continues to drive asset prices to record levels.

Hsu also raised concern about banks' growing reliance on lending across the border.

"Hong Kong banks have substantially increased their mainland China exposures to 16.5 per cent of consolidated total assets at the end of 2012, up from 9.8 per cent at the end of 2009," he said in Moody's banking system outlook report for Hong Kong, released yesterday.

But Nicholas Kwan, research director at the Trade Development Council, who formerly headed a regional research team at Standard Chartered, said the rate was not high when compared with the city's dependence on mainland tourism and trade, which might be in the 60 to 70 per cent range.